airbnb property for sale Los Angeles City Center

If you’ve ever heard of the city of angels, then you would know that Los Angeles is truly one of the most traveled cities in the world. While many travelers consider this city on their travel bucket list for its tropical climate, it’s most certainly a thrill for property investors too!

LAX Airport confirms that the total amount of passengers as of July 2022 in Los Angeles has reached the incredible amount of 36 million. While it’s an attractive number for those who want to start an Airbnb, it’s highly recommended to learn about buying a property in Los Angeles and making sure that it’s profitable.

To begin with, the major costs, revenue, and Airbnb occupancy rates in Los Angeles should be considered before deciding to purchase a property. Another excellent option is to do rental arbitrage since it’s fairly popular and does not require you to purchase a property as a start.

Here’s an interesting fact: Los Angeles is one of the best places to Airbnb in California! Feel free to listen and learn more about Airbnb hosts in LA with our podcast, Into The Airbnb:

Aside from looking at a property’s fascinating architectural design, proximity to major tourist areas, and accessibility to the best go-to places, the primary step is to determine profitability. In this article, we’ll discuss the metrics in order to gauge the best property investment.

This includes the best website recommendations for property investment in Los Angeles, property gross rental yield, cash-on-cash return, and annual revenue, along with some of the most ideal and profitable properties according to their location. Stoked to learn more? Continue reading!

Is Property Investment Profitable in Los Angeles City Center?

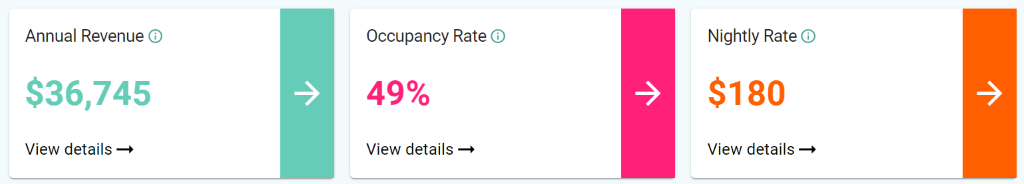

Using an Airbnb calculator, it was discovered that a 2-bedroom apartment in Los Angeles City Center can generate an annual revenue of $36,745 with a steady occupancy rate of 49% and a nightly rate of $180.

airbnb property for sale Los Angeles City Center

Profitable Properties for Sale in Los Angeles City Center

Finding the best properties that have the potential to produce high yields and capital growth are certainly some of the preferences of major investors. It’s always best to ask for assistance from real estate agents to access exclusive and unique properties during the development stage.

At the same time, it’s even better when a property investor like you conducts research about predicted growths and market forecasts. Some of the preferred neighborhoods in Los Angeles are Beverly Hills and Brentwood. Here are some of the profitable properties in Los Angeles City Center along with the calculated gross rental yield, cash-on-cash return, and annual revenue:

2548 Peck Rd Spc 24, Monrovia, CA 91016

1. Studio-type Property for Sale Los Angeles

Near Puerto de Santa María train station

Asking Price: $105,000

| GROSS RENTAL YIELD | 24.69% |

| ANNUAL REVENUE | $16,786 |

| CASH ON CASH RETURN | 48.29% |

10799 Sherman Grove Ave Spc 6, Sunland, CA 91040

2. 1-Bedroom Property for Sale Los Angeles

0.4 miles Sunland Elementary School

Asking Price: $109,000

| GROSS RENTAL YIELD | 25.04% |

| ANNUAL REVENUE | $27,294 |

| CASH ON CASH RETURN | 49.35% |

8811 Canoga Ave Spc 120, Canoga Park, CA 91304

3. 2-Bedroom Property for Sale Los Angeles

2 km. from the well-known Granada airport

Asking Price: $159,995

| GROSS RENTAL YIELD | 25.68% |

| ANNUAL REVENUE | $41,091 |

| CASH ON CASH RETURN | 51.28% |

12001 Foothill Blvd Spc 11, Lake View Terrace, CA 91342

4. 3-Bedroom Property for Sale Los Angeles

0.6 miles to Charles Maclay Middle School

Asking Price: $210,000

| GROSS RENTAL YIELD | 24.69% |

| ANNUAL REVENUE | $16,786 |

| CASH ON CASH RETURN | 48.29% |

21500 Lassen St Spc 70, Chatsworth, CA 91311

5. 4-Bedroom Property for Sale Los Angeles

0.6 miles Ernest Lawrence Middle School

Asking Price: $450,000

| GROSS RENTAL YIELD | 23.46% |

| ANNUAL REVENUE | $105,566 |

| CASH ON CASH RETURN | 44.61% |

Conclusion

Since Airbnb is rapidly increasing and constantly changing for each city in the world, it is crucial to make decisions based on wild guesses. The data points mentioned in this article for Los Angeles such as Airbnb occupancy rates, annual revenue, and average daily rate should be the primary basis before investing in a property.

Hence, if the data presented above has given you ideas to boost your strategic pricing plan for your business, then an Airbnb rental arbitrage calculator is certainly what you need for success in the long run. It’s a fact that some of the STR investors are also considering Airbnb Rental Arbitrage, but they still need to have a reliable data tool on which to base their conclusions!

As we live in a digital era, an accurate data analytics tool can help your business stand out among your surrounding competitors and benchmark your property by tracking the occupancy rates of competing listings in your preferred city.