Who would say NO to additional income and financial freedom? There’s no arguing that renting out your home or purchasing an investment property can be an excellent way to make more money. But, there are always risks and challenges to consider.

If you want to learn about the risks and rewards of investing, compare Airbnb vs traditional renting, understand a good rental yield, and identify the best property types for Airbnb investment – continue reading!

Investing in Airbnb Rentals

Investing in an Airbnb property usually caters to various short-term guests throughout the year. Depending on your location, it can be a lot more profitable than traditional rentals – especially in high-demand areas.

However, managing an Airbnb property will need skills such as time management, handling multiple tasks and responsibilities, and efficient communication among others. Consider it as a second job as it will require effort and time – but expect revenue as the major reward!

Let’s take a closer look at some of the most important questions regarding Airbnb real estate investments:

1. How much do Airbnb hosts make?

A US Airbnb host can make an average monthly revenue of $4,607.95 according to Airbtics’ data.

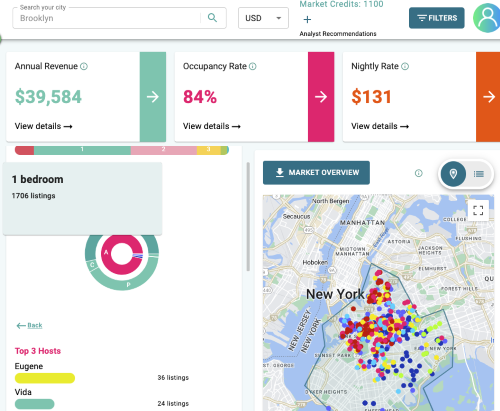

Essentially, this varies on several factors including the location, property type, seasonality, supply & demand, and many other important Airbnb key metrics. Let’s take a look at a typical Airbnb host’s earnings in Brooklyn:

Airbtics’ data shows that an average Airbnb host in Brooklyn, New York can earn the highest monthly revenue of $4,264 during the peak season in July.

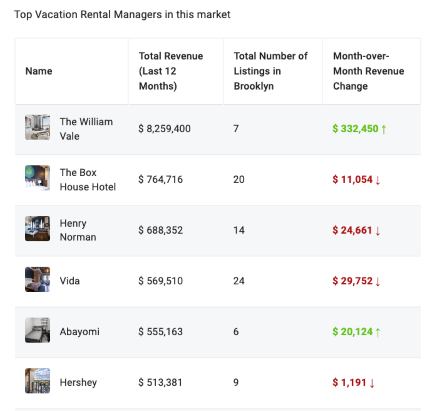

On the contrary, the lowest monthly revenue of $1,615 can be expected during the off-season in January. Here is a brief overview of actual Airbnb hosts along with their total revenue:

Source: Airbtics

Airbtics’ data shows that Airbnb investment can be profitable in Brooklyn. As long as you choose the right property type according to demand, target the best neighborhood, and consider your pricing strategy, you can easily calculate your Airbnb revenue.

2. Which cities are the BEST for Airbnb real estate investment?

We’ve taken a look at Airbnb’s travel trends in 2023, but the majority of cities did not achieve the 25% gross rental yield.

To accurately identify the best cities with 25% GRY, we used Airbtics, one of the best short-term rental analytics in the market. Here are the top-ranking cities for Airbnb real estate investment in the USA:

1. Warren, Michigan

- Gross Rental Yield: 25.99%

- Average Property Price: $194,475 (3-bedroom property)

- Annual Revenue: $50,547

- Seasonality: 51%

- Highest Revenue: $4,568 (July)

- Lowest Revenue: $1,894 (January)

- Occupancy Rate: 61%

2. Torrington, Connecticut

- Gross Rental Yield: 25.99%

- Average Property Price: $108,573 (1-bedroom property)

- Annual Revenue: $28,220

- Seasonality: 59%

- Highest Revenue: $3,685 (June)

- Lowest Revenue: $1,032 (January)

- Occupancy Rate: 57%

3. Fort Smith, Arkansas

- Gross Rental Yield: 25.98%

- Average Property Price: $93,469 (2-bedroom property)

- Annual Revenue: $26,217

- Seasonality: 43%

- Highest Revenue: $3,007 (July)

- Lowest Revenue: $1,491 (August)

- Occupancy Rate: 58%

4. Fond Du Lac, Wisconsin

- Gross Rental Yield: 25.98%

- Average Property Price: $137,834 (2-bedroom property)

- Annual Revenue: $135,814

- Seasonality: 77%

- Highest Revenue: $4,157 (July)

- Lowest Revenue: $244 (May)

- Occupancy Rate: 40%

5. Danvers, Massachusetts

- Gross Rental Yield: 25.97%

- Average Property Price: $761,082 (4-bedroom property)

- Annual Revenue: $197,690

- Seasonality: 65%

- Highest Revenue: $6,237 (October)

- Lowest Revenue: $1,609 (January)

- Occupancy Rate: 76%

6. Tiverton, Rhode Island

- Gross Rental Yield: 25.97%

- Average Property Price: $385,940 (2-bedroom property)

- Annual Revenue: $100,212

- Seasonality: 61%

- Highest Revenue: $8,734 (July)

- Lowest Revenue: $2,402 (January)

- Occupancy Rate: 67%

7. Cedar Lake, Indianapolis

- Gross Rental Yield: 25.96%

- Average Property Price: $354,778 (4-bedroom property)

- Annual Revenue: $92,116

- Seasonality: 41%

- Highest Revenue: $5,025 (July)

- Lowest Revenue: $2,552 (February)

- Occupancy Rate: 86%

8. Desert Hot Springs, California

- Gross Rental Yield: 25.94%

- Average Property Price: $513,635 (5-bedroom property)

- Annual Revenue: $133,219

- Seasonality: 70%

- Highest Revenue: $4,967 (April)

- Lowest Revenue: $1,270 (September)

- Occupancy Rate: 50%

9. Pontiac, Michigan

- Gross Rental Yield: 25.94%

- Average Property Price: $83,509 (2-bedroom property)

- Annual Revenue: $21,659

- Seasonality: 50%

- Highest Revenue: $3,974 (July)

- Lowest Revenue: $1,676 (November)

- Occupancy Rate: 59%

10. Niagara Falls, New York

- Gross Rental Yield: 25.93%

- Average Property Price: $149,384 (3-bedroom property)

- Annual Revenue: $38,739

- Seasonality: 76%

- Highest Revenue: $5,520 (July)

- Lowest Revenue: $926 (February)

- Occupancy Rate: 53%

These are the 3 factors that you should consider to select the best location for Airbnb business:

Lenient Local Rules and Regulations

There’s nothing more complicated than starting a business that breaches local laws. So it’s always best to invest in cities that have lenient local rules and regulations. Airbnb rules have zoning areas and other restrictions that vary per state and city. So it’s recommended to visit the local city hall and inquire to get answers.

Seasonality

A market’s seasonality is important to expect revenue shifts in the Airbnb business. Low seasonality does not also mean that investing in that area is not profitable.

Usually, real estate investors are looking into markets with low seasonality. This is because they want a steady revenue! Compared to markets with high seasonality, there are also minimal risks.

For instance, let’s look at the seasonality of two popular cities in California:

San Francisco: Low seasonality (49%)

Jackson: High seasonality (100%)

San Francisco achieves a 10.2% Gross Rental Yield for a 5-bedroom property. Although it has a low seasonality of 49%, it gets year-round bookings.

For a similar 5-bedroom property in Jackson, it can provide an 8% Gross Rental Yield. It also has a high seasonality of 100%, but only has bookings during the peak season in March. Jackson’s seasonality is high because there’s not much travel demand throughout the year.

In this case, it’s ideal to invest in an Airbnb property in San Francisco instead of Jackson. Even with its low seasonality, a property investor can expect year-round bookings. At the same time, you won’t have to wait only for a certain month to get bookings.

Saturated Market

Competition in the Airbnb market varies depending on a particular location or neighborhood. For instance, Paris, France is an oversaturated market in Europe for tourists.

So if you plan on investing in a property within this city, expect that there will be a handful of competitors. This means that you will need to exert more effort to maintain profitability. Investing in an oversaturated market will force you to lower your prices to get bookings. The sad news here is that you won’t have much profit left.

Risks and Rewards of Airbnb Real Estate Investment

Learning the risks and rewards of investing in Airbnb is important. If you want to become an Airbnb host, here are the risks and rewards that you can expect:

🏆PROS: Rewards of Airbnb Investment:

I. Excellent Source of Passive Income

Let’s talk about money! If you plan on doing Airbnb as a side hustle or full-time, it’s certainly an excellent source of passive income. . Traditional renting’s monthly fee is a fixed rate. While Airbnb is a lot more profitable as you can increase your prices on a regular basis.

II. Ease of Finding Guests

Do you have a vacant room that’s waiting to get bookings? Airbnb property promotes itself and lets you worry less about finding renters. As long as you have all the details indicated to promote your Airbnb, it’s easier to get bookings.

III. Vacation Home for Personal Purposes

If you ever want to just invite some friends over or host a family gathering, this is one of the perks! You can just simply block off certain dates on Airbnb if you feel like doing so. One of the rewards of investing in an Airbnb property is that you get to enjoy your hard work with the people you love!

IV. Worry-Free Cleaning Fees

Have we mentioned that Airbnb guests pay for cleaning? Once your guests book your property, they shoulder the cleaning fees! If your property has maintenance issues, you can add these in detail to your listing. This is so that guests will know what to expect.

⚠️CONS: Risks of Airbnb Investment:

I. Theft or Damaged Property

It’s always recommended to have cameras and home security equipment in case a robbery occurs. This will also increase security on your property. Airbnb insurance covers theft and damages caused by guests, but it’s certainly one of the risks.

II. Complaints from Neighbors

Several hosts claim that their neighbors are against Airbnb for various reasons. This includes excessive noise, parking, and even fear for their safety. The good news is that Airbnb global parties have been recently banned for good.

It’s recommended to speak with your neighbors beforehand to avoid complaints. Provide clear guest policies and purchase noise management tools such as Noise Aware.

III. Possible Higher Expenses

Anticipating that there is a chance of higher expenses in Airbnb is common. This is because being an Airbnb host is a lot different from traditional renting. Almost everything should be available for guests’ use and positive reviews are crucial. The typical expenses include furniture and decor, utensils, and kitchen and bathroom amenities.

3. What is a Good Gross Rental Yield?

An excellent Gross Rental Yield should be at least 25%. This is to make sure that you can turn an undervalued property into a good investment in a short period of time. It’s more practical to purchase a cheaper property with a good return – instead of purchasing an expensive property in a high-revenue market.

A gross rental yield of 25% will give you an assurance that the cost of your Airbnb property will be recouped before considering the expenses. By anticipating your property’s gross rental yield, you will be able to determine your return on investment and make the right decisions moving forward.

Comparison: Airbnb vs Rental Income

If you’ve ever tried traditional renting, then you know that Airbnb can be a lot more lucrative. How so? Airbnb rental can be more lucrative because you can charge more on a daily basis! Depending on the seasonality, local events, and holidays, you can adjust prices accordingly. In comparison to renting a property for the long term to a tenant, which is usually a fixed monthly rate.

Check out the following comparison of Airbnb vs Traditional Rentals:

| Airbnb | Traditional Rentals |

|---|---|

| Various pricing: Pricing can be adjusted according to seasonality and local events | Fixed pricing: Pricing can only be based on a monthly or yearly rate according to a contract |

| Possible Higher Operating Costs: Requires effort to invest in furniture, appliances, amenities, and other expenses | Steady Operating Costs: Does not require to spend much on expensive upfront costs for furnishing |

| Active Management: Can be managed remotely and management tools can be automated, Experience hosting different guests and create connections | Passive Management: Does not need consistent monitoring but could be risky for damages, Minimal interactions with long-term tenants |

| More Control Over Property Since Airbnb guests are in your property only for a short period of time, you can easily control and track any damages or mishaps. The best part is it’s mostly covered by Airbnb insurance. | Less Control Over Property Long-term tenants are expected to decorate and make use of drills or hammers to do so. Should there be any damages, it should be discussed in the contract and agreed upon. |

Airbnb Rental Analysis

Airbnb rental analysis is an important process that helps investors make wise decisions. To guarantee profitability, the property price should be cheaper than the return on investment.

You’ll be glad to know that there are plenty of properties out there that have below-market value. And now is the time to take advantage of them!

It’s also required to understand seasonality to expect high and low seasons. For instance, it’s best to look at beach areas that have a low seasonality but gets year-round bookings. Locations that guarantee high-season bookings only in certain months will bring inconsistent revenue. You should look forward to investing in a place that gets bookings all year round instead!

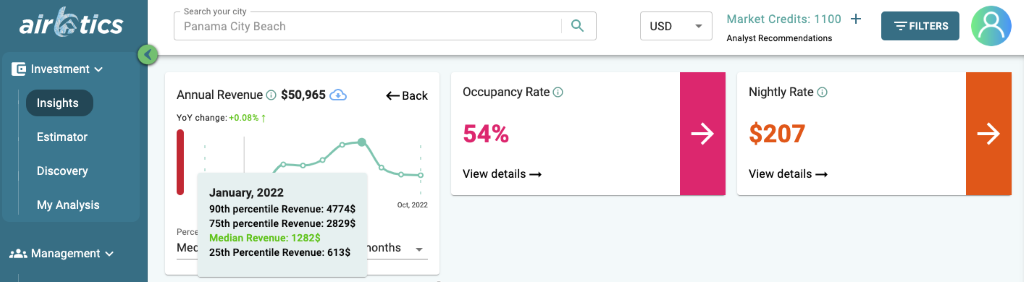

We analyzed Airbnb’s report about the top 10 states with high income and featured 2 cities in Florida. Here is a market comparison:

| FLORIDA | ||

|---|---|---|

| Airbnb Key Metrics | Deerfield Beach | Panama City Beach |

| Gross Rental Yield % | 29% | 13% |

| Property prices: (2-bedroom) | $225,565 | $432,733 |

| Annual Revenue | $67,220 | $56,666 |

| Seasonality | 62% | 83% |

| Highest Revenue (peak season) | $7,460 (March) | $9,033 (July) |

| Lowest Revenue (off-season) | $2,070 (September) | $1,282 (January) |

Source: Airbtics

Based on Airbtics’ data, investing in Deerfield Beach is an excellent Airbnb investment. Here’s how you can create this analysis compared to Panama City Beach:

1. Cheaper Property Value

The property price for a 2-bedroom apartment in Deerfield Beach is low-priced ($207,168 cheaper) than in Panama City Beach. With the same property size, Panama City Beach requires you to pay more. Whereas in Deerfield Beach, you can spend the other $200k in maintenance, utilities, and amenities. This is more than enough to make your Airbnb property prepared for beachfront guests!

2. Expect More Revenue

Aside from the fact that you paid less for the property in Deerfield Beach, the annual revenue is a lot higher ($10,554 more) than in Panama City Beach.

Imagine if you had to pay $400k + and only earn $56k per year in Panama City Beach. Why waste money and invest there when there are several options that can bring good returns?

3. Low Seasonality

Deerfield Beach has low seasonality of 62%. But even during its off-season, you can still expect a monthly revenue of $2,070 in November.

In comparison to the off-season in Panama, you can only earn $1,282 in January. Deerfield Beach also has a relatively consistent round of bookings.

This thorough analysis of Airbnb is crucial for an investment property’s success. It’s easier to compare several locations using an accurate STR tool like Airbtics. It’s best to explore short-term rental providers available in the market to fulfill your investment goals.

Experts’ Insights: What’s the Best Property Type for your Airbnb Investment?

Let’s conclude that you have an allocated budget for any property type and would want to choose the best. By spying on your competitors in the market, you’ll be able to have an overview and make the best decision.

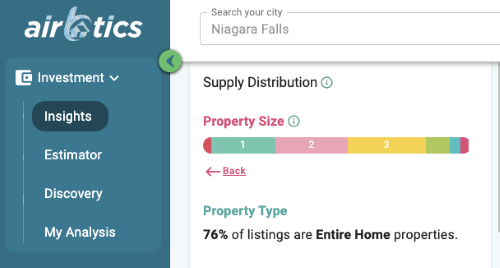

To cite an example, we featured Niagara Falls in New York. There’s no denying that this is one of the many favorite tourist destinations in the USA! Here are the best property types for Airbnb investment in Niagara Falls.

| Bedrooms | Gross Rental Yield | Property Prices | Annual Revenue |

|---|---|---|---|

| 1-bedroom | 35% | $95,537 | $33,549 |

| 2-bedroom | 27% | $116,754 | $38,831 |

| 3-bedroom | 25% | $149,384 | $38,739 |

| 4-bedroom | 31% | $149,446 | $46,737 |

| 5-bedroom | 36% | $146,879 | $54,059 |

Airbtics’ data shows that 76% of listings in Niagara Falls are Entire Home Properties. At the same time, the majority of listings are 3-bedroom properties. We can conclude that property investors in Niagara are more likely to cater to families. With a solid 25% GRY for a 3-bedroom property, it’s not surprising to do so!

However, a 1-bedroom home property in Niagara Falls can also be a great investment. It has the cheapest value among the rest! At the same time, you can expect a revenue of $33.5k, with a GRY of 35%. Imagine if you purchase two separate 1-bedroom properties, you can expect an annual revenue of $67,098 in Niagara Falls.

| Property Types | Number of Listings |

|---|---|

| 1-bedroom | 444 |

| 2-bedroom | 511 |

| 3-bedroom | 543 |

| 4-bedroom | 163 |

| 5-bedroom | 81 |

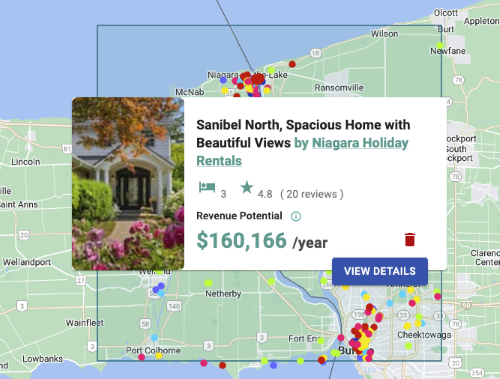

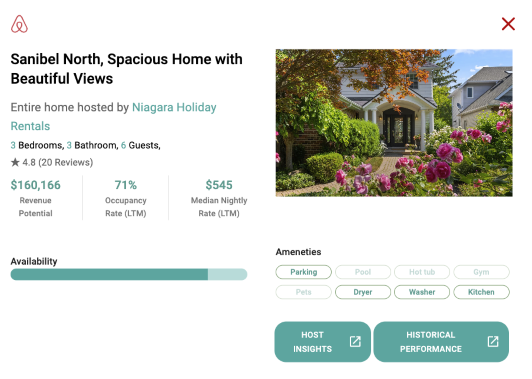

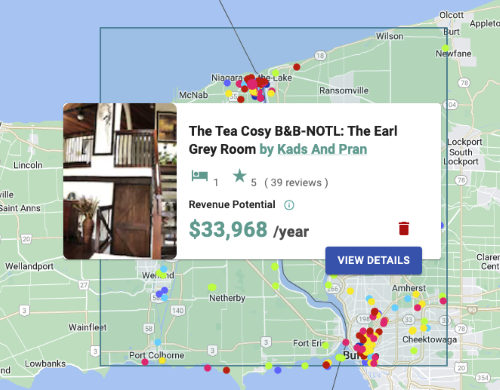

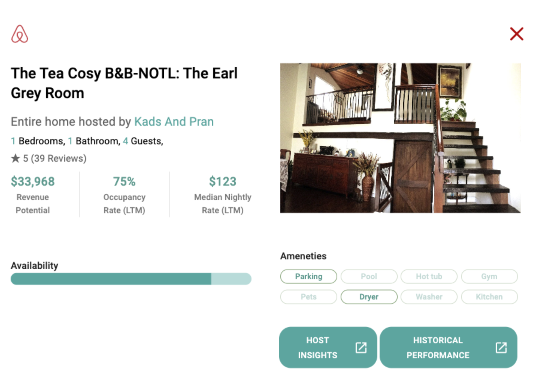

Looking at some of the competitors in the Niagara Falls market, you can easily compare their Airbnb data.

LOOKING FOR PROFITABLE CITIES TO INVEST IN OUTSIDE THE US?

Discover the most recommended cities for property investments in Canada by checking the Airbnb occupancy statistics!

Conclusion

In summary, Airbnb real estate investment can be risky if market research is not done as the first step. This is where a smart & reliable tool like Airbtics is truly needed! It’s bad enough to waste money and energy on a property that won’t meet your financial expectations. But what’s worse is not taking advantage of resources to avoid losses.

Here’s our final recommendation! Once you set your eyes on a particular city, it’s best to analyze and compare each property’s prices and returns. Conducting market research using STR analytics tools like Airbtics will help you make a wise decision that you won’t regret