A beginner’s guide to Airbnb Arbitrage: 4 steps to have a successful first Airbnb arbitrage property. What is Airbnb arbitrage? You rent a property from a landlord, furnish it, and list it on Airbnb. You earn more than what you pay to the landlord.

Airbnb Arbitrage is amazing. You can start this as a side hustle, but you can scale this up to build enough wealth for you to achieve financial freedom.

You can start your first rental arbitrage unit in a matter of 1-2 weeks as long as you make right progress. Here are 3 key tasks you need to complete.

- Last updated May 27, 2024

Airbnb Arbitrage is amazing. You can start this as a side hustle, but you can scale this up to build enough wealth for you to achieve financial freedom.

What is Airbnb arbitrage? You rent a property from a landlord, furnish it, and list it on Airbnb. You earn more than what you pay to the landlord. You can start this without your own property and with very little capital.

Is it legal? Mostly, yes. Agree with your landlord. Check Airbnb regulations in your city. Many cities allow Airbnb.

You can start your first rental arbitrage unit in a matter of 1-2 weeks as long as you make right progress. Here are 3 key tasks you need to complete.

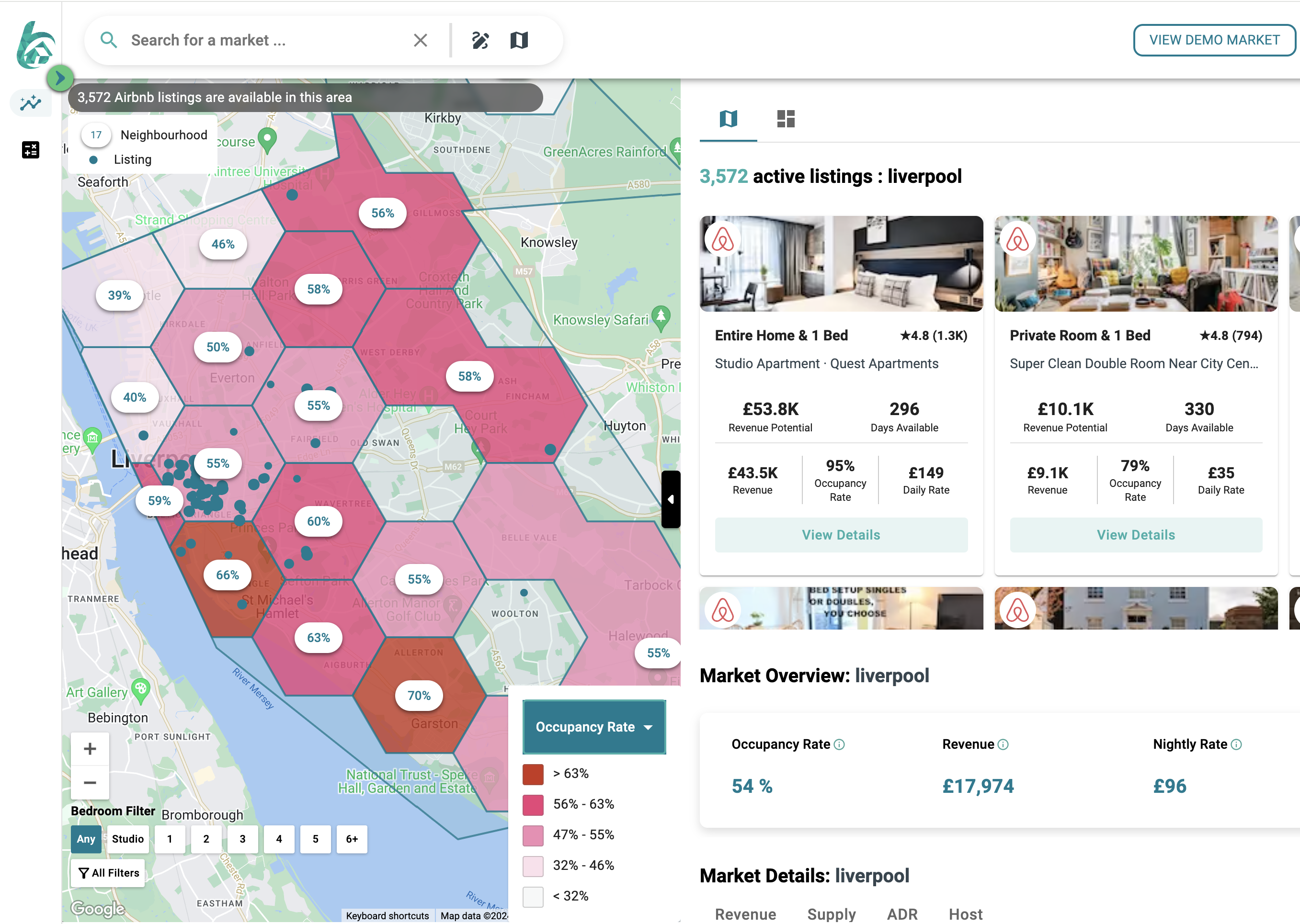

1. Market research (Tip: Use Airbnb analytics to finish this in a few minutes)

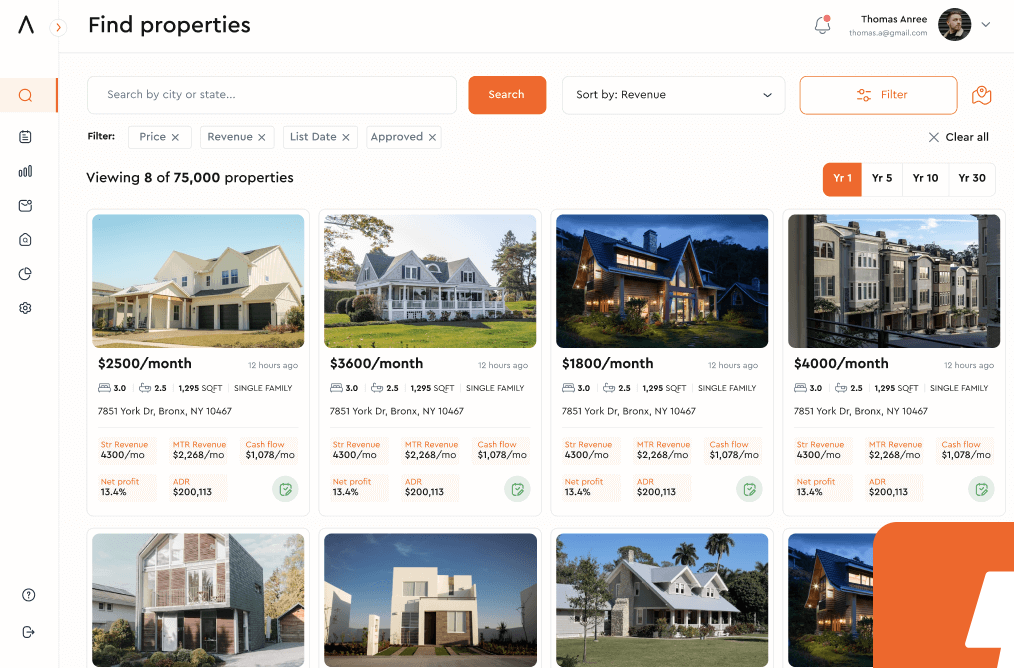

2. View properties & sign the contract (Tip: Use secret software to get access to landlord-approved properties for rent.)

3. Furnishing

Start with market research

Find the goldmine areas. Find an area with abundant available long-term rentals in the market. At the same time, travelers should love this area. In other words, It is a property with a huge pricing gap between long-term and short-term rental.

Via market research, you must get an answer for the 3 things. 1) What’s the short-term rental rule there? 2) What area has some serious pricing gaps? 3) What type of properties?

For example, when I started it in Liverpool, UK, I found there’s no city-wise regulation, but it depends on which building. Some buildings are strictly for residential but not all. The downtown area has very high short-term rental demand compared to long-term rental. I found out small Studio & 1-bed type flat in well well-maintained building is the most popular on Airbnb in the area.

Regulation

What sort of regulation does your city have? Is there a limit on how many days you can rent it out as a short-term rental? Do you need to get a short-term rental permit? Clear this out. Search on Google, and check out the local government website.

Find high-demand neighborhoods

You can use the heatmap feature from the Airbtics app. The intensity of color represents the guest’s demand. Therefore, the dark red areas have a high occupancy rate. This will show you the Airbnb hotspots. In my case, the downtown area is the only hotspot with many short-term rentals available. Find out rent estimate of neighbourhoods.

Type of property

On the right side of the map, you can see the top-performing Airbnb listings in the area. Check out some of them and see which type of properties you could go after.

You can think in terms of the number of bedrooms (e.g. Studio vs 2 bedrooms) and type of properties (e.g. high-rise, modern).

Acquire your first property

Acquiring the first property may sound challenging, but your first landlord may accept your offer too. Most landlords are not too keen on short-term rentals. Their three main concerns are complaints from their neighbors, excessive wear and tear, and unable to collect monies from you.

The best way is to meet the landlords face to face and talk with them. Many landlords are open to this. Building the trust is the key.

Here are a few pointers to convince the landlord for your first property.

- Offer 5-10% higher rental fee

- Offer a higher amount of deposit

- Pay a few months rent in advance

- Monthly report on their property on property damages

- You’ll use noise monitoring software to quickly address situations in which neighbors may feel uncomfortable

- You’ll sign up for short-term rental insurance

If you are in the US, then try out a software called Airvana. On their website, you can find properties for rent that the landlords have already approved for rental arbitrage. Airvana use Airbtics data to power their market intelligence side.

Furnish your property

If this is your first property, start lean, and invest in better items as you make more money. For a 1-bedroom apartment, you can furnish a basic listing under $2,000. Providing a kitchen isn’t a must.

For an Airbnb property, you need to choose your theme and color palette. This will drastically improve your listing on photos and attract short-term guests.

Here are examples of basic amenities you need

- Refrigerator

- Dining table and chairs

- Sofa

- Bed frame

- Mattress

- Pillows

- Linen

- Closet organizer

- Decorative items

We have an in-depth article on the Airbnb startup cost. Here’s an example of how you can furnish your listing from scratch with $3,300.

Publish an Airbnb Listing

It’s surprisingly easy to publish a listing. One can publish a listing in 30 minutes. Once you publish, potential guests can see your listing and start booking.

The most important part here is to use really nice pictures of your Airbnb. If it’s your first time, hire a professional who has done this before in your area. Your listing doesn’t have any reviews so guests can only rely on your listing’s picture before making a reservation.

Start with renting out a room, not the entire property

Are you a student or just got your first job? One idea for you. Rent an entire property with 3-4 bedrooms. You can live in one of the rooms and rent out the rest of the rooms on Airbnb. I did this personally when I was living in London in the UK. My Airbnb guests covered my entire rent. When my parents visited me in London, I just blocked the calendars on Airbnb so that I could use the entire property for my family. This would have been not possible with a long-term tenant.

This also taught me good lessons on how to operate an Airbnb business efficiently.