Mashvisor is one of the data analytics tool software in the market which was launched in 2014. Its major purpose is to help real estate investors to strategize their businesses based on accurate data.

But the real question is this: Is Mashvisor still useful in 2023?

In this article, we’ll find the answer to this question and feature Mashvisor’s products, pricing, and reviews. We also added a list of great Mashvisor alternatives in the last part – continue reading to learn more!

What is Mashvisor?

Mashvisor is a property analytics data tool. It is designed to help real estate investors to acquire good investment properties. Its process is finding potential good deals and using the data to predict their performance on long and short-term leasing.

How does Mashvisor obtain data?

Mashvisor has multiple channels from which it obtains its data. It exports the same data from various channels to verify the accuracy of data by comparing it to multiple sources. Some of their sources are Realtor.com, Zillow, MLS, Airbnb, Auciton.com, and Roofstock among others.

Each source has its own agenda and the type of data it provides. Websites like Realtor.com, Zillow, and MLS provide publically available property data. This includes physical description, past owner history, price, and size.

Whereas, Airbnb provides data on the short-term rental market, using which Mashvisor predicts the STR rental income of properties. Similarly, Roofstock helps in acquiring single-family houses that have a guarantee of a minimum rent. But, this is only on properties that have been not occupied or vacant for more than 45 days.

The last source, Auction, helps in gathering data on bank foreclosures. Residential properties that are for sale through offline or online auctions are monitored and their data is updated on Mashvisor using Auction.com API.

Mashvisor Review

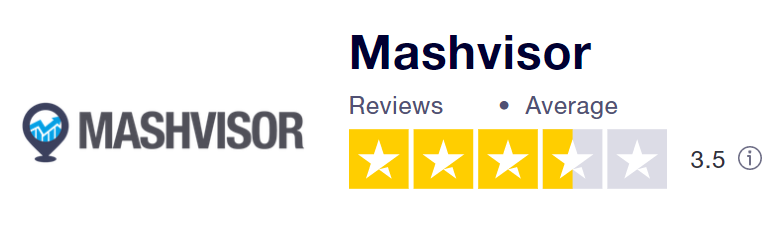

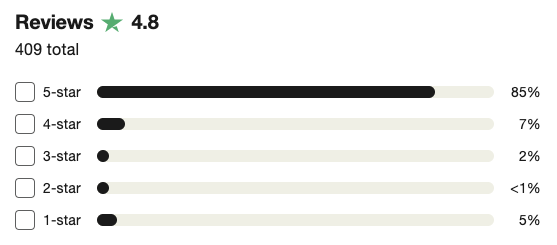

Mashvisor has an average review score of 4.8 out of 5 on Trustpilot. This shows people somewhat like this tool but there is a lot of room for improvement still. In our AirDNA Review, it was discovered that the majority of users had problems with pricing and inaccuracy

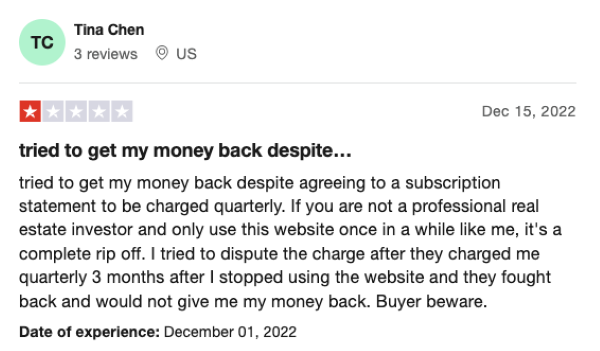

According to users’ feedback on Mashvisor, it seems that most of the negative reviews and comments are related to the data quality. Some people are complaining about missing listings and properties and incomplete data. Having incomplete data can be a huge con as it can give wrong results when analyzing an area to make a wise investment decision.

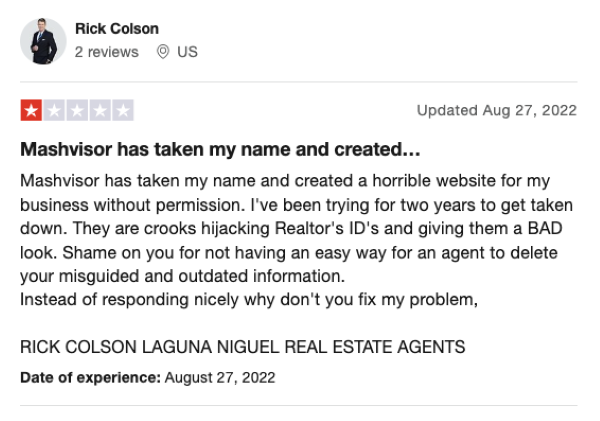

Mashvisor Dashboard

In the last 9 years, Mashvisor has made significant improvements in its UI and data. The dashboard is very user-friendly and easy to use. For someone new, it shouldn’t be hard to get hang of the dashboard quickly.

The color-coded “Heatmap” of the search function is especially useful. Users can sort the database for a specific variable such as listing price, cap rate, or cash on cash return with results displayed for neighborhoods in hues of “red” for low and “green” for high.

A prospective buyer, for example, would theoretically look for properties that are green for cash on cash return and red for market price. A user with unique search criteria can modify the search metrics at will. For example, an investor can quickly move from a cash purchase to a mortgage (and vice versa) with unique down payments, terms, and interest rates to see the impact on rates of return.

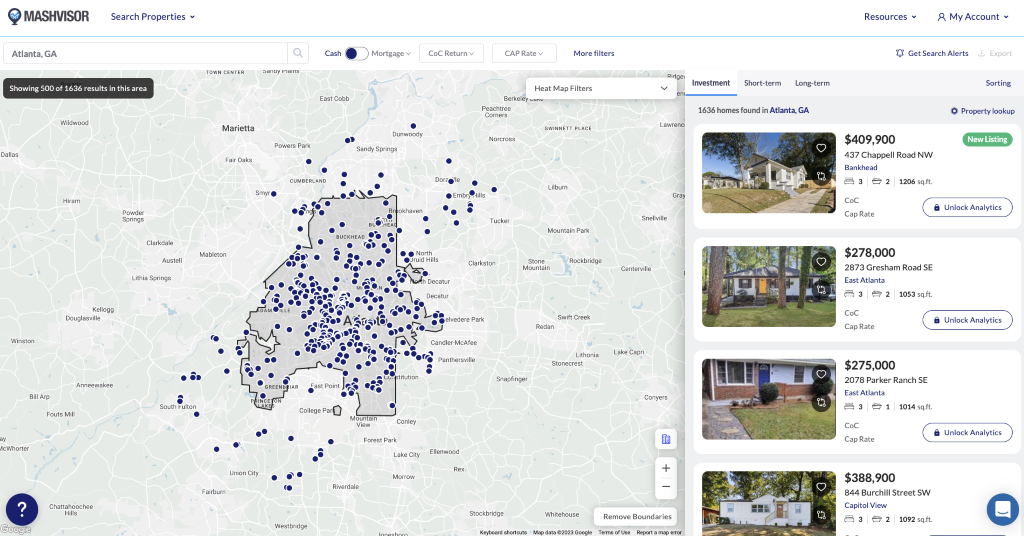

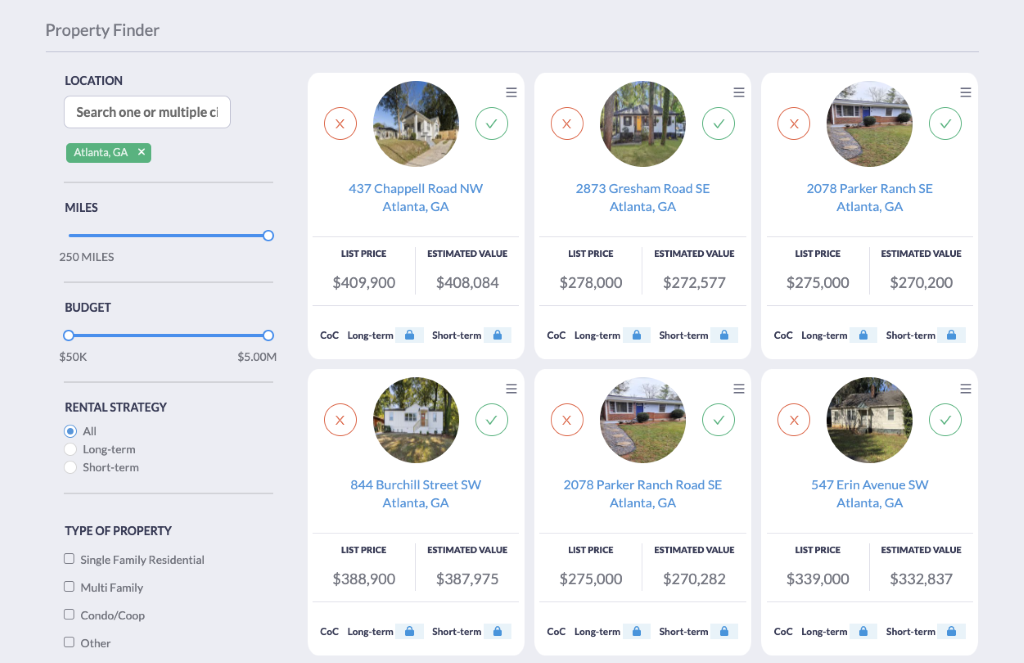

Mashvisor Property Finder

The properties identified through Mashvisor’s Property Finder should be further analyzed to ensure they meet an individual investor’s threshold for minimum returns. The process typically requires developing a spreadsheet of probable profits, expenses, and cash flows.

Building a unique spreadsheet or a fill-in-the-blank model can be a daunting task for those who do not regularly work with spreadsheets.

Mashvisor’s Property Analysis tool is a mathematical model designed solely for residential real estate investors. Its format identifies the major categories of revenues and expenses which are necessary to calculate net operating income. Subsequently, it’s also related to rates of return and cap rates.

Errors in the calculations arise because investors typically overestimate revenues and underestimate expenses. The model minimizes the chance of gross errors by populating revenue figures from data collected with the Property Search function. It also estimates costs(initial and ongoing costs) based on averages for comparable properties in the database. The software allows users to override each element to create a unique worksheet based on their experience that more accurately represents future results.

Mashvisor’s analysis modeling also helps investors determine the best usage of a potential property. It compares returns for short-term Airbnb renting versus long-term leasing. In some markets, short-term rentals don’t make ideal investments!

The Property Analysis model, in my opinion, successfully transforms a usually messy project into an elegant, easily understandable, and auditable result to make the right investment decision.

Ph: 1.415.742.8118

The customer support email is [email protected]

Mashvisor Pricing

Mashvisor offers various plans and pricing. Each subscription is billed quarterly with a free 7-day trial period:

- Lite: Investors can focus on one or two city markets for $22.99 /month. The fee includes traditional rental and Airbnb income and ROI analysis based on actual rental comps.

- Standard: For $69.99 monthly, a subscriber can discover profitable properties and markets, export 20 searches to Excel (every month), and compare various properties.

- Professional: For $99.99, investors can filter their property searches to find multifamily and foreclosure properties, export 60 searches to Excel and property PDFs, and analyze property listings.

Mashvisor Alternatives

Not satisfied with Mashvisor’s features and pricing? It’s certainly risky to spend efforts – and of course, money, if the software doesn’t provide everything you need.

In fact, Mashvisor vs AirDNA are consistently compared, but none of them have proven accuracy according to reviews. AirDNA vs Mashvisor Let’s not forget the fact that Mashvisor’s data coverage is limited within the USA.

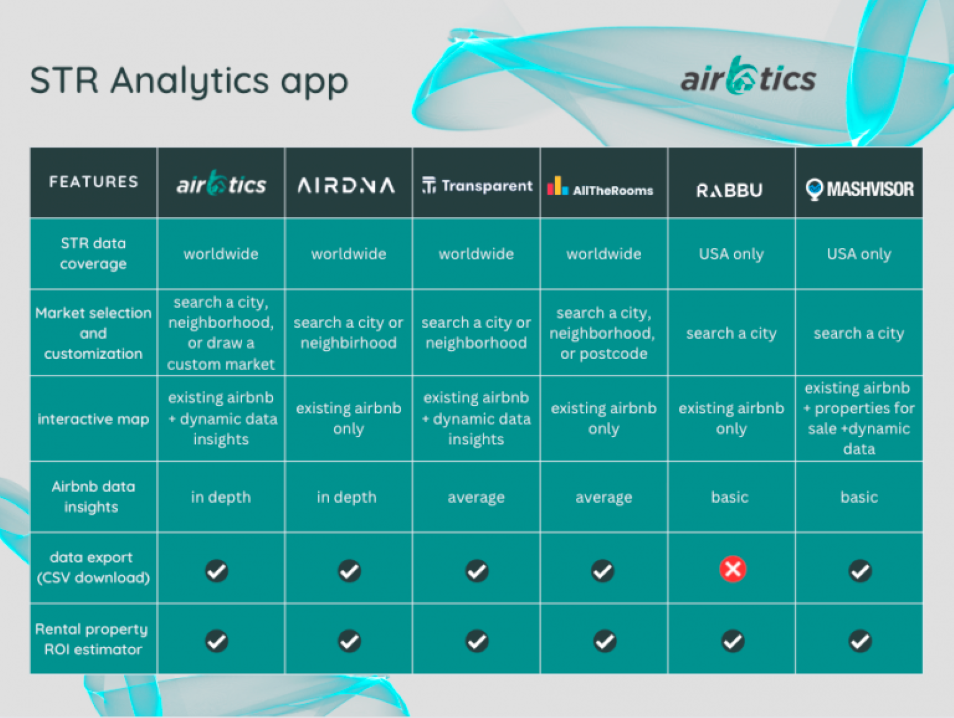

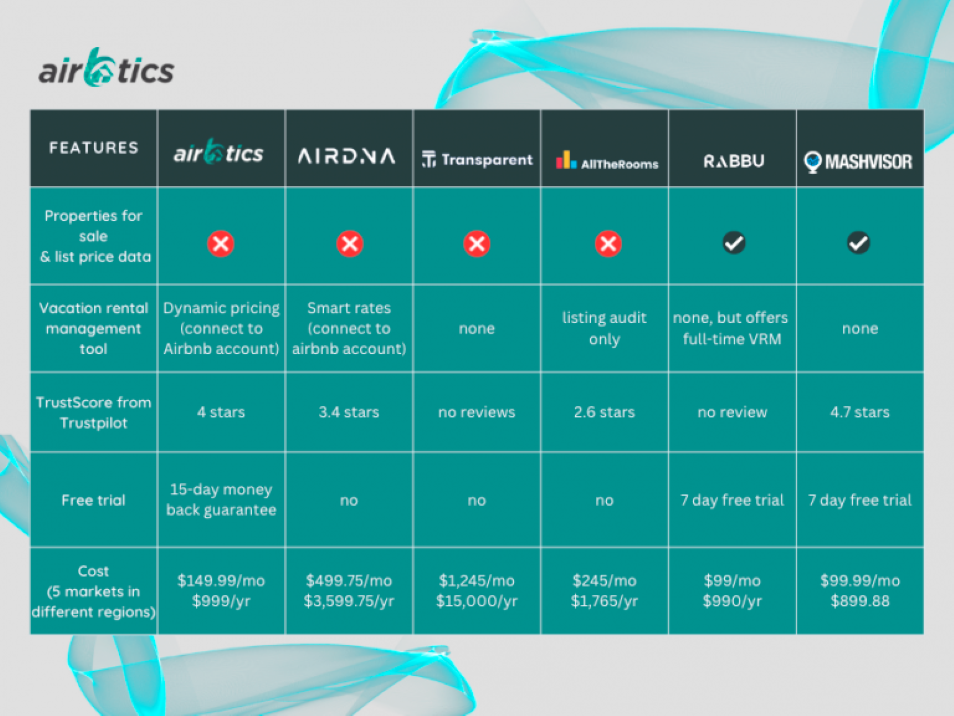

The good news is that there are Mashvisor alternatives that are affordable, accurate and top-of-the-line in the market. Check out the comparison table below to identify the best Airbnb data tool software for you:

Conclusion

Mashvisor is considered one of the leading real estate investor software in the market. It has its own pros and cons – which you can already gauge based on the features, reviews, and pricing in this article.

In comparison to Mashvisor, Airbtics covers worldwide regions with specific markets that fully cover historical performance data, guest demographics, and more. Investing in the digital era shouldn’t be a difficult task as long as you’re using the right short-term rental analytics tool for your success!