Bolton

Airbnb Market Data & Overview

UK

Is it profitable to do Airbnb in Bolton, UK?

What is the occupancy rate of Airbnb in Bolton, UK?

What is the average daily rate of Airbnb in Bolton, UK?

Bolton, UK Airbnb Data

Last updated on: 5th May, 2024

UK / Bolton

Is Airbnb Profitable in Bolton ?

Yes, it’s profitable to Airbnb

because the average net rental yield for a

one-bedroom property is

9.6%.

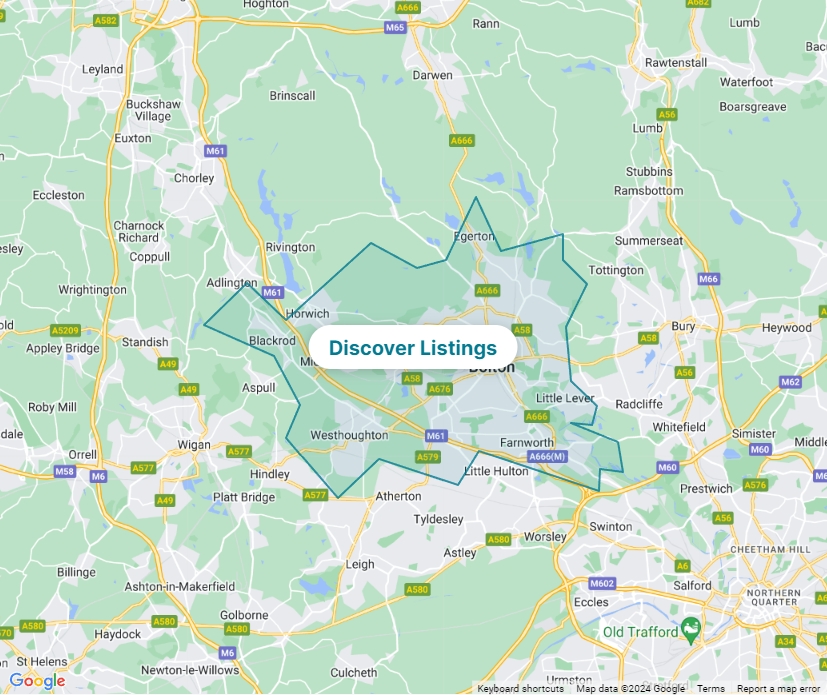

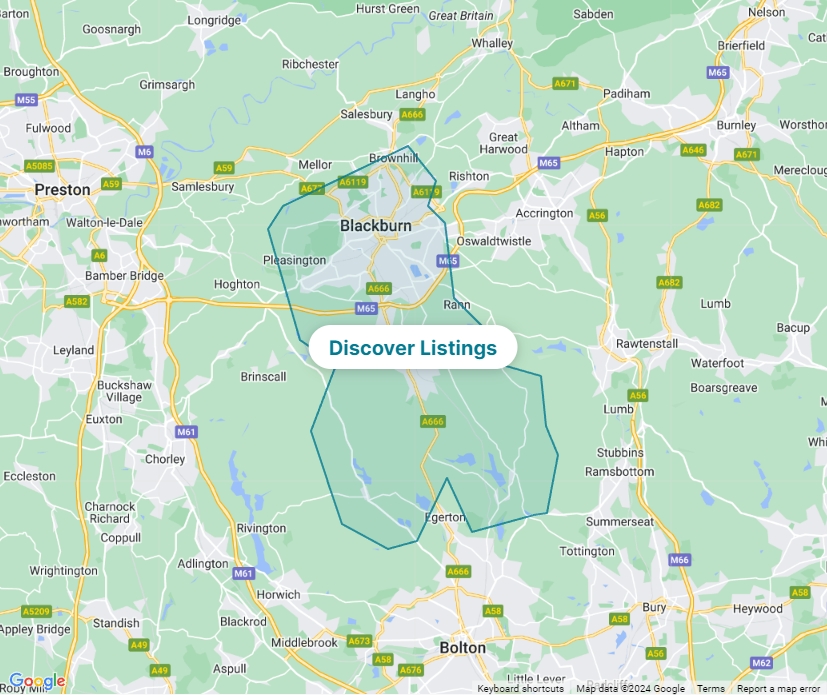

Best Areas in Bolton for Airbnb

Are you wondering where to invest in Bolton? Look no further! Here are 10 areas travelers often search for. You can find the short-term rental statistics of all of these neighborhoods from Airbtics! Check out which neighborhood has the highest rental demand. 🚀- Turton Tower

- Smithills Hall

- Bolton Museum

- Jumbles Country Park

- Moses Gate Country Park

- Queens Park

- Octagon Theatre

- Bolton Steam Museum

- Rivington Pike

- Hall i’ th’ Wood Museum

Signup and check out more in-depth

vacation rental data for free.

See

Bolton‘s Airbnb Data

⟶