Airbnb Investing For Beginners: Unlock the secrets of Airbnb Investing for Beginners. Gain expertise and confidence with proven strategies for short-term rental success!

Home > Resources > Airbnb Investment >

Unlock the secrets of Airbnb Investing for Beginners. Gain expertise and confidence with proven strategies for short-term rental success!

- Last updated January 31, 2024

Meet Uncertainty with the Best Airbnb Investment Strategies

In the ever-evolving world of real estate investments, Airbnb has captivated both seasoned investors and newcomers alike. The attraction of turning spare rooms or entire properties into lucrative side hustles has sparked a global scale of curiosity and excitement. Yet, Airbnb real estate investing is not without its fair share of uncertainties, twists, and turns.

But you can meet uncertainty with knowledge and savvy strategies! This can pave the way for financial empowerment as you embark on investing in Airbnb for the first time. This guide is your roadmap in the short-term rental landscape. We’ll show key strategies and insights that will surely light your path in this exciting journey!

Know The Local Airbnb Regulations

As a budding Airbnb investor, you might have already heard how regulations have become a major concern in the short-term rental industry. First-time Airbnb investors should prioritize understanding the Airbnb regulations in their preferred city before investing. Limiting the number of short-term listings, capping the number of booking nights, adding zoning restrictions, and imposing fees and taxes are a few stipulations in an Airbnb regulation.

While this already becomes an issue among investors and hosts, you can leverage these regulations and use them to your advantage. Other than being a legal obligation, Airbnb regulations can become part of your property investment in Manchester.

1. Financial Feasibility – Airbnb regulations can impact the financial feasibility of a rental property. Some locations may have registration and licensing fees. Aside from those fees, regulations can affect your Airbnb business with high taxes on your rental income. Understanding these financial obligations from the get-go allows you to assess the potential return on investment more accurately.

2. Market Analysis – In any way, shape, or form, regulations can definitely dictate the landscape of an Airbnb market. Understanding the local rules helps investors assess the market conditions. A short-term rental market with strict regulations may have fewer hosts, this, however, can lead to higher demand for available properties. On the other hand, lax regulations can lead to increased competition but lower occupancy rates due to oversaturation of the market.

💰 Planning to invest in the US? Here are STR-friendly cities with lenient Airbnb regulations

Pros of Doing Airbnb

The lure of Airbnb investing can be tempting, especially for first-time investors seeking to enter the real estate market. Here are some advantages of Airbnb:

- Potential for Higher Returns – Nightly rates can be adjusted according to market demand. Hosts can charge premium rates if the property is in a popular tourist destination. They can be higher during peak seasons. This is why short-term rental properties often yield higher returns compared to traditional long-term rentals.

- More Frequent Income Stream – Airbnb hosting can allow you to receive income multiple times per week, depending on how often your short-term rental is booked. The more bookings you secure, the more frequently you can expect income to flow into your account

- Flexibility with Business and Personal Use – Airbnb gives hosts the freedom to set their own house rules. This allows them to establish expectations regarding smoking, pets, and noise. Charging the nightly rates is also at the discretion of the hosts.

Airbnb hosts can reserve their property for personal use (or maintenance) whenever they want. They can just block specific calendar dates, making their rentals unavailable for bookings. This means that they can enjoy their property for vacations, holidays, or family gatherings without coordinating with a long-term tenant.

Hosts can also decide to shift their strategy as they see fit. They can transition from a short-term to a long-term rental. - Be Part of the FIRE Movement – Because of the reasons above, Airbnb allows you to enjoy a FIRE (Financial Independence, Retire Early ) lifestyle. The higher income potential, flexibility, and control over your investments allow you to build wealth while enjoying your properties when they’re not being rented out.

Cons of Doing Airbnb

All the best things in the world have some downsides. In the business of Airbnb, these are the following:

- High Turnover – This comes in the territory of doing short-term rentals. Managing an Airbnb can take much of your time due to frequent guest turnovers, cleaning, and maintenance.

- Unstable Income – Short-term rental income can be unpredictable, especially during off-peak seasons. You will have to plan for cash flow fluctuations and potentially lower income during lean months.

- Operating Expenses – Unlike traditional rentals where the tenants shoulder the costs, managing an Airbnb property entails various costs that will be covered by the hosts. These include cleaning fees, utility bills, listings commission, and different business and licensing permits depending on your state.

- Round-the-Clock Availability – It is only a reasonable expectation for a host to be accessible whenever a guest needs them. Guests may encounter unexpected problems or have some urgent questions during their stay. These may range from a malfunctioning appliance to clarifying the check-in procedures. Being available allows hosts to address such issues swiftly, minimizing the guests’ frustration and inconvenience.

Important Factors in Airbnb Investing For Beginners

People always ask, “Is Airbnb profitable?” The answer is yes – but only in the right markets!

Location remains the be-all and end-all in real estate investing, including short-term rentals. In this section, we will show how to invest in Airbnb by doing simple math!

1. Location

It might not be news to you that you should invest in an Airbnb in cities that have high tourist traffic. After all, tourists are your target customers. You must already have a list in mind of your target short-term rental markets.

But which one will give you the highest return on investment? I believe this is the most important factor for first-time Airbnb investors. The faster you get your return on investment, the faster you can scale up your short-term rental operations from only one unit to having multiple rentals!

One of the industry standards to know the ROI is by getting the gross rental yield in a market. This is calculated by dividing the average annual revenue of an Airbnb by its median property price.

Market’s Gross Rental Yield =

(Average Airbnb Annual Revenue / Median Property Price)

Let us now compare the gross rental yields of 2 of the most visited cities in the United States. These are Washington DC and Chicago.

The median property prices of US real estate markets are available on real estate websites such as Redfin. However, when it comes to getting accurate Airbnb metrics of any market worldwide such as annual revenue, your most reliable source is Airbtics Dashboard.

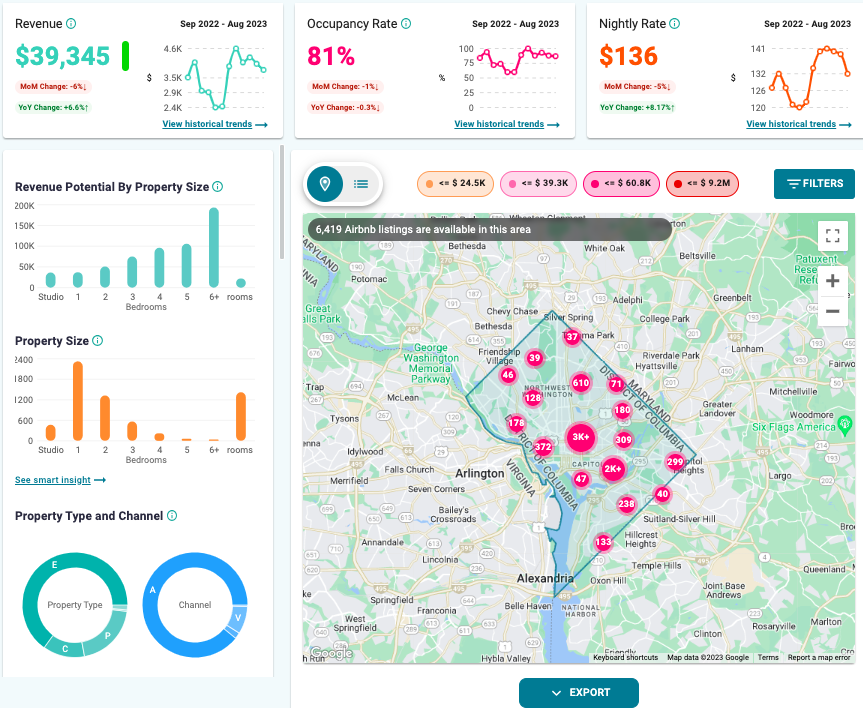

The Washington DC short-term rental market has 6,419 active Airbnb listings. A host can expect to generate an annual revenue of $39,345 by charging an average nightly rate of $136. According to Redfin, its average property price is $676,950. Let’s now calculate the gross rental yield in Washington DC.

$39,345 / $676,950 = 5.81% Gross Rental Yield

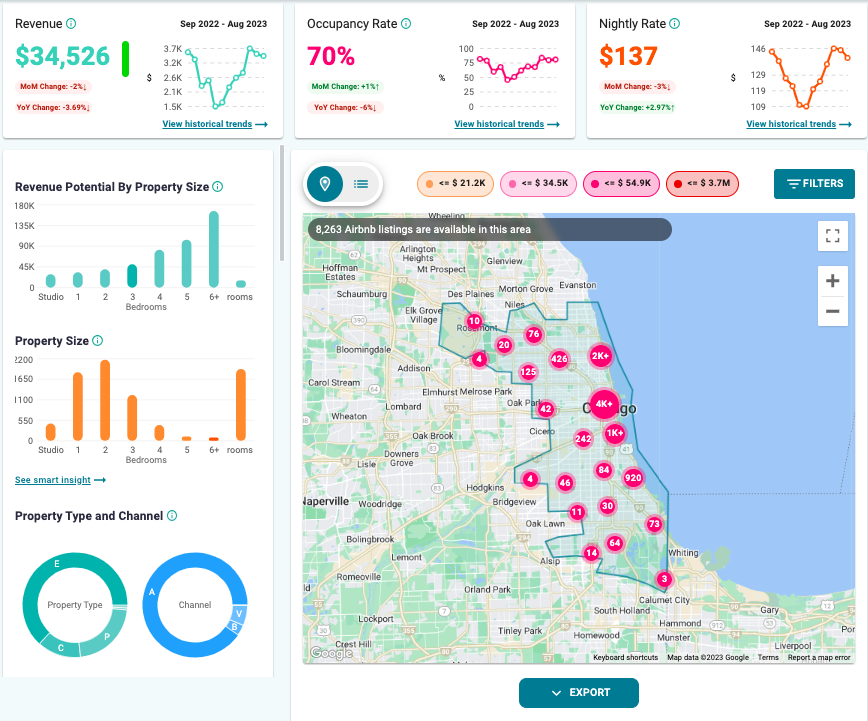

The Chicago short-term rental market has 8,263 active Airbnb listings. A host can expect to generate an annual revenue of $34,526 by charging an average nightly rate of $137. According to Redfin, its average property price is $379,000. Let’s now calculate the gross rental yield in Chicago.

$34,526 / $379,000 = 9.11% Gross Rental Yield

Based on calculations, you get a faster ROI by investing in Airbnb in Chicago. This makes Chicago a better place for your first Airbnb investment even if the competition is stiffer with a higher count of active Airbnb listings. Given this, we will now lead you to what type of property is best in Chicago for first-time Airbnb investors.

2. Best Property Type

In the previous section, we have underscored the competitive environment of the Chicago Airbnb market. Now, we will optimize your investment by leading you to the best property type in this location.

One of the best things about using the Airbtics Dashboard is allowing you to see the Airbnb data depending on the Advanced Filters. This way, you can check the profitability of different property attributes. According to Redfin, below are the average property prices in Chicago:

- Houses: $335,000

- Apartment/Condo: $374,900

There are 6,337 house listings while 1,115 apartment/condo listings in the Chicago Airbnb market. Judging by their annual revenue, apartments earn more compared to entire houses. But still, let us run the numbers just to follow a methodical approach to Airbnb investing for beginners.

|

|||

|---|---|---|---|

| Property Type | Annual Revenue | Average Property Price | Gross Rental Yield |

| Entire House | $40,627 | $335,000 | 12.13% |

| Apartment / Condo | $44,673 | $374,900 | 11.92% |

Property Type

Dataset

Entire House

- Annual Revenue: $40,627

- Average Property Price: $335,000

- Gross Rental Yield: 12.13%

Apartment / Condo

- Annual Revenue: $44,673

- Average Property Price: $374,900

- Gross Rental Yield: 11.92%

It was a close call, but the entire houses in Chicago have higher Airbnb gross rental yield! If you’re planning to buy a house for Airbnb in Chicago, know that you will be competing with more than 6,000 hosts in the city. We can still optimize your earnings in the final leg of your property search for investing in Airbnb.

3. Best Property Size

The Advanced Filters of Airbtics are not only limited to the type of property. You can actually delve deeper into the best number of bedrooms in your chosen property type, in our example, house listings. Simply tick the items on our filters, and the data will instantly update to your preferences.

Based on the results, here are the profitability according to the number of bedrooms in house listings in Chicago:

|

|||

|---|---|---|---|

| Number of Bedrooms | Annual Revenue | Average Property Price | Gross Rental Yield |

| 1 Bedroom | $33,522 | $180,000 | 18.62% |

| 2 Bedrooms | $39,998 | $189,950 | 21.06% |

| 3 Bedrooms | $50,644 | $279,900 | 18.09% |

| 4 Bedrooms | $82,359 | $375,000 | 21.96% |

| 5 Bedrooms | $104,161 | $499,450 | 20.86% |

Number of Bedrooms

Dataset

1 Bedroom

- Annual Revenue: $33,522

- Average Property Price: $180,000

- Gross Rental Yield: 18.62%

2 Bedrooms

- Annual Revenue: $39,998

- Average Property Price: $189,950

- Gross Rental Yield: 21.06%

3 Bedrooms

- Annual Revenue: $50,644

- Average Property Price: $279,900

- Gross Rental Yield: 18.09%

4 Bedrooms

- Annual Revenue: $82,359

- Average Property Price: $375,000

- Gross Rental Yield: 21.96%

5 Bedrooms

- Annual Revenue: $104,161

- Average Property Price: $499,450

- Gross Rental Yield: 20.86%

While 4-bedroom Airbnb house rentals have the highest gross rental yield, its average property price may be too steep for a first-time Airbnb investor such as yourself. You may go for the second one which is 2-bedroom house units that boast also a high gross rental yield of 21.06% with only a $189,950 average property price.

💡Not yet sure where to invest? We have compiled the top cities to invest in the US, UK, Canada, and Australia. This list is a great overview of which places to buy a property and start your Airbnb investment.

If you want to have in-depth data for every city, Airbtics offers an exclusive report for Airbnb investors who want to stay ahead and make smarter decisions with data.

Deeper STR Insights. Broader Investment Opportunities.

Want to go deeper, broader, and faster? Supercharge your Airbnb Investment by accessing the most in-depth Airbnb & real estate insights with our exclusive STR report.

- Vital vacation rental data from 50 Markets – Airbnb Occupancy Rate, ADR, Revenue, and Listings! Access 2-year data from June 2021 to June 2023.

- Uncover 5-year real estate investability metrics for 50 markets including population, property prices, income levels, Google travel interest, crime, and unemployment trends 2017 - 2021)!

- All yours in 3 business days!

Elevate Your Airbnb Rental, Delight Your Guests

Now that you’ve successfully identified a profitable Airbnb location, determined the ideal property type, and pinpointed the optimal number of bedrooms, you’re now about to begin transforming your space into a welcoming haven for travelers.

Furnishing your Airbnb can be a daunting task, especially if you’re new to the world of hospitality. Worry not, because we got you!

To make this process smoother for you, we have meticulously curated a comprehensive list of essentials that will elevate your Airbnb rental and provide a comfortable experience for your guests. These carefully selected items will not only enhance the aesthetics of your Airbnb. They will also make your guests feel more at home away from their own cities.

Read one of our top articles, “The Complete Airbnb Furniture Checklist + Printable PDF”, as it has guided a lot of first-time Airbnb investors.

List and Put a Spotlight on Your Airbnb

Acquiring your first short-term rental property is a remarkable achievement! Now, that your property is ready for business, it’s time to take the next step: Listing your property on Airbnb!

Visit the “Host” section of Airbnb’s official website, where you will find detailed instructions on how to list your first short-term rental property.

But wait, you need to plan how you’ll promote your rental property!

Promoting your Airbnb listing effectively is like shining a spotlight on your property in a vast range of options (or competitors). It’s not just about creating an attractive listing. It’s more about ensuring that potential guests can find it, enticing them to book their stay.

In our article, “How to Promote Your Airbnb Listings the Right Way: 10 Effective Strategies & More!”, we delved deeper into the importance of promotion and provide readers with actionable tips to boos their rentals’ visibility and bookings!

Secrets Unlocked: Airbnb Investing for Beginners with Airbtics

For first-time Airbnb investors inexperienced in the industry, how to invest in an airbnb property requires a methodical approach. And the use of a powerful data analytics tool like Airbtics empowers investors, regardless of their experience, in several critical ways.

Airbtics provides a wealth of data and insights that guide investors to make informed decisions. Instead of relying on guesswork, investors can access comprehensive market data. These include occupancy rates, nightly rates, and competitor analysis, among others. This data-driven approach enables them to assess the potential risks and rewards associated with specific properties and markets.

Without the insights provided by Airbtics, it can be challenging for first-time Airbnb investors to pinpoint the best opportunities. So, you can use the Airbtics Dashboard to compare different locations and evaluate their revenue potential. And as we have seen, investors can use this tool to optimize their property investments. This helps them identify the ideal property type and size in each market.

Investing in Airbnb for beginners comes with uncertainties and anxieties. Ultimately, Airbtics instills confidence in first-time Airbnb investors. This confidence is a valuable asset. As a result, first-time Airbnb investors are better equipped to make sound investment decisions, manage their properties effectively, and increase their chances of success in the dynamic world of short-term rentals.

Got an eye for a property? Check its profitability with the most powerful Airbnb Calculator

Short-Term Rental Data

Short-Term Rental Data

-

Quick Links

Annual Airbnb Revenue in Austin texas, USA

Austin, Texas| Airbnb Market Data & Overview | USA Austin, Texas Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Austin, …

Annual Airbnb Revenue in Augusta georgia, USA

Augusta, Georgia| Airbnb Market Data & Overview | USA Augusta, Georgia Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Augusta, …

Annual Airbnb Revenue In Sicily Italy

Sicily| Airbnb Market Data & Overview | Italy Sicily Airbnb Market Data & OverviewItaly Is it profitable to do Airbnb in Sicily, Italy? What is …

Airbnb Rules in Nottingham

If you are looking to buy investment properties in the UK, knowing the Airbnb rules in your preferred city is the first step! In this …

Best Airbnb Markets in New mexico

Best Airbnb Markets in New Mexico Best Places to Buy an Airbnb in New Mexico Last updated on: 12th May, 2024 USA / New Mexico …

Annual Airbnb Revenue in Pinellas park florida, USA

Pinellas Park, Florida| Airbnb Market Data & Overview | USA Pinellas Park, Florida Airbnb Market Data & Overview USA Is it profitable to do Airbnb …