Airbnb Rental Arbitrage NZ: Explore the world of Airbnb rental arbitrage in NZ – a savvy strategy for generating passive income without the need for substantial upfront capital!

Explore the world of Airbnb rental arbitrage in NZ – a savvy strategy for generating passive income without the need for substantial upfront capital!

- Last updated January 1, 2024

Airbnb Rental Arbitrage NZ

Key Takeaways

- This blog navigates you through the process of Airbnb rental arbitrage in the evolving landscape of New Zealand.

- Uncover essential insights on startup costs, cash return times, and how to find potential landlords for successful arbitrage in NZ.

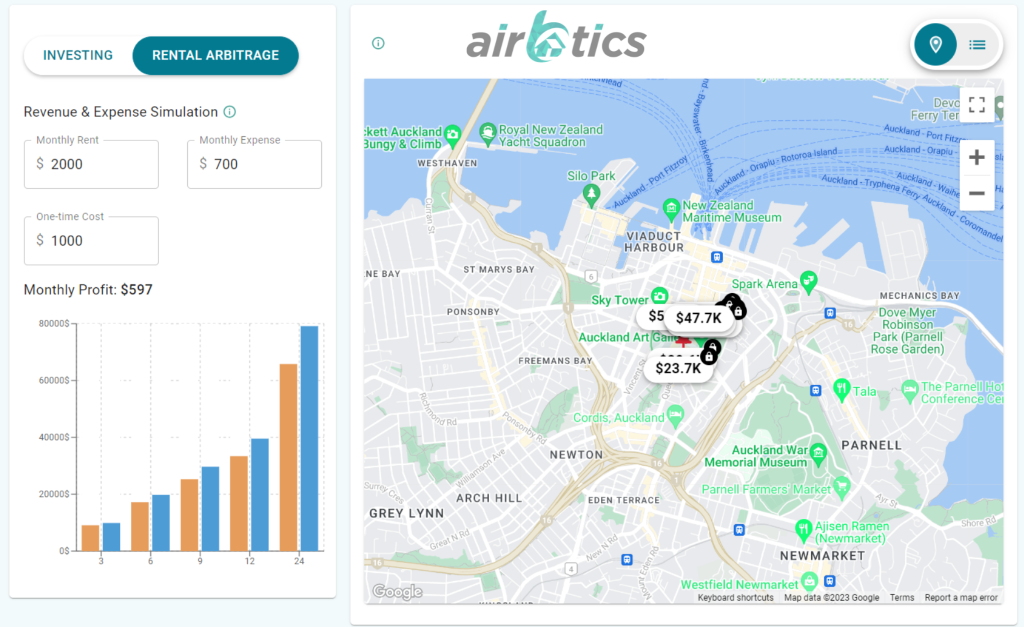

- Delve into the process, regulations, and potential profits of Airbnb arbitrage in NZ, and use Airbtics’ Airbnb host calculator to evaluate your venture’s viability.

Airbnb Arbitrage in NZ: A Guide to Profitable Short-Term Rentals with Minimal Initial Investment

Rental arbitrage emerges as an ideal way to start a short-term rental business without the need for large upfront capital as you won’t have to buy a property straight away.

Since you came into this blog, we assume that you are thinking of doing rental arbitrage in New Zealand. This island country became quite the catch for investors thanks to its strong tourist market, solid short-term rental market, and flourishing economy.

Yet, it’s important to consider if this type of business would turn into a viable investment. Why? Because even if you won’t invest a large amount of money, that doesn’t mean you won’t be putting some funds at stake. And the primary goal is to generate income rather than incur significant debt.

In this article, we delve deeper into the entire process of Airbnb rental arbitrage in NZ, its legality, and profitability, along with some of the top cities to consider subletting in. Keep reading to find out more about this business model.

What is Airbnb Rental Arbitrage?

Rental arbitrage, also known as subletting, is the practice in which a tenant rents out the property they have leased to another person. In this case, the tenant becomes a “sublessor” by listing the dwelling for short-term use on platforms like Airbnb and VRBO.

This is a legal business model that allows you to begin your venture into the Airbnb world with no money. The short-term rental income can help you cover the long-term lease on the property, allowing you to keep the remaining surplus at the end of each month after paying the long-term lease.

Is Airbnb Arbitrage Legal in NZ?

Wondering if rental arbitrage is worth it? Subletting a property is a worthwhile investment idea. But first, you need to know what are you getting yourself into. It’s important to consider the short-term rental market conditions of the city you want to target as well as its rental regulations and subletting laws in NZ.

Short-term rentals are legal in New Zealand. However, lessors and sublessors must review the rental rules set by the local councils in NZ, as certain regions may require property registration and obtaining resource consent.

Doing rental arbitrage is also legal in NZ, but tenants must speak with their landlord a get written consent before renting out the property to another person. The conditions for this will also depend on whether the rental will be a holiday or long-term:

- If a tenant sublets their residence on a long-term basis, they must sign a written residential tenancy agreement with the subtenant. This sub-tenancy agreement follows standard tenancy rules of the Residential Tenancies Act.

- For holiday sublets as they are not covered by the Act, no residential tenancy agreement is needed, but the landlord’s consent is still required.

Subletting a property without the landlord’s permission is considered an unlawful act that must be avoided. Otherwise, this may result in a financial penalty of up to $1,000 and potential compensation owed to the landlord.

How Much Profit Can You Make from Subletting a Property in New Zealand?

Before investing your money in a rental arbitrage business, it’s crucial to understand the potential profit of a STR in your target market. For instance, let’s say you’re targeting Auckland, particularly its central business district, a sought-after location for Airbnb investment.

By making use of a free Airbnb calculator, you can quickly discover the profitability of rental arbitrage in New Zealand.

Profit & Monthly Expense in New Zealand

According to Airbtics’ data, you can earn up to $4,595 per month for a 2-bedroom apartment in Auckland CBD alone. So you can expect that investing in a property in New Zealand can secure a positive cash flow.

|

|||||

|---|---|---|---|---|---|

| Average Rent Price (2 BR) | Airbnb Monthly Revenue | Monthly Expense | Monthly Profit | ||

| $2,500 | $4,595 | $919 | $1,176 | ||

Average Rent Price (2 BR)

$2,500

Airbnb Monthly Revenue

$4,595

Monthly Expense

$919

Monthly Profit

$1,176

Source: Airbtics dashboard

The monthly profit can be calculated by subtracting the Airbnb monthly revenue, the rental price, and the monthly expenses ($4,595 – $2,500 – $919 = $1,176).

Startup Cost in New Zealand

After getting an overview of your monthly expenses and revenue, let’s shift our focus to startup costs. Here’s the big question “How long does it typically take an investor to recover the startup cost?”. Let’s go straight to the point and take a look at this calculation:

|

|

|---|---|

| Total Startup Cost (Average startup cost + 2 months rent price) | Cash Return Time |

| $7,000 | 6 months |

Let’s say that the estimated startup cost for furnishings in New Zealand is around $2,000. To determine the total startup cost, you should add 2 months’ worth of average rent prices ($5,000). With a total startup cost of $7,000, the cash return time is calculated by dividing this by the monthly profit ($1,176). Thus, you can anticipate recovering the startup cost in approximately 6 months.

If these results sound promising to you, then go ahead and look at other recommended areas for rental arbitrage in New Zealand.

Top 3 Profitable Locations for Airbnb Arbitrage in NZ

Prior to making an investment in a specific New Zealand market, you need to research the best locations for short-term rental investments and consider factors like seasonality and local events that can affect the occupancy rates. This will help you to establish realistic expectations and guarantee your success.

Explore other top cities aside from Auckland in New Zealand, along with their annual revenue, monthly profit rates, cash return time, and more.

1. QUEENSTOWN

Queenstown is a popular destination for tourists with breathtaking surroundings, featuring crystal-clear lakes, snow-capped mountains, and lush landscapes. For this reason, it has become an attractive area for investors targeting the hospitality and short-term rental sectors.

|

|||||

|---|---|---|---|---|---|

| Number of Bedrooms | Average Rent Price | Average Airbnb Revenue | Startup Cost | Monthly Profit | Cash Return Time |

| 1 BR | $2,383 | $4,484 | $6,766 | $1,204 | 6 months |

| 2-BR | $3,250 | $7,324 | $8,500 | $2,609 | 3 months |

| 3-BR | $3,683 | $9,502 | $9,366 | $3,919 | 2 months |

Number of Bedrooms

Airbnb Rental Arbitrage Dataset

1 Bedroom

- Average Rent Price (Monthly): $2,383

- Average Airbnb Revenue: $4,484

- Startup Cost: $6,766

- Monthly Profit: $1,204

- Cash Return Time: 6 months

2 Bedrooms

- Average Rent Price (Monthly): $3,250

- Average Airbnb Revenue: $7,324

- Startup Cost: $8,500

- Monthly Profit: $2,609

- Cash Return Time: 3 months

3 Bedrooms

- Average Rent Price (Monthly): $3,683

- Average Airbnb Revenue: $9,502

- Startup Cost: $9,366

- Monthly Profit: $3,919

- Cash Return Time: 2 months

2. WELLINGTON

The capital city of New Zealand presents a compelling option for real estate investment due to its different strengths. Wellington is a political and administrative hub but also offers plenty of recreational activities and a thriving cultural scene that attracts visitors. Additionally, is home leading educational institution that attracts a high influx of students.

|

|||||

|---|---|---|---|---|---|

| Number of Bedrooms | Average Rent Price | Average Airbnb Revenue | Startup Cost | Monthly Profit | Cash Return Time |

| 1 BR | $1,603 | $2,518 | $5,206 | $411 | 13 months |

| 2-BR | $2,297 | $3,383 | $6,594 | $409 | 16 months |

| 3-BR | $2,816 | $4,592 | $7,632 | $858 | 9 months |

Number of Bedrooms

Airbnb Rental Arbitrage Dataset

1 Bedroom

- Average Rent Price (Monthly): $1,603

- Average Airbnb Revenue:

$2,518 - Startup Cost: $5,206

- Monthly Profit: $411

- Cash Return Time: 13 months

2 Bedrooms

- Average Rent Price (Monthly): $2,297

- Average Airbnb Revenue: $3,383

- Startup Cost: $6,594

- Monthly Profit: $409

- Cash Return Time: 16 months

3 Bedrooms

- Average Rent Price (Monthly): $2,816

- Average Airbnb Revenue: $4,592

- Startup Cost: $7,632

- Monthly Profit: $858

- Cash Return Time: 9 months

3. CHRISTCHURCH

Christchurch stands as an attractive destination for real estate investment, shaped by its healthy real estate market, great quality of life, and economic growth. Additionally, the city underwent significant rebuilding efforts after the earthquakes in 2010 and 2011. This has led to new infrastructure developments and modernization which makes the city more appealing to investors.

|

|||||

|---|---|---|---|---|---|

| Number of Bedrooms | Average Rent Price | Average Airbnb Revenue | Startup Cost | Monthly Profit | Cash Return Time |

| 1 BR | $1,040 | $1,999 | $4,080 | $559 | 7 months |

| 2-BR | $1,712 | $2,430 | $5,424 | $232 | 23 months |

| 3-BR | $2,123 | $3,167 | $6,246 | $411 | 15 months |

Number of Bedrooms

Airbnb Rental Arbitrage Dataset

1 Bedroom

- Average Rent Price (Monthly): $1,040

- Average Airbnb Revenue: $1,999

- Startup Cost: $4,080

- Monthly Profit: $559

- Cash Return Time: 7 months

2 Bedrooms

- Average Rent Price (Monthly): $1,712

- Average Airbnb Revenue: $2,430

- Startup Cost: $5,424

- Monthly Profit: $232

- Cash Return Time: 23 months

3 Bedrooms

- Average Rent Price (Monthly): $2,123

- Average Airbnb Revenue: $3,167

- Startup Cost: $6,246

- Monthly Profit: $411

- Cash Return Time: 15 months

How to Find Landlords for Airbnb Rental Arbitrage?

Investing in Airbnb rental arbitrage can be an excellent strategy for generating passive income. Yet, it may not be easy to find a landlord who permits subletting on Airbnb because not many of them know about the process of rental arbitrage or are not fond enough of this business model. Thus, to convince a landlord, you must involve proactive and strategic efforts to explore this mutually beneficial opportunity. We also recommend using our rental arbitrage email template to add more creativity to your proposal!

Here are some ways that you can use to identify potential landlords for your Airbnb arbitrage in NZ:

- Real Estate Platforms: Search for real estate platforms in NZ such as Realestate.co.nz, OneRoof.co.nz, Trademe.co.nz, or other websites to explore available rental properties and contact landlords.

- Real Estate Agents: Establish connections with real estate agents who possess insights into possible rental properties in your target market as they can connect you with potential landlords.

- Social Media & Networking: Don’t be shy and join online forums and communities centered around real estate in your chosen location. Platforms like BiggerPockets can offer valuable networking opportunities.

Additionally, ensure your interactions with landlords are conducted in a professional manner and be ready to address any concerns they may have about subletting.

Let’s wrap up: Should you do Airbnb Arbitrage in NZ?

Airbnb rental arbitrage presents a great opportunity for those seeking to enter the short-term rental industry in New Zealand without the need for significant upfront capital. The potential for passive income is evident, and the country’s strong tourist market, flourishing economy, and solid short-term rental market contribute to its appeal to investors.

So should you go ahead and do Airbnb arbitrage in NZ? Well, this is a question that only you can answer after weighing all the pros and cons of this business model as well as its profitability. New Zealand is a market full of opportunities that can certainly deliver you rewarding financial results.

To succeed in rental arbitrage, it’s essential to learn about local regulations, follow legal requirements, and strategically connect with landlords open to this mutually beneficial arrangement.

Moreover, thorough research is necessary to understand the market conditions. Thus, modern analytics tools like Airbtics Dashboard can provide investors like you with data-driven insights that can help the success of your short-term rental venture!

Short-Term Rental Data

Short-Term Rental Data

-

Quick Links

Interview with an Airbnb Host from Metro Atlanta, Georgia – S2 EP21

Welcome back to another episode of Into The Airbnb, where we talk with Airbnb hosts about their short-term rental experience. Today’s guest is Makeba Matthews …

Is Airbnb Property Investment in Lake Arrowhead Profitable?

airbnb property investment Lake Arrowhead Located in the “The Alps of Southern California”, Lake Arrowhead is a small mountain resort surrounded by nature, wildlife and …

Best Airbnb Markets in Illinois

Best Airbnb Markets in Illinois Best Places to Buy an Airbnb in Illinois Last updated on: 12th May, 2024 USA / Illinois 82% of American …

Annual Airbnb Revenue in Winter garden florida, USA

Winter Garden, Florida| Airbnb Market Data & Overview | USA Winter Garden, Florida Airbnb Market Data & Overview USA Is it profitable to do Airbnb …

Annual Airbnb Revenue in Lancaster texas, USA

Lancaster, Texas| Airbnb Market Data & Overview | USA Lancaster, Texas Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Lancaster, …

Annual Airbnb Revenue in Goldendale washington, USA

Goldendale, Washington| Airbnb Market Data & Overview | USA Goldendale, Washington Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Goldendale, …