The best areas to invest in Cardiff can guide investors on a prosperous investing journey. Find out more about this market here!

Home > Resources > Airbnb Investment >

The best areas to invest in Cardiff can guide investors on a prosperous investing journey. Find out more about this market here!

- Last updated January 31, 2024

Key Takeaways

- Real estate investment can be a successful venture thanks to the profitable opportunities it provides while allowing investors to secure a solid cash-on-cash return.

- Discover the top areas for buy-to-let properties in Cardiff with the aid of Airbtics. As a bonus, you’ll also find out what’s the recommended property type for each location, their potential annual revenue, rental yields, and more Airbnb dataset.

Introduction

Located in the southeast region of Wales we can find the biggest city in the country, Cardiff, and is regarded as the most important economic, cultural and political center in the area. The city is truly a destination filled with exciting experiences and majestic sights composed of historical houses and impressive castles.

Cardiff blends history, culture and entertainment perfectly, providing visitors with unique ventures that will later turn into gratifying lifetime anecdotes. But Cardiff not only stands out for its beautiful surroundings but also because of its attractive housing market that offers several opportunities to investors.

If you’re thinking of investing in short-term lets in Cardiff, it’s important to establish clear goals as well as analyze a market thoroughly to ensure the success of your investment. Thus, knowing where should you invest in Cardiff certainly is crucial so that you can find the finest investment opportunities.

In this article, we feature the best areas to invest in Cardiff along with an important Airbnb dataset. We also mention a few reasons why you should consider investing in a rental property in this city. If you’re eager to learn more about this market, you should keep reading!

Why invest in the Cardiff real estate market?

Although buying investment properties in Cardiff may help investors earn a decent rental income, it’s essential to conduct thorough market research. Thus, considering what benefits the rental market in your target city can provide to real estate investors is important.

Make sure to check out some of the reasons why property investment in Cardiff can be a great way to earn a nice passive income:

One of the most profitable Airbnb locations in the UK

If you’re looking to target the Cardiff rental market, let us give you great news: This city owns one of the most profitable Airbnb markets in the UK! The Cardiff real estate market has proved particularly profitable when it comes to investment performance.

While the housing market prices have risen over the last few years, properties in Cardiff are still more affordable compared to other major cities in the UK. Currently, the average house price in Cardiff is £288,163 as confirmed by Zoopla. On top of that, the city offers high rental yields and a solid rental demand, which provides investors with excellent income-generation opportunities.

Stable economy

In Wales, Cardiff is known as an economically thriving city and is regarded as an important financial and economic hub. The city provides a wide range of career prospects that attract young professionals and entice them to relocate there. As a result, the city has a consistent demographic increase and has become one of the fastest-growing cities in the UK.

It’s a great city to live and work

Cardiff is undeniably a vibrant city where you can enjoy lifetime experiences while having access to high-quality amenities. From excellent higher education institutions to modern infrastructure and plenty of leisure facilities, Cardiff surely won’t disappoint you. In addition, the city has low crime rates and great connectivity with a reliable transport network that facilitates access to other cities inside and outside the UK.

Plenty of things to do

With a wide variety of museums, art galleries, theaters, shopping districts, lively bars and restaurants, there’s always something to do and see in Cardiff. The best part is that you can easily get in touch with Cardiff’s historical and cultural legacy while exploring its fascinating sites of interest such as the Cardiff Castle or St Fagans National Museum of History! And don’t worry, if you’re craving nature, there are also plenty of green areas where you can enjoy fresh air and outdoor activities.

Is Airbnb profitable in Cardiff?

Worried that your Airbnb listing in Cardiff won’t be profitable? Don’t worry! Airbtics assures you that you can earn a nice passive income while operating a short-term let in this city.

If we dive a little more, we can find that Airbnb hosts can earn an average revenue of £45,177 with a median occupancy rate of 56% for operating a 3-bedroom property in Cardiff as confirmed by Airbtics’ data.

Aside from the level of profit that a listing can provide, it’s equally important to be aware of the Airbnb regulations in Cardiff if you want to become a host in this city.

Source: Airbtics Dashboard

Best Areas for Short-Term Lets in Cardiff

It might be difficult to find the ideal rental market in Cardiff to list your property because each area can generate a different amount of profitability. You may have a rough idea of how long and tedious this process can take. But if you use advanced analytics tools, like Airbtics, this research will end up being less time-consuming.

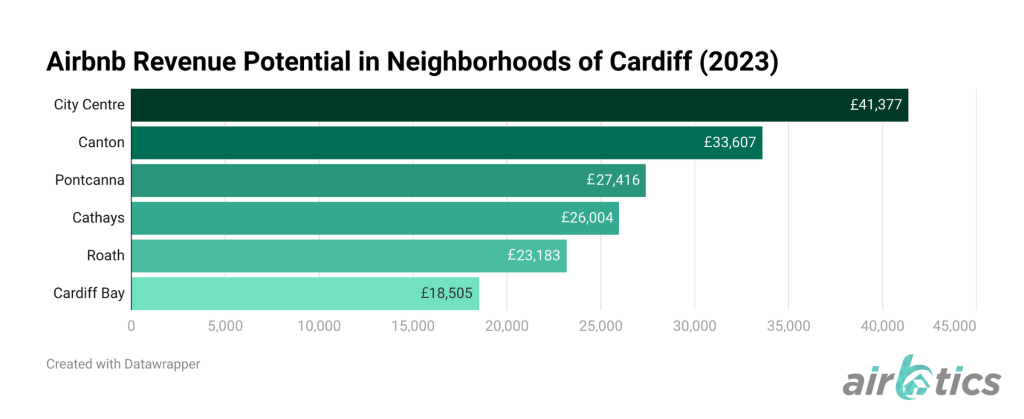

Go ahead and check out the top 6 Airbnb areas in Cardiff to invest in buy-to-let properties:

|

|||||

|---|---|---|---|---|---|

| Best Area | Number of Airbnb Listings | Best Number of Bedrooms | Median Property Price | Airbnb Annual Revenue | GRY |

| City Centre | 43 | 2 bedrooms | £230,000 (2 BR) | £41,377 | 18% |

| Canton | 56 | 2 bedrooms | £230,000 (2 BR) | £33,607 | 14.61% |

| Pontcanna | 56 | 2 bedrooms | £275,000 (2 BR) | £27,416 | 10% |

| Cathays | 30 | 1 bedroom | £140,000 (1 BR) | £26,004 | 18.57% |

| Roath | 74 | 1 bedroom | £145,000 (1 BR) | £23,183 | 16% |

| Cardiff Bay | 97 | 1 bedroom | £125,000 (1 BR) | £18,505 | 14.80% |

Best Area

Airbnb Dataset

- Total Number of Airbnb Listings: 43

- Best Numbers of Bedrooms: 2 bedrooms

- Median Property Price (2 bedrooms): £230,000

- Airbnb Revenue Potential: £41,377

- Gross Rental Yield: 18%

- Total Number of Airbnb Listings: 56

- Best Numbers of Bedrooms: 2 bedrooms

- Median Property Price (2 bedrooms): £230,000

- Airbnb Revenue Potential: £33,607

- Gross Rental Yield: 14.61%

- Total Number of Airbnb Listings: 56

- Best Numbers of Bedrooms: 2 bedrooms

- Median Property Price (2 bedrooms): £275,000

- Airbnb Revenue Potential: £27,416

- Gross Rental Yield: 10%

- Total Number of Airbnb Listings: 30

- Best Numbers of Bedrooms: 1 bedroom

- Median Property Price (1 bedroom): £140,000

- Airbnb Revenue Potential: £26,004

- Gross Rental Yield: 18.57%

- Total Number of Airbnb Listings: 74

- Best Numbers of Bedrooms: 1 bedroom

- Median Property Price (1 bedroom): £145,000

- Airbnb Revenue Potential: £23,183

- Gross Rental Yield: 16%

- Total Number of Airbnb Listings: 97

- Best Numbers of Bedrooms: 1 bedroom

- Median Property Price (1 bedroom): £125,000

- Airbnb Revenue Potential: £18,505

- Gross Rental Yield: 14.80%

Source: Airbtics Dashboard

How to Find the Best Areas to Invest in Short-Term Lets?

When property investors want to target a new niche market to invest in, there will always be the big question of “how much can I make with Airbnb?” on their minds. But finding rental markets that can generate a good level of profit can be a time-consuming task and there’s nothing more valuable than one’s time. For this reason, taking advantage of the many available resources for property investors to hasten this process is an excellent idea.

We also recommend visiting real estate forums or doing a throughout research in search engines to find out which locations are drawing the investors’ attention in specific countries. This way, you can also sort your list and have a clear view of which cities you can target.

In addition, we encourage investors like you to make use of analytics tools to find profitable markets to invest in Airbnb, particularly those that can provide dynamic data.

Imagine exploring a city while getting useful info that can make things easier for you, it sounds like a dream come true, right? It’s possible with Airbtics Dashboard since you can get a reliable dataset that will show you metrics like the average revenue, occupancy rates, nightly rates, and seasonality, among others.

But don’t take just our word for it, go ahead and take a look at Simon, an Airbtics customer, who was led to a new Airbnb market that generated more profitability than his previous one!

Now, you will have complete insights into your target market and can easily monitor its demand. On top of that, you can use filters to find out what type of property offers the most attractive profit in your preferred area. The best part of using dynamic data is that by moving and zooming in and out of your map, the data will also change accordingly.

This process can now be repeated until you decide what type of property would be a good investment in your target city or neighborhood. Compare data between different property types and you find out the option that suits you the best!

Have a fulfilling investment experience with the aid of Airbtics

With the information provided, we can conclude that Cardiff is an attractive market to invest in given the range of properties and locations it provides that can generate high rates of profitability. If real estate investors list their entire houses or flats on Airbnb, it could result in a gratifying financial experience.

But there are still many profitable cities to find, so don’t jump to a conclusion just yet. For instance, if you’re not keen enough to invest in Cardiff, you can explore other attractive rental markets in the UK.

The first step in achieving success with property investments is to identify the best areas to invest in Cardiff for Airbnb. However, you should continue your research and make wise investment decisions by using the best resources such as an Airbnb profit calculator. Take advantage of the digital era and boost your gains now!

Deeper STR Insights. Broader Investment Opportunities.

Want to go deeper, broader, and faster? Supercharge your Airbnb Investment by accessing the most in-depth Airbnb & real estate insights with our exclusive STR report.

- Vital vacation rental data from 40 Markets – Airbnb Occupancy Rate, ADR, Revenue, and Listings! Access 2-year data from June 2021 to June 2023.

- Uncover 5-year real estate investability metrics for 40 markets including population, property prices, income levels, Google travel interest, crime, and unemployment trends 2017 - 2021)!

- All yours in 3 business days!

Short-Term Rental Data

Short-Term Rental Data

-

Quick Links

Airbnb Smoking Fee: How to Claim from Airbnb?

Airbnb Smoking Fee Key Takeaways Airbnb’s host damage protection covers every host’s claim for any damages, cleaning costs, or income lost. Particularly when guests damage …

Annual Airbnb Revenue in Cortez colorado, USA

Cortez, Colorado| Airbnb Market Data & Overview | USA Cortez, Colorado Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Cortez, …

Annual Airbnb Revenue in Fontana california, USA

Fontana, California| Airbnb Market Data & Overview | USA Fontana, California Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Fontana, …

Annual Airbnb Revenue in Lithonia georgia, USA

Lithonia, Georgia| Airbnb Market Data & Overview | USA Lithonia, Georgia Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Lithonia, …

Alertas a tener en cuenta cuando alquilas en Airbnb (Huéspedes sin evaluaciones)

Tabla de Contenido Add a header to begin generating the table of contents Ser anfitrión de Airbnb nunca fue una tarea fácil, debe encargarse del …

Annual Airbnb Revenue in Macomb illinois, USA

Macomb, Illinois| Airbnb Market Data & Overview | USA Macomb, Illinois Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Macomb, …