Best Buy to Let Areas in Edinburgh: Where to Invest in Airbnb?: The best buy to let areas in Edinburgh can help investors to experience a rewarding investment journey. Learn more about this market in this article!

Home > Resources > Airbnb Investment >

The best buy to let areas in Edinburgh can help investors to experience a rewarding investment journey. Learn more about this market in this article!

- Last updated January 31, 2024

Key Takeaways

- Real estate investment in Edinburgh can be a profitable business idea for investors since it offers fruitful opportunities that can secure a good return on investment.

- With the help of Airbtics, you will learn about the top areas for buy to let properties in Edinburgh. You will also discover their recommended property types, estimated annual revenue, rental yields, and more essential data.

Introduction

Located on the southern shore of the Firth of Forth lies the capital city of Scotland, Edinburgh, a charming destination with an intriguing historical and cultural legacy. This city offers a unique experience to visitors and residents with permanent attractions like the famous Edinburgh Castle as well as bustling commercial areas.

But Edinburgh not only stands out as an attractive city because of its dazzling surroundings but also because of its strong real estate market that offers plenty of opportunities to investors.

It is always important to set clear goals to guarantee your investment success, especially if you are considering investing in short-term rentals in Edinburgh, Scotland. And for this reason, it’s essential to know where you can find the best investment opportunities in Edinburgh.

In this article, we feature the best buy to let areas in Edinburgh as well as some of the main reasons why you should consider investing in a rental property in this city. If you’re eager to learn more about this market, we encourage you to keep reading!

Top reasons to invest in Edinburgh real estate market

While owning investment properties in Edinburgh sounds like a profitable plan to generate a nice rental income, it’s crucial to research the market carefully. For this reason, knowing what kind of advantages the rental market of your target city can offer to real estate investors is important.

Make sure to check out some of the reasons why a real estate investment in Edinburgh can help you build your path toward the desired financial freedom:

Edinburgh owns a stable economy

Edinburgh is known for being a flourishing city in economic terms. In fact, it’s regarded as the powerhouse of Scotland with plenty of employment opportunities in a variety of sectors that attract young professionals to relocate to the city. Thanks to this, the city also enjoys a steady demographic growth.

Strong real estate market

With a rising population and low unemployment rates thanks to its strong job market and educational opportunities, Edinburgh enjoys a great demand for housing stock. Moreover, the city is home to renowned educational institutions and owns a strong tourist market, thus, investors can expect greater markets for both students and tourist lettings.

In addition, we must also mention that Edinburgh offers a high rental yield for short-term lets. For this reason, investing in real estate in Edinburgh can open the doors to a gratifying and prosperous experience for investors.

High standard of living

It’s a given fact that Edinburgh is a dream city with a friendly community that would make anyone fall in love with this place. The ice of the cake is that you can also enjoy the best living conditions while staying in this city. Moreover, it’s a paradise for commuters considering that the city center is well-connected to surrounding areas and is also quite a walkable city, which can even make people feel healthier.

Edinburgh is home to excellent universities, modern infrastructure with an efficient transport network, a reliable healthcare system, and a wide range of recreational facilities among other positive aspects.

Enjoy the cultural and historical legacy of Edinburgh

Imagine walking around a historical city that is surrounded by impressive architecture, and striking green scenery. Just by the thought of it, you can already be aware of Edinburgh’s charm. The city offers a lively cultural scene with plenty of museums, art galleries, restaurants, festivals, and music events. In addition, Edinburgh is also a dream place for outdoor lovers as there is no lack of parks, trails, and hills where you can easily connect with nature.

Aside from its plenty of leisure options, we should also take into account that Edinburgh welcomes a high influx of tourists from all over the world, which increases the city’s attractiveness for investments.

Is Airbnb profitable in Edinburgh?

Owning a successful Airbnb listing in Edinburgh seems like an unreachable dream, but don’t worry because Airbtics assures you that you can earn a nice passive income while operating a short-term rental in this city. As a matter of fact, Edinburgh is among the top profitable Airbnb locations in the UK, so you can already have an idea that vacation rentals can be a success here.

If we dive a little more, we can find that Airbnb hosts can earn an average revenue of £37,003 with a median occupancy rate of 75% for operating a 2-bedroom house in Edinburgh as confirmed by Airbtics’ data.

Aside from the amount of profit that a listing can create, it’s also essential to know about the latest Airbnb regulations in Edinburgh if you’re aiming to become a host in this city. By doing so, you will be able to manage your business smoothly while avoiding legal trouble.

Source: Airbtics Dashboard

Best Areas for Property Investment in Edinburgh

Considering that each neighborhood generates a different level of profitability, it can become a tedious task to choose the right rental market in Edinburgh to list your property. You may already imagine how time-consuming this step can be. But, this research can be less overwhelming if you take advantage of reliable analytics tools that are available, like Airbtics.

What is more, you can take a look at Simon, an Airbtics customer, who was led to a new Airbnb market that generated more profitability than his original one!

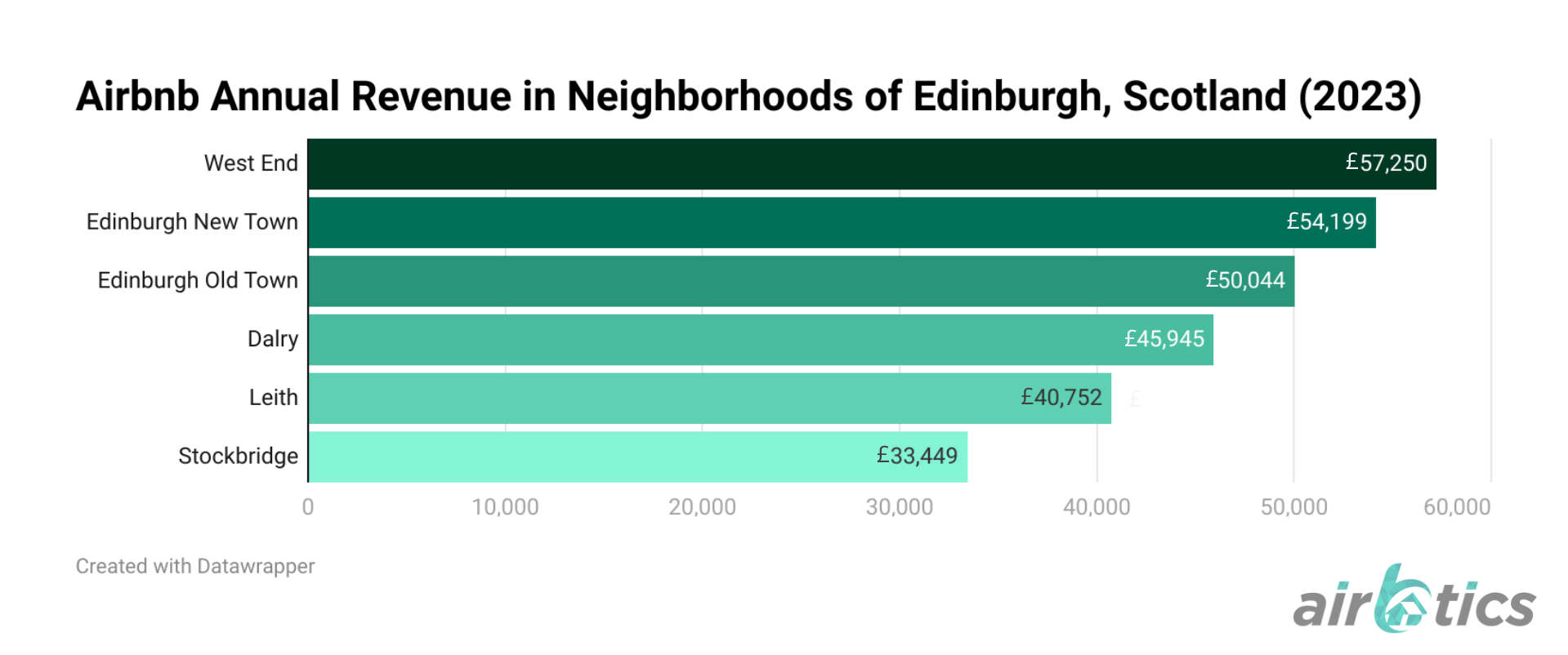

Don’t miss out on the best part! Go ahead and check out the top Airbnb areas in Edinburgh to invest in short-term lets:

|

|||||

|---|---|---|---|---|---|

| Best Area | Number of Airbnb Listings | Best Number of Bedrooms | Median Property Price | Airbnb Annual Revenue | GRY |

| West End | 91 | 2 bedrooms | £435,000 (2 BD) | £57,250 | 13.16% |

| Edinburgh New Town | 162 | 2 bedrooms | £450,000 (2 BD) | £54,199 | 12.04% |

| Edinburgh Old Town | 245 | 2 bedrooms | £340,000 (2 BD) | £50,044 | 14.72% |

| Dalry | 50 | 2 bedrooms | £325,000 (2 BD) | £45,945 | 14.14% |

| Leith | 91 | 2 bedrooms | £295,000 (2 BD) | £40,752 | 13.81% |

| Stockbridge | 36 | 1 bedroom | £223,000 (1 BD) | £33,449 | 15% |

Best Area

Airbnb Dataset

- Total Number of Airbnb Listings: 91

- Best bedroom size: 2 bedrooms

- Median property price (2 bedrooms): £435,000

- Airbnb Annual revenue: £57,250

- Gross rental yield: 13.16%

- Total Number of Airbnb Listings: 162

- Best bedroom size: 2 bedrooms

- Median property price (2 bedrooms): £450,000

- Airbnb Annual revenue: £54,199

- Gross rental yield: 12.04%

- Total Number of Airbnb Listings: 245

- Best bedroom size: 2 bedrooms

- Median property price (2 bedrooms): £340,000

- Airbnb Annual revenue: £50,044

- Gross rental yield: 14.72%

- Total Number of Airbnb Listings: 50

- Best bedroom size: 2 bedrooms

- Median property price (2 bedrooms): £325,000

- Airbnb Annual revenue: £45,945

- Gross rental yield: 14.14%

- Total Number of Airbnb Listings: 91

- Best bedroom size: 2 bedrooms

- Median property price (2 bedrooms): £295,000

- Airbnb Annual revenue: £40,752

- Gross rental yield: 13.81%

- Total Number of Airbnb Listings: 36

- Best bedroom size: 1 bedroom

- Median property price (1 bedroom): £223,000

- Airbnb Annual revenue: £33,449

- Gross rental yield: 15%

Source: Airbtics Dashboard

Deeper STR Insights. Broader Investment Opportunities.

Want to go deeper, broader, and faster? Supercharge your Airbnb Investment by accessing the most in-depth Airbnb & real estate insights with our exclusive STR report.

- Vital vacation rental data from 40 Markets – Airbnb Occupancy Rate, ADR, Revenue, and Listings! Access 2-year data from June 2021 to June 2023.

- Uncover 5-year real estate investability metrics for 40 markets including population, property prices, income levels, Google travel interest, crime, and unemployment trends 2017 - 2021)!

- All yours in 3 business days!

How to Find the Best Areas to Invest in Short-Term Lets?

Finding profitable rental markets can be a time-consuming task and we know that the investor’s time is valuable. For this reason, taking advantage of the many available resources for property investors to speed things up in this journey is a great way to start.

We also recommend visiting real estate forums or doing a throughout research in search engines to find out which locations are drawing the investors’ attention in specific countries. This way, you can also sort your list and have a clear view of which cities offer the best buy to let opportunities in the UK!

So wait no more and make use of the best analytics tools to find profitable markets to invest in Airbnb. As a tip, we recommend you focus on those that can provide dynamic data. In the past, it was quite a challenge to find apps that offer this type of dataset, but sites like Airbtics have taken the helm to provide this resourceful service to investors!

Imagine exploring a city while getting useful dynamic data that can make things easier for you. It’s possible with Airbtics Dashboard since you can easily collect important information such as the average revenue, occupancy rates, nightly rates, and seasonality, among others.

Now, you will have a better view of your target market. Go ahead and play around with the filters and find the results that fit your needs. You can use filters to find out what type of property offers the most attractive profit in your preferred area. The best part of using dynamic data is that by moving and zooming in and out of your map, the data will also change accordingly!

This process can now be repeated until you decide what type of property would be a good investment in your target city or neighborhood. Compare data between different property types and you find out the option that suits you the best!

Enjoy a rewarding investment experience with the help of Airbtics

In summary, it’s visible that Edinburgh is an attractive market to invest in as it offers investors a variety of property options and locations that can generate good levels of profitability. This can deliver a rewarding investment experience to property investors if they list their houses or flats on Airbnb.

But don’t rush into making a decision yet because there are still a lot of profitable cities to discover. Additionally, I recommend you analyze markets using dynamic data with reliable tools like Airbtics to get the most out of your investment.

Finding out the best buy to let areas in Edinburgh for Airbnb is the first rung on this investment ladder. Continue your research and make smart investment decisions & strategies by using the best tools such as the Airbnb calculator. Take advantage of the digital era and boost your profit now!

Short-Term Rental Data

Short-Term Rental Data

-

Quick Links

Annual Airbnb Revenue in Burnley, UK

Burnley| Airbnb Market Data & Overview | UK Burnley Airbnb Market Data & Overview UK Is it profitable to do Airbnb in Burnley, UK? What …

Annual Airbnb Revenue in Towson maryland, USA

Towson, Maryland| Airbnb Market Data & Overview | USA Towson, Maryland Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Towson, …

Top Property Management Companies Pensacola united states

Top 10 Property Managers in Pensacola, United states Top 10 Property Managers in Pensacola, United states Last updated on: 5th July, 2024 This list aims …

Annual Airbnb Revenue in South haven michigan, USA

South Haven, Michigan| Airbnb Market Data & Overview | USA South Haven, Michigan Airbnb Market Data & Overview USA Is it profitable to do Airbnb …

Top Property Management Companies Adelaide, Australia

Top 7 Property Management Companies in Adelaide Top 7 Property Management Companies in Adelaide Last updated on: 14th June, 2024 This list aims to provide …

Annual Airbnb Revenue in Baytown texas, USA

Baytown, Texas| Airbnb Market Data & Overview | USA Baytown, Texas Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Baytown, …