Is Airbnb Investment Property Profitable in St Louis?: Discover profitable Airbnb investment properties for sale in St Louis, MO this 2023 – from studio to property of 1,2,3, and 4+ bedrooms!

Home > Resources > Airbnb Investment >

Discover profitable Airbnb investment properties for sale in St Louis, MO this 2023 – from studio to property of 1,2,3, and 4+ bedrooms!

- Last updated on

- August 17, 2023

Targeting to invest in a property in St. Louis? Here’s what you need to know. Home to the famous Gateway Arch & origin of ice cream cones, St. Louis attracts plenty of tourists and young professionals due to its various trending industries like tech and art.

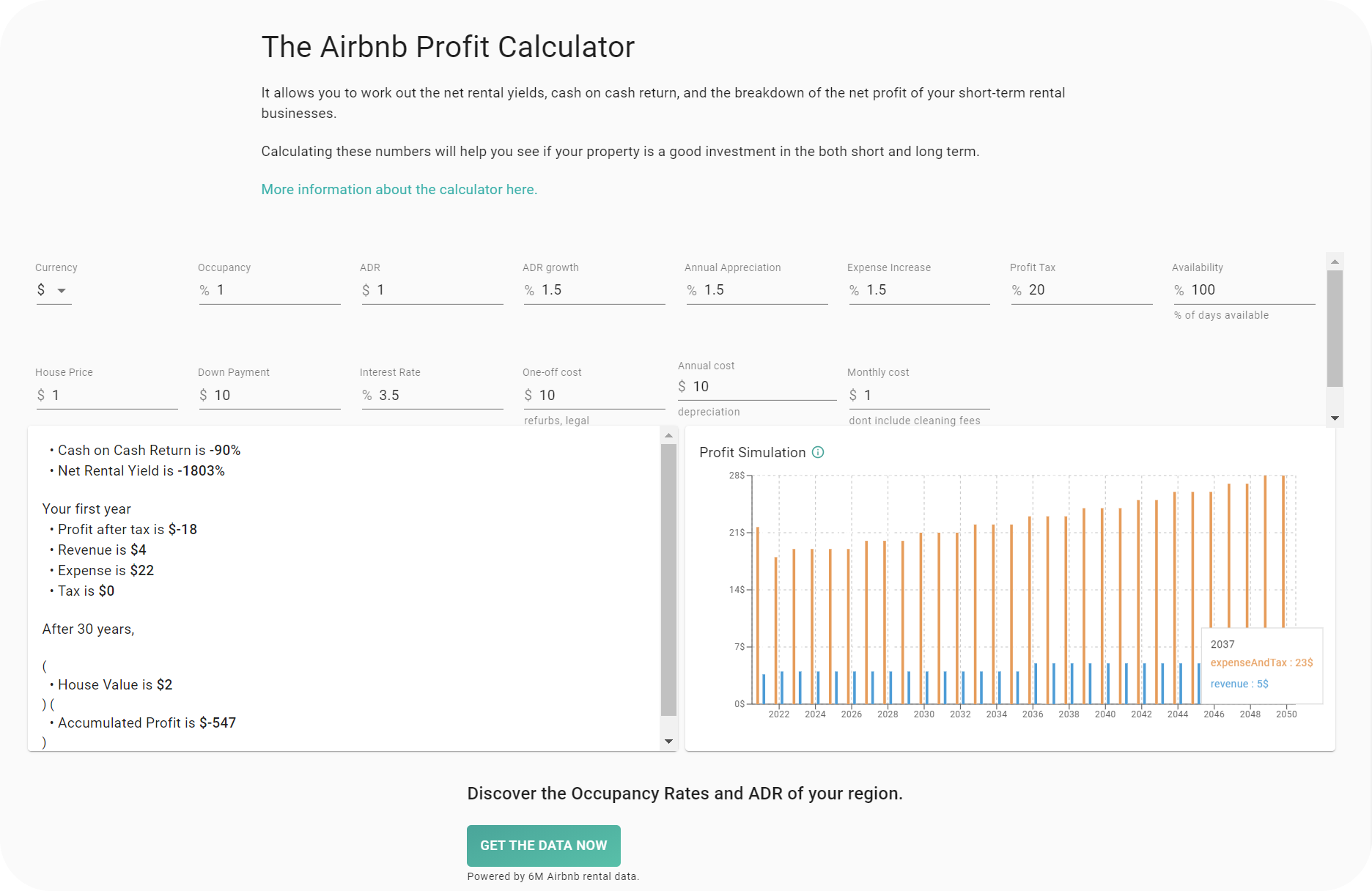

Before deciding to purchase a property in St. Louis, it’s highly recommended to learn about the process of buying a property for Airbnb in order to make sure that it’s profitable. To begin with, it’s certainly important to consider the major costs and revenue before deciding to purchase a property in Trinidad. Another excellent option is to do rental arbitrage in St. Louis as it’s fairly popular and does not require you to purchase a property.

.

“A shortage of homes to buy in St. Louis is one reason that the market ranks as one of the best for rental property, with more than half of the households in St. Louis occupied by renters.”

– Roofstock on St. Louis Real Estate Market

Aside from looking at a property’s fascinating architectural design, proximity to major tourist areas, and accessibility to the best go-to places, the primary step is to determine profitability. In this article, we’ll discuss the metrics in order to gauge the best property investment.

This includes the best website recommendations for property investment in St. Louis, property gross rental yield, cash-on-cash return, and annual revenue, along with some of the most ideal and profitable properties according to their location. Stoked to learn more? Continue reading!

Why Should You Consider Buying An Airbnb in St. Louis?

Some of the attractive features that St. Louis has to offer include its wide list of lively leisure activities, many popular landmarks such as Gateway Arch and Forest Park as well as exquisite gastronomy! Aside from the fact that St. Louis is fairly affordable compared to other cities, it’s clearly perfect for a property investor who wants to enjoy these rewards while earning a passive income through Airbnb. Not yet convinced? Here are some of the major reasons why you should consider buying a property for Airbnb in St. Louis:

1. Affordable housing market

Another characteristic that investors will certainly like to know about St. Louis is that it has one of the most affordable housing markets in the US. Based on the Redfin index, St. Louis home prices are up 5.0% compared to last year and the median selling price is $210K.

2. Appealing cost of living

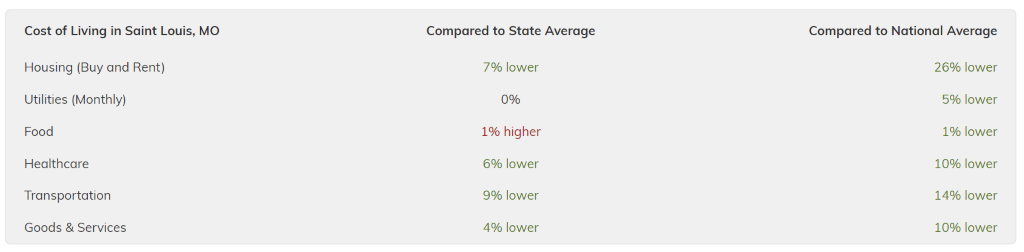

St. Louis not only has an affordable housing market but also an appealing cost of living that it’s 4% lower than the state average and 13% lower than the national average according to RentCafe portal.

Source: RentCafe

3. Tourists love St. Louis!

It’s a given fact that St. Louis is a beautiful city with a vibrant music scene that has a lot to offer, thus many travelers visit it every year (around 25M annually). That’s of course great info for investors that are interested in investing in tourist accommodations here!

What are the cons of buying an Airbnb property in St. Louis?

Now that we know the advantages of investing in St. Louis, let’s move on and take a quick look at the cons. It’s always better to look at the two sides of each coin in order to properly set your expectations!

High Crime Rates & Homelessness

Like any other city, St. Louis also has some flaws and here, we need to mention its high crime rates as this city is already well-known for it. Crime statistics are especially high in the northern suburbs of St. Louis than in the southern ones. Thus, probably you will prefer to look for properties located in the southern area of the city.

Best Neighborhoods for Airbnb in St. Louis

Let’s take a closer look at the important Airbnb key metrics to discover which is the most profitable neighborhood in St. Louis. Filtered for a 1-bedroom apartment, here is a brief overview of some of the most recommended and profitable neighborhoods:

1. Tower Grove South

- Annual Revenue: $31,646

- Occupancy Rate: 85%

- Average Daily Rate: $86

2. Soulard

- Annual Revenue: $31,515

- Occupancy Rate: 78%

- Average Daily Rate: $101

3. Central West End

- Annual Revenue: $27,293

- Occupancy Rate: 71%

- Average Daily Rate: $91

Is Property Investment Profitable in St. Louis City Centre?

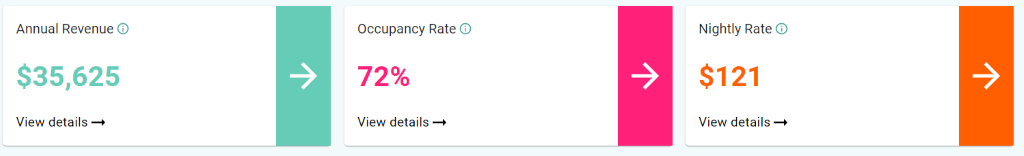

Using an Airbnb profit estimator, it was discovered that a 2-bedroom apartment in St. Louis City Centre can generate an annual revenue of $35,625 with a steady occupancy rate of 75% and a nightly rate of $121.

Cheap Houses & Properties For Sale in St. Louis City Center

Finding the best properties that have the potential to produce high yields and capital growth are certainly some of the preferences of major investors. It’s always best to ask for assistance from real estate agents to access exclusive and unique properties during the development stage.

At the same time, it’s even better when a property investor like you conducts research about predicted growths and market forecasts. Here are some of the houses for salein St. Louis City Center along with the calculated gross rental yield, cash-on-cash return, and annual revenue:

7219 West Florissant Ave, Saint Louis, MO 63136

1. Studio-type Property for Sale St. Louis

- Near W Florissant Ave

- Asking Price: $65,000

| GROSS RENTAL YIELD | 33.99% |

| ANNUAL REVENUE | $22,095 |

| CASH ON CASH RETURN | 76.21% |

2006 McLaran Ave, Saint Louis, MO 63136

2. 1-Bedroom Type Property for Sale St. Louis

- Near McLaren Ave

- Asking Price: $65,000

| GROSS RENTAL YIELD | 31.29% |

| ANNUAL REVENUE | $20,337 |

| CASH ON CASH RETURN | 68.10% |

2113 Wolter Ave, Saint Louis, MO 63114

3. 2-Bedroom Type Property for Sale St. Louis

- Near Wolter Ave

- Asking Price: $80,000

| GROSS RENTAL YIELD | 32.00% |

| ANNUAL REVENUE | $25,599 |

| CASH ON CASH RETURN | 70.23% |

7808 Madison Dr, Saint Louis, MO 63133

4. 3-Bedroom Type Property for Sale St. Louis

- Near Page Ave

- Asking Price: $135,000

| GROSS RENTAL YIELD | 25.99% |

| ANNUAL REVENUE | $35,084 |

| CASH ON CASH RETURN | 52.20% |

2453 Downs Ct, Saint Louis, MO 63136

5. 4-Bedroom Type Property for Sale St. Louis

- Near Fair Acres Rd

- Asking Price: $200,000

| GROSS RENTAL YIELD | 30.06% |

| ANNUAL REVENUE | $60,120 |

| CASH ON CASH RETURN | 64.41% |

Conclusion

It’s always best to conduct market research before investing in a property to know if it’s worth investing your money in a city of your preference. A great way to start is by researching different lucrative rental markets that can give a good return on investments to investors.

St. Louis can generate a good cash flow for property investors, as long as they target the right neighborhood as well as calculate the potential revenue by making use of an Airbnb rental arbitrage calculator.

As we live in a digital era, an accurate data analytics tool can help your business stand out among your surrounding competitors and benchmark your property by tracking the occupancy rates of competing listings in your preferred city.

Short-Term Rental Data

Short-Term Rental Data

-

Quick Links

Annual Airbnb Revenue in Los altos california, USA

Los Altos, California| Airbnb Market Data & Overview | USA Los Altos, California Airbnb Market Data & Overview USA Is it profitable to do Airbnb …

Annual Airbnb Revenue in Greenwich connecticut, USA

Greenwich, Connecticut| Airbnb Market Data & Overview | USA Greenwich, Connecticut Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Greenwich, …

Annual Airbnb Revenue in Pontiac michigan, USA

Pontiac, Michigan| Airbnb Market Data & Overview | USA Pontiac, Michigan Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Pontiac, …

Annual Airbnb Revenue in Cedar rapids iowa, USA

Cedar Rapids, Iowa| Airbnb Market Data & Overview | USA Cedar Rapids, Iowa Airbnb Market Data & Overview USA Is it profitable to do Airbnb …

Airbnb Calculator: How to estimate your earnings

The Ultimate Short-term Rental Income Calculator.

Reglas Airbnb en Cordoba

Si es que deseas comprar inversiones inmobiliarias en España, el primer paso que debes realizar es conocer más a fondo las reglas de Airbnb! En …