Learn how to harness the ultimate Airbnb research tool to make data-informed Airbnb investment decisions!

- Last updated September 26, 2024

Airbnb Market Research

Doing an Airbnb is not just about listing your rental unit and hoping for the best. In a digital platform like Airbnb where every click and booking counts, the need for the best Airbnb research tools has never been greater. The use of such tools empowers investors in several crucial ways.

Airbnb operates in countless cities globally, each with its own characteristics and demand. Without the insights provided by short-term rental analytics, it can be challenging for both veteran and first-time investors to locate the markets that offer the best opportunities. A methodical approach that relies on the best Airbnb market research tool is the key to unlocking the full potential of your Airbnb investments. It all begins with understanding the Airbnb market’s key metrics such as:

- Average Annual Revenue

- Average Occupancy Rate

- Average Nightly Rate

- Total Number of Listings

Why You Need Airbnb Research Tool: 5 Top Reasons

Setting sail on a journey without a map sounds risky. That’s exactly what investing in a rental looks like without proper market research for Airbnb. And remember, your hard-earned money is at stake in this venture. The following are the other reasons why you should do your homework on Airbnb investing.

1. Locate Profitable Markets

This is exactly the point of doing your homework. Market research for Airbnb serves as a map to locating the most lucrative Airbnb markets. By analyzing occupancy rates, profitability, and local regulations, you can identify the cities where your investment will yield the highest returns.

2. Know Your Competition

In the Airbnb landscape, knowledge is power. Part of your market research is knowing your competitors. What do they offer, and what will make you stand out? With this information, you can fine-tune your future rental way before buying a property. This proactive approach helps you cater to your target audience and rise above the competition in the early stages of doing a property search.

3. Be on Top of Trends

The short-term rental industry is ever-evolving. What’s in demand today may not be around tomorrow. An Airbnb market research can help you stay ahead of the curve by allowing you to align with changing trends, guest preferences, and booking patterns. Being adaptable can help your property remain relevant and profitable.

4. Calculate ROI with Precision

Airbnb investments aren’t just about property search and acquisition. They also involve return on investment. Market research allows you to crunch the numbers with precision. This should factor in expected costs and revenue.

5. Boost Confidence and Peace of Mind

Confidence and peace of mind matter in any form of business venture, especially in the fast-paced world of Airbnb. There’s serenity that comes from knowing that you have practiced due diligence. You’re not just hoping for the best, you’re driving your venture with purpose. This sense of preparedness can be a powerful antidote to the anxieties that often come with financial and investment decisions. It allows you to sleep better at night, knowing you’ve taken every possible step to ensure your Airbnb’s success.

Finding a Profitable Rental Using an Airbnb Research Tool

If you’re in pursuit of a profitable short-term rental property, a reliable Airbnb research tool should be your companion. In this section, we’ll unveil its incredible potential to help you with your market search for Airbnb. We’ll explore the functionalities, strategies, and expert tips that can empower you to make data-informed decisions. This will ensure that your investment property not only reaps rewards but also aligns with your long-term aspirations.

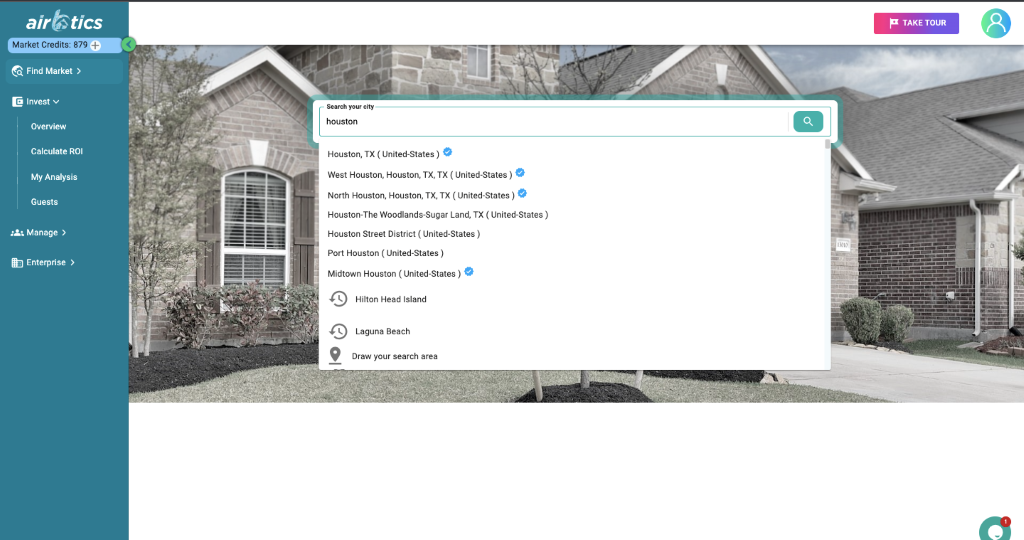

To give you an idea of what the best Airbnb research tool should do, we’ll use the Airbtics Dashboard and show how it can lead investors to the best Airbnb location where they can maximize their investments. In fact, anyone can instantly get insights by simply typing in the city name on the search bar. If you like something simpler, try out our ChatGPT type tool for Airbnb investors.

1. Compare Markets

Every Airbnb investor already has a target market in mind. The wiser ones know that it is better to cast their nets wide. So, let’s consider these 2 Airbnb markets. These are Miami and Nashville, 2 of the most visited cities in the US.

An Airbnb host in Miami can earn $41,031 in annual revenue compared to $49,744 in Nashville. This part is a no-brainer. In terms of profit, you can expect to gain more in Nashville. But let’s keep our Airbnb market search methodical by computing their gross rental yields.

According to Redfin, the median property prices in Miami and Nashville are $639,000 and $525,000, respectively. We already know that Nashville is a better choice, with its lower median property price and higher annual revenue!

|

|||

|---|---|---|---|

| City Name | Annual Revenue | Average Property Price | Gross Rental Yield |

| Miami, FL | $41,031 | $639,000 | 6.42% |

| Nashville, TN | $49,744 | $525,000 | 9.48% |

Property Type

Dataset

- Annual Revenue: $41,031

- Average Property Price: $639,000

- Gross Rental Yield: 6.42%

- Annual Revenue: $49,744

- Average Property Price: $525,000

- Gross Rental Yield: 9.48%

While Nashville is already a strong contender in the case, a good Airbnb research tool such as Airbtics should also provide additional insights that investors should consider. Among these are occupancy rates and nightly rates. While Miami has a higher Airbnb occupancy rate, the nightly rate in Nashville is $41 more compared to Miami.

To put the icing on the cake, Nashville has a lower number of active Airbnb listings of 9,241. This means that its Airbnb market is less competitive than Miami with 11,130 Airbnb listings.

2. Find the Most Profitable Neighborhood in an Already Profitable Airbnb Market

It goes without saying that Airbnb research tools should provide city-specific short-term rental data. Yet, the challenge remains in identifying the exact location where the highest profit lies!

Airbtics Dashboard grants investors the capability to zoom seamlessly from a city-wide perspective to a super specific neighborhood focus. Compare specific locations as you drag the map. All of this advanced feature comes with the assurance of real-time data updates.

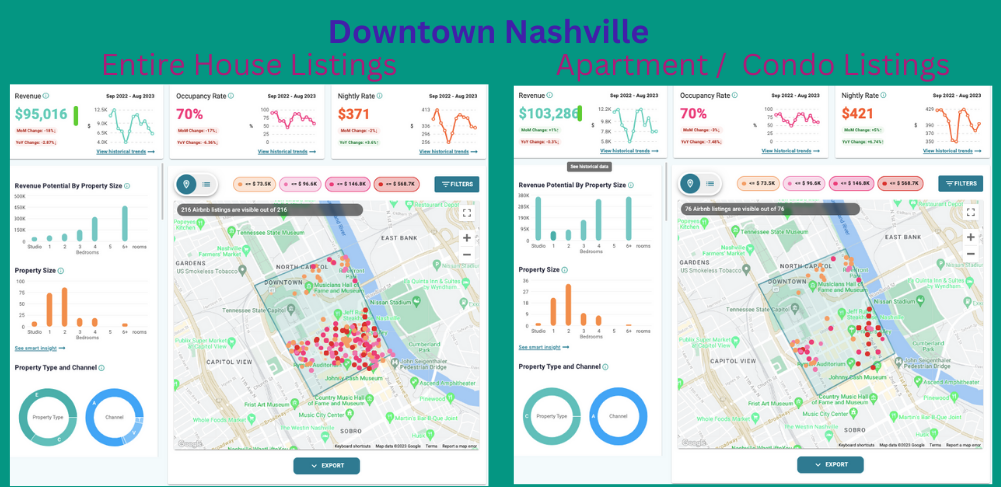

This feature, which you can’t find elsewhere, allows investors to delve really deep into the ins and outs of any Airbnb city worldwide. And just by zooming in, you have identified the most profitable Airbnb neighborhood in Nashville. The Downtown Area has an average annual revenue of more than $95,000. This makes your search for only the most profitable Airbnb listings a lot easier.

If you want to “bookmark” any location in the Airbtics Dashboard, you can simply create a custom market. Tailor your own region with or without regard for specific geographical boundaries!

3. Be Specific with The Property Type

After or before saving your custom market on the Airbtics Dashboard, you can study further the specifics of your chosen neighborhood. For instance, you can check the profitability of different property types in a market just by using Airbtics Advanced Filters. Instantly see the profitability according to property type by ticking the item of your choice!

Let’s analyze the results of this filter using Downtown Nashville market. Airbnb houses in the area generate $95,016 in annual revenue, while Airbnb condos earn $8,000 more. Both types have a 70% average Airbnb occupancy rate. Lastly, Airbnb condos charge $50 more for the nightly rate.

Let’s now compute the gross rental yield to check which is more profitable in Downtown Nashville. Using the median prices from Redfin for each property type and the annual revenue from Airbtics Dashboard, their gross rental yields are:

|

|||

|---|---|---|---|

| Property Type | Annual Revenue | Average Property Price | Gross Rental Yield |

| House | $95,016 | $567,000 | 16.76% |

| Condo | $103,286 | $795,000 | 12.99% |

Property Type

Dataset

House

- Annual Revenue: $95,016

- Average Property Price: $567,000

- Gross Rental Yield: 16.76%

Condo

- Annual Revenue: $103,286

- Average Property Price: $795,000

- Gross Rental Yield: 12.99%

Given that we have found out using Airbtics Dashboard that Downtown Nashville is the most profitable location in the city, both property types have excellent gross rental yield. Both of them surpass the 10% mark.

While condos in Downtown Nashville have higher annual revenue, they also have a higher average property price. In my opinion, the $228,000 difference in property price is just too steep for the $8,270 difference in annual revenue. This is why houses have higher gross rental yields.

The Ultimate Airbnb Research Tool

The use of a powerful Airbnb research tool should not be considered a luxury but a necessity for any Airbnb investors wanting success in the competitive world of short-term rentals.

Airbtics offers incredible potential to help you narrow down your search to the most lucrative investment options. The Airbtics Dashboard showcases a depth of information. You now have the ability to search deeper into the most profitable neighborhoods in already profitable cities. Just dragging or zooming into the map allows investors to make highly informed choices as the data updates in real time. Aside from this, it also has advanced filters to lead you to the most profitable property type and also the best number of bedrooms for Airbnb!

So, boost your confidence and peace of mind as you make the best investment decisions using Airbtics!

Ready to uncover short-term rental success? Check any property’s profit potential with the best Airbnb Calculator.

Short-Term Rental Data

Short-Term Rental Data

-

Quick Links

Annual Airbnb Revenue in Warren pennsylvania, USA

Warren, Pennsylvania| Airbnb Market Data & Overview | USA Warren, Pennsylvania Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Warren, …

Annual Airbnb Revenue in Palm beach florida, USA

Palm Beach, Florida| Airbnb Market Data & Overview | USA Palm Beach, Florida Airbnb Market Data & Overview USA Is it profitable to do Airbnb …

Interview with an Airbnb Host from Golden, Colorado – S2 EP26

Welcome back to another episode of Into The Airbnb, where we talk with Airbnb hosts about their short-term rental experience. Today’s guest is Daniel Bordeau, …

Annual Airbnb Revenue in Fullerton california, USA

Fullerton, California| Airbnb Market Data & Overview | USA Fullerton, California Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Fullerton, …

Annual Airbnb Revenue in Denton texas, USA

Denton, Texas| Airbnb Market Data & Overview | USA Denton, Texas Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Denton, …

Fully Booked Airbnb City: Croatia

Home > Resources > Fully Booked Airbnb > Fully Booked Airbnb City: Croatia Fully Booked Airbnb Fully Booked Airbnb City: Croatia Check out the best …