The hype for short-term rentals like Airbnb is reaching a fever pitch with more and more people jumping on the trend and offering their properties to guests worldwide. For most investors, Airbnb is an excellent way to earn money on the side while also keeping themselves connected with guests from different backgrounds. In fact, there are exciting ways to start Airbnb with no money and the initial costs will give you an overview to anticipate Airbnb host expenses.

It isn’t surprising that a lot of people are looking for properties that they can turn to Airbnb and while rental arbitrage is certainly a good investment, there is a lot that could be said about its cost.

Aside from the Airbnb start-up cost, you also need to factor in your monthly expenses since they will be deducted from your monthly gross income. Preparing for all of these outlays will help you make a better investment decision.

With that said, we decided to cover the basic expenses you will have in a month as you manage your short-term rental. Stick to the end for tips on how to save on your monthly operating costs, Airbnb accounting suggestions, and a FREE downloadable Airbnb expenses spreadsheet to help you track your expenses and income.

How Much Does It Cost to Operate an Airbnb?

The overhead cost of operating an Airbnb can go somewhere between $700 to a few thousand dollars depending on what amenities you provide in your rental as well as how big your property is.

You might ask yourself why and how it managed to cost that much to run an Airbnb. Well, there are plenty of variables that contribute to these expenses. Some of these are electricity, water, gas, insurance, maintenance, and cleaning fees, which we will discuss in greater detail below so buckle up and prepare to have your eyes opened to what it truly costs to run an Airbnb property!

By the way, are you wondering if you are getting enough bookings? Compare your occupancy rate against to other similar listings around your area using Airbnb Analytics tool (Click the banner below). Once you are in the app, search for your market, and zoom into the area where your listing is located. Then, you can find the average occupancy rate of the area you are seeing in the map.

Most Common Airbnb Operating Expenses

Whether you are new or seasoned in the Airbnb industry, accounting for your expenses monthly is one of the tasks you can’t ignore. After all, your operating cost factors into how much revenue you will make.

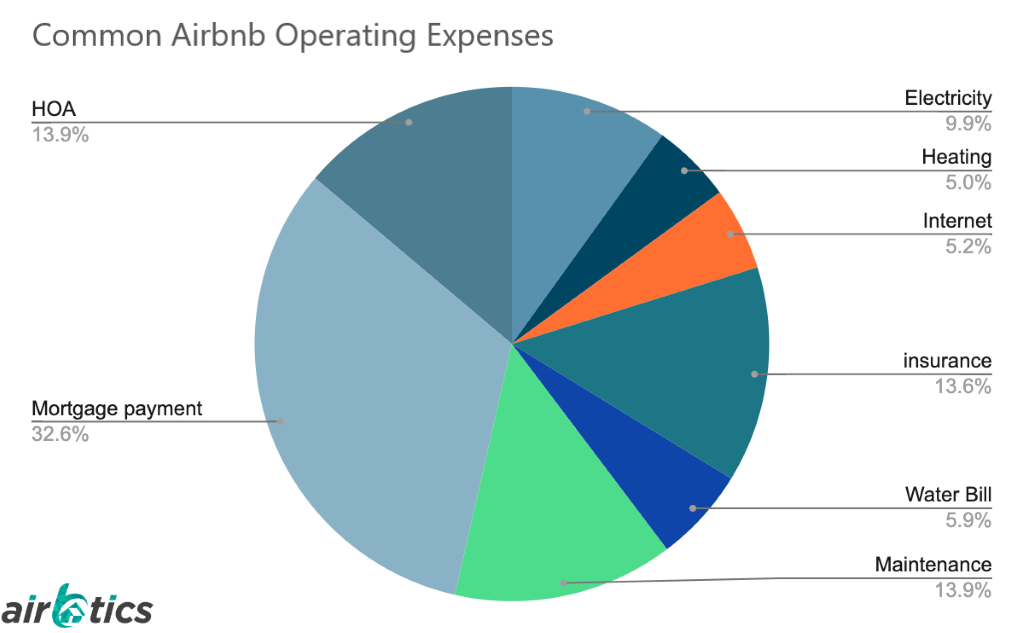

In this article, we will guide you through the most common Airbnb host expenses you need to be aware of before you dive right into your short-term rental investment. The pie chart below will give you an overview of your biggest possible expenses:

1. Mortgage/lease payment

Mortgage or lease payment takes up the biggest chunk of your monthly expenses and understandably so, after all, it is the payment for the property in which you built your business.

Based on the data from the US Census Bureau, the National Association of Realtors, and the Department of Housing and Urban Development, the average lease or mortgage payment for a property in the US is somewhere between $2,062 to $3,059. These can of course change depending on where your property is located and if it is in a popular spot like California, Hawaii, and New York, which has some of the highest monthly rental rates in the country.

Mortgage or lease payment won’t be a problem if you already own the property, but for people who want to invest in a rental arbitrage, you should be aware of how much your monthly rent would be and if your possible income could cover the amount.

To check the potential revenue, occupancy rate, and price of the property you are interested in, you can use a free Airbnb calculator from Airbtics and make the best investment decision.

2. Homeowners Association Fee (HOA)

If your property is situated within a condo or a subdivision, you are likely required to pay the HOA fee. The HOA fee is a monthly expense that you must pay as part of a particular residential area.

These collected fees are used to maintain the shared space of the neighborhood. Along with this, HOA fees also help fund the regulations that prohibit a single homeowner from creating adjustments that will lower the real estate value of the community.

The average monthly HOA fee in the U.S. is $170. The fee can still vary widely depending on where your property is located as well as what amenities are provided within your community so be sure to check in with your HOA board.

3. Maintenance

Establishing a beautiful and serene Airbnb space is one thing, but keeping it in a pristine condition is another. As a property owner, it is not enough to beautify your rental and leave it at that once you are already gaining profit.

To ensure that your property will have the same value or more, you must spare a percentage of your budget on maintenance.

The rule of thumb in the STR (Short-term Rental) community suggests that you set aside 1% of your property’s annual value to maintenance alone and by maintenance, we mean repairing broken appliances and parts of the house.

Follow the maintenance checklist below to secure a long lifespan for your property:

- Check for loose locks and squeaky handles

- Check for water heater leaks

- Check if all kitchen appliances are working

- Check if the drains are working

- Check if kitchen exhaust filter is blocked

- Check for molds and cracks

- Check for wood, sink, shower, and bathroom deterioration

- Check fireplace for hazards

- Check for chipped and peeling paint

- Check for faulty light bulbs

- Check for cracks and gaps in windows, doors, and walls

- Check for damage on the ceiling and roof

- Check for overgrowth of shrubs and indoor plants

- Check if security system is working

- Check for rusts or watermarks in appliances.

These are all the things you need to take note of when maintaining your property. Having all of these things on the checklist doesn’t mean that you will have to spend money on them monthly. The monthly fund that you are setting aside for maintenance is just to ensure you have the budget to handle any sudden repairs or replacements.

4. Insurance

When it comes to your short-term rental investment, one of the wisest decisions you can make is getting your property insured. Comprehensive policies for Airbnbs help safeguard every aspect of your short-term rental business and secure you from any loss of income.

On average, you have to pay $166.67 for your short-term rental insurance, but the price can vary depending on the provider. Below, we have provided you with a list of the top 3 best STR insurance companies in the U.S.:

Best Overall: Proper Insurance

We consider Proper Insurance as the best overall short-term rental insurance since they tailor their policies based on what your business needs. Additionally, this company specializes in short-term rental insurance so you can rest easy knowing that you are in the right hands. Some of their specs and perks include the following:

- Covers all 50 states including Washington D.C.

- Has a stand-alone policy type

- Has a coverage amount of $1 million

- Easy quote and claim process through phone

- Specializes in short-term rentals

- Has a $0 deductible option

- Has a loss-of-use coverage built into every policy

- Multiple policy add-ons are available

The only downside of this insurance company is that you cannot fully complete your quotes online and thus, you need to visit their office nearest to your location.

Best for Online Processing: Safely

Safely offers one of the best online experiences for investors who want to get their properties insured without going to physical locations. The website of Safely has a completely intuitive and user-friendly interface that makes it easier for you to process your insurance quotations and claims. Their unique quest-screening service also helped land them on our second most recommended STR property insurance provider in the U.S.

Check out the list below for an overview of Safely’s perks:

- Covers 50 states and Washington D.C.

- Has a stand-alone policy type

- Covers up to $1 million

- Can process quotes and claims online and on the phone

- Specializes in short-term rental and guest-screening

- Has a $0 deductible option

- User-friendly online portal for quotes and claim process

- Provides an option to conduct guest background checks upon confirmation of booking.

Safely has a set of pretty convenient specs; the downside, however, is that their short-term rental insurance may not be available on every ZIP code within their service area. They also don’t cover weather-related damage.

Best Claim Process: Allstate

Allstate is known for having one of the easiest and fastest claim processes among insurance companies. Additionally, they also have a convenient app that you can use to manage different aspects of your STR policy which includes filing and tracking insurance claims. Check out the list below to see its complete list of perks:

- Has an indorsement policy type

- Covers $10,000 per rental period

- Has multiple options for quote and claim process including online, app, phone, and agent

- Convenient claim process

- Has the potential to avoid a rate increase following a claim

As one of the biggest insurance policy providers in the U.S. Allstate offers an attractive set of benefits. However, since short-term rental insurance is not their main focus, this service might not be available in all states serviced by Allstate.

5. Electricity bill

This one is a no-brainer. Once your guests stay on your rental, they will use your appliances and consume electricity in one way or another. The difference in your electricity bill can be affected by the season, how many appliances you have in your rental along with how often the guests will use them.

Be sure that your guests will not abuse their stay by setting up rules on how they will use the appliances. This will save you not just from the overwhelmingly high bill but from a nasty headache as well. With that said, here’s a list of common appliances that guests might be looking for in your Airbnb:

- Washer and dryer

- Refrigerator

- Clothes iron

- Smart TV

- WiFi

- Hot pad

- Streaming service

- Air conditioner

- Exhaust fan

- Lights

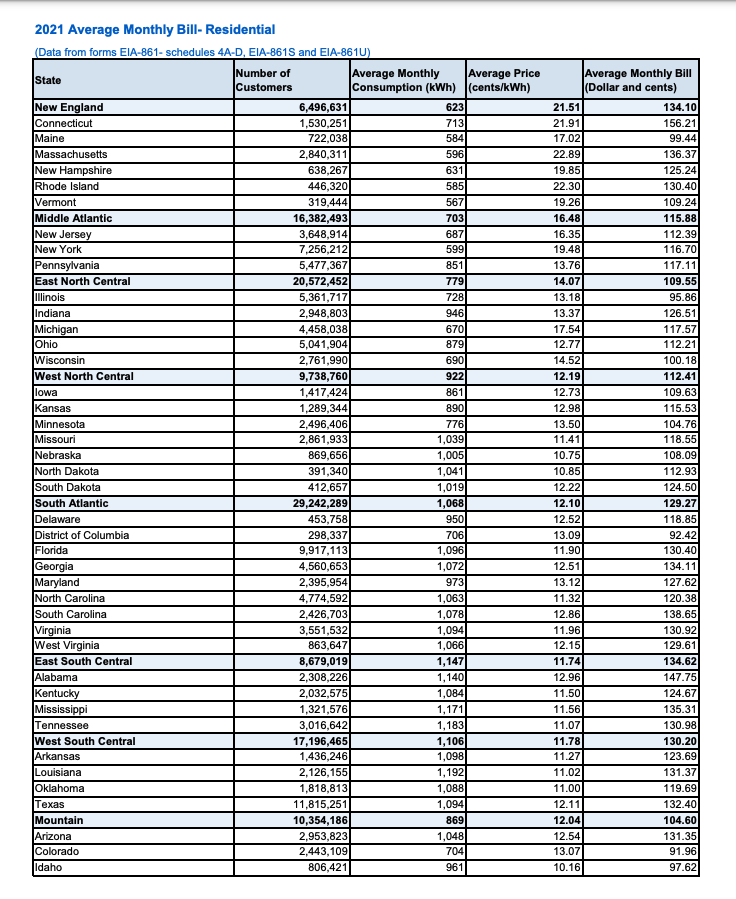

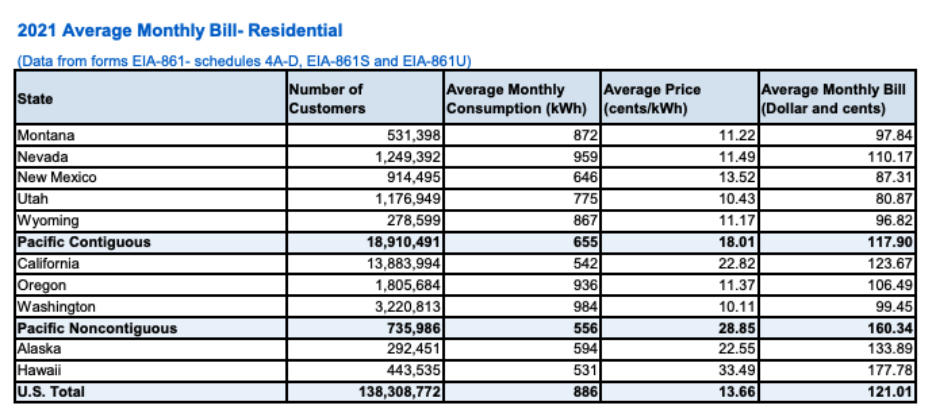

These are all the basics. You can add more to the list if you want to go the extra mile to impress your guests. The screenshot below shows the average electricity bill you would have to pay in the U.S. depending on your place of residence.

*Screenshot from the United States of America Energy Information Administration (EIA) 2021 Average Monthly Bill – Residential.

6. Water bill

The water bill is one of the most basic expenses you need to settle when you have a short-term rental. On average, this could cost you around $45.44 a month. When you think about it, this price isn’t so bad and you’d be right. Water bills rarely leave any drastic effect on your budget, but having a pool as one of your STR amenities is a completely different story.

If your Airbnb has a pool or jacuzzi, your water bill might increase by 10x or more of the average cost so this is something you need to be prepared for if you want to offer the pool as part of your amenities.

7. Internet

We are living in a world where people can’t survive without wifi. If you want to satisfy your guests, getting an internet subscription is a must. The good thing is that it doesn’t cost as much as your other monthly expenses.

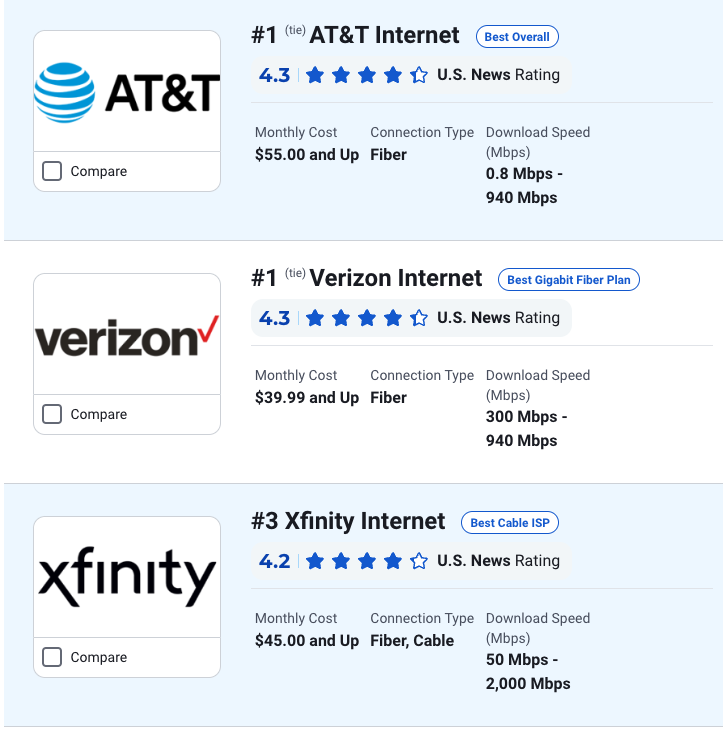

On average, the monthly internet bill could amount to only $45, which isn’t so bad considering that it will bring in more bookings. If you haven’t had an internet provider yet, here are some of our recommended options:

Screenshot from USNews.com

8. Heating

If you are using electric heating for your home, you can just chalk this up in your electricity bill, but if you are using natural gas, you should account for heating in your monthly expenditures.

On average, you can spend $61.69 on heating in the U.S., but that might also depend on where you are living as well as the season.

Naturally, if you are in the Northern side of the U.S. your heating expense might be higher than the rentals in the South since the South has generally humid weather. Additionally, you can also expect higher heating costs during winter months, but outside of that, heating will barely leave a dent in your monthly expense budget.

Additional Airbnb Host Expenses

Aside from what was mentioned above, there are expenses that you can consider adding to your monthly expenditures. Some of these are mentioned below:

Cleaning

You might find it odd that we included cleaning in the additional expenses section instead of the most common monthly expense list. The reason for this is that there are some hosts who prefer to handle cleaning on their own. And while others might rely on cleaning services, as a host you are allowed to charge cleaning fees to the guest and thus, cleaning costs will hardly affect your monthly budget.

Monthly entertainment subscriptions

If you are one of those hosts who want to go the extra mile to give your guests the best service, then you might consider subscribing to entertainment channels like Disney +, Netflix, HBO Go, and more. If this is the case, then you might want to consider adding these subscriptions to your Airbnb expense tracker.

Management service

Some hosts are content with managing their Airbnb personally, while some need a little hand from experts. If you are one of the latter, you might want to set aside a budget for management costs.

One thing you might want to know about management services is that they can typically cost somewhere between 10% to 40% of your rental income, which is a pretty big deal.

You, of course, have the option to manage your business yourself and save a huge percentage of your profit, but if you want someone to handle your guests, communicate and manage bookings, coordinate maintenance services, and provide customer service while you sit back and earn, then you might want to add management cost on your monthly expense.

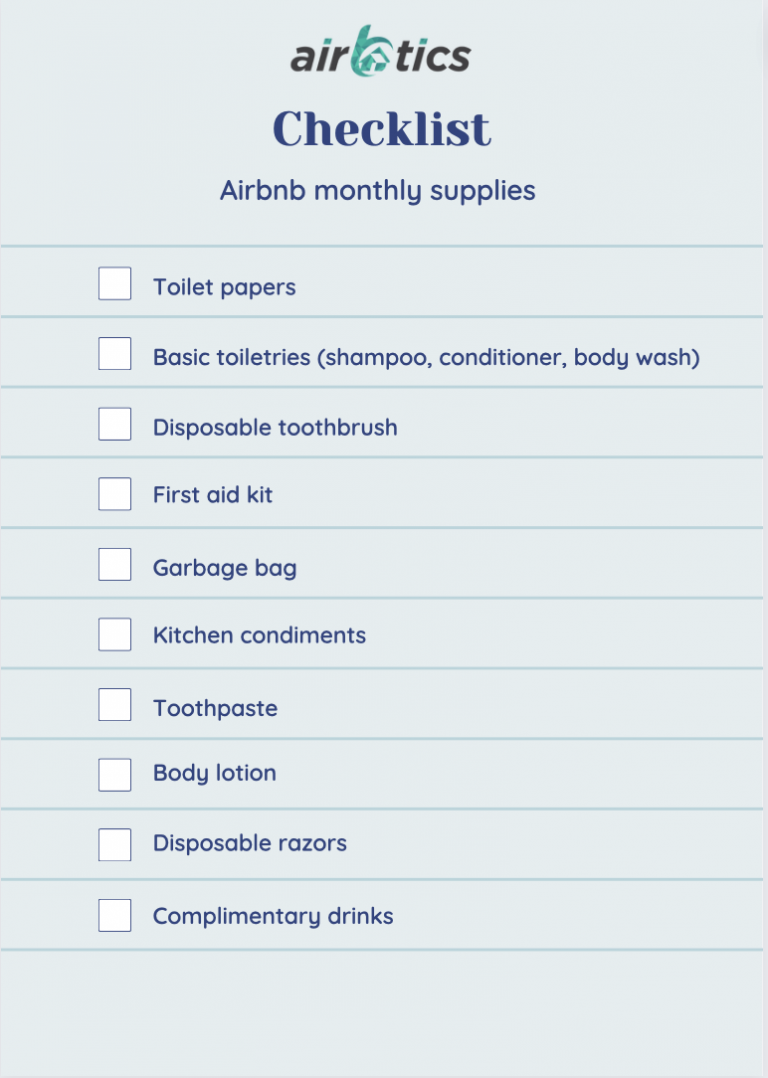

Supplies

Just like cleaning, you might find it weird that we included supplies here, but a lot of Airbnb hosts actually don’t provide guests with toiletries and other common supplies for their stay. Instead, they opt to ask guests to bring their own stocks. If you are a generous host who wants to give your guests the best experience, here are some supplies you can include in your inventory:

Airbnb Accounting: Tracking your expenses and income

Having a hard time keeping track of your expenses and income? We have just the right set of tools for you. Below are some of the most recommended apps and tools to help you keep track of your STR investment.

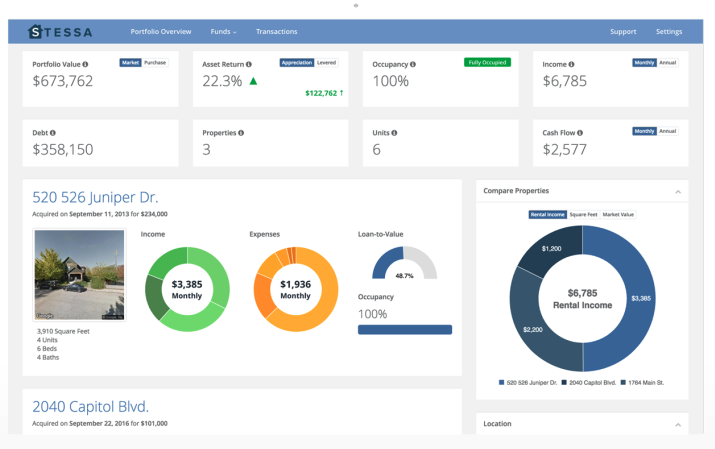

Stessa (Free)

Stessa is a finance tool that is created to help property investors like you to manage and monitor the performance of your short-term rentals. It has the perfect visual dashboard to help you view your key metrics in real time. With their new Airbnb file importer, keeping track of your income and expenses has never been easier. Check out how we do it below:

Step 1: Download your Airbnb transaction history in CSV format and upload the file to your Stessa account.

Set the necessary date range and click “Download CSV” along the “Paid out” tab. After that, select the “Import” button on the transactions page to upload the file without making any changes to the document. Once uploaded, Stessa will automatically categorize your Airbnb file.

Step 2: Switch the rent roll to “Short-term rental” through the Leases & tenants page then input your occupancy percentage for the calendar year along with your expected average nightly rate.

Step 3: Enter your expected Airbnb monthly expenses under the “Pro Forma” column in the “Monthly Expenses” card. Use this as a baseline to compare with your actual monthly expenses.

Step 4: Connect your bank account where you receive payments from Airbnb. Doing this will enable you to automatically capture your transaction and income data.

As you can see, Stessa has everything you need to record your expenses and income. What’s wonderful about this software is that it is simple to understand and keep up with. The best part is that it is absolutely free!

Quickbooks (Paid)

Quickbooks is the perfect software for a small business that doesn’t want to spend too much on managing and accounting costs. It gives you the option to handle your invoices, taxation, payroll, expense tracking and income tracking all in one place. To keep up with your income and expenses, here’s a step-by-step guide on using Quickbooks:

Recording expenses

Step 1: Go to New (+) and click Expense

Step 2: Select the name of the payee

Step 3: Select the account you use to pay for the expense. If your account is connected to Quickbooks, your expense will automatically be recorded on the expense report.

Step 4: Select the payment date and payment method. Then choose the appropriate category for what you bought and enter its description.

Step 5: State the amount you paid. You can also add receipts as an attachment to your expense report.

Recording income

Quickbook only records income coming from accounts that are connected to it. Make sure to connect your bank to where your Airbnb income is coming from and track your revenue through Quickbooks’ Income Tracker.

While Quickbooks is certainly a helpful tool for small businesses, it requires a bit of accounting experience on your end. Once you are familiar with the function of the app and your necessary business accounts are connected to Quickbooks, it would be easy to keep track of your expenses and income, especially since it automatically records the activities of the accounts you connected it to.

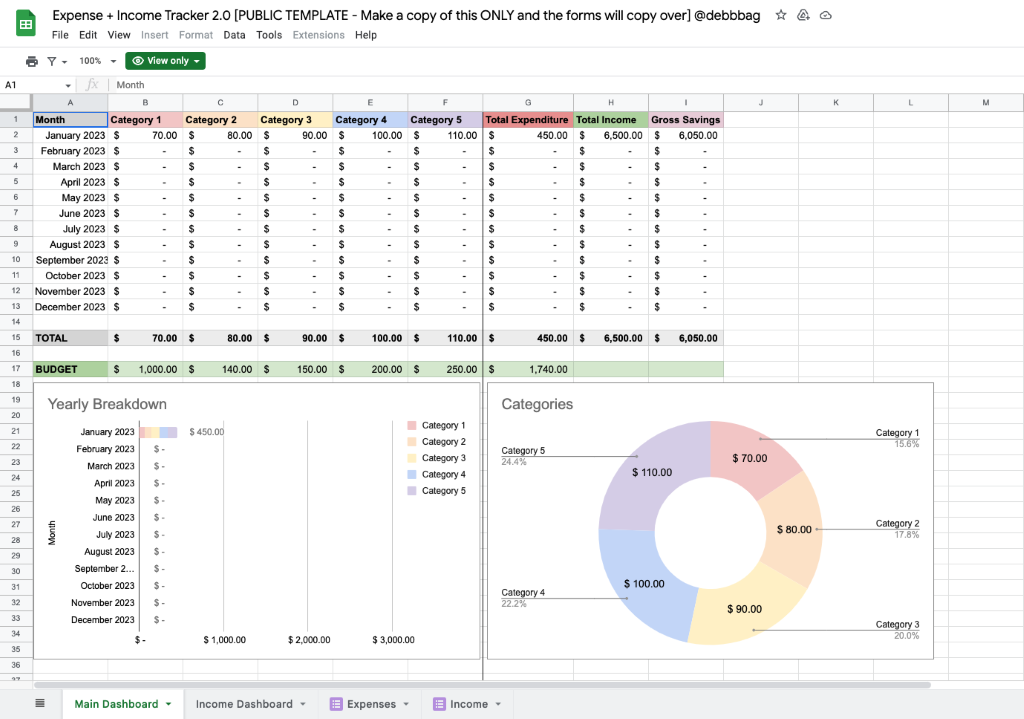

Spreadsheet (Free)

If the available softwares didn’t stand out to you, a spreadsheet might be just the answer you are looking for.

This spreadsheet template by Deborah Ho is one of the most comprehensive income and expense trackers for Google Sheet users. It offers customizable categories with a pie chart to show you where most of your expenses go. It also has a yearly breakdown so you can track which expenses you spend on the most for each month of the year.

What makes it even better is that it is FREE and you can create a copy of it using THIS link. Here’s a step-by-step guide on how to use this sheet:

Step 1: First, you must create a copy of the sheet on your own drive.

Step 2: Change the category into the name of your specific expense. For example, change Category 1 to Electricity and so on.

Step 3: Go to the Income Dashboard then change the name from “Workplace” to the name of your property.

Step 4: Input your income from your properties on the Income Dashboard. The sheet will automatically compute the total of your income for the month and it will reflect on the Main Dashboard.

Step 5: Go back to the Main Dashboard then type in the cost of your monthly expenses per category. The total amount of your expenses will reflect under the Total Expenditures. This total expenditure will be deducted from your total income to give you your gross savings.

You can customize the spreadsheet once you have made a copy, but make sure to check the formula if you are adding another category on the sheet since it might affect the overall data reading.

Airbnb Saving Tips for Hosts

Did the list of expenses sound overwhelming? Don’t worry, we got your back. Read the tips below and save on your monthly expenditures:

Tip 1: Use energy-efficient appliances and light bulbs

Electricity is one of your major Airbnb expenses so you want to save on it as much as possible. Fortunately, there are energy-efficient appliances like LED light bulbs. Although these bulbs have a higher initial cost, they can help you lower your energy use boasting durability that your regular bulbs don’t have.

Additionally, you can also opt for motion-sensing lights for outdoor lighting to save on energy. Even better if it is solar-powered!

Tip 2: Buy in bulk

If you are thinking of adding supplies to your Airbnb, we recommend purchasing in bulk since it is usually cheaper. Try taking the time to look into good markets where you can purchase items for a lower price.

Tip 3: Keep your tax deductibles in mind

You might not have to worry about tax on a monthly basis since it is automatically deducted by Airbnb after every confirmed listing, but it doesn’t mean that it isn’t there and it isn’t affecting your profit.

To make sure that it wouldn’t leave you with too little income to enjoy, make sure to meet all the tax deduction requirements and record all your expenses associated with running your Airbnb and be sure to fill out the tax form provided by Airbnb to avoid any legal negligence.

Tip 4: Be proactive in maintenance

Maintenance is one of your biggest expenses as an Airbnb host, but there is a way to reduce its cost and that is through proactive maintenance. What we mean by this is fixing things before it becomes irreparable. Keep track of every small issue on your Airbnb and jump into action before it could get worse.

Tip 5: Do your own cleaning

We know a lot of us hate cleaning but if you want to save on the cleaning expense, you better gear up with your cleaning gloves and start doing the chores on your Airbnb. What’s fun about this is that you can charge the guest for the cleaning expense even if you are the one to handle your own cleaning. The average cost that you can charge per reservation is $150.

Tip 6: Reduce marketing expense

Marketing is an important part of your business, but that doesn’t mean you have to go overboard with it. Instead of throwing money left and right to market your Airbnb, you can opt for low-cost marketing strategies using social media.

Get professionally taken shots of your property and post them on your Facebook, Twitter, or Instagram page. We also recommend being consistent with producing high-quality content to attract the audience that you want.

The bottom line

Before investing in an Airbnb property, you must identify the ongoing expense you will have to keep your short-term rental running. Your expenses shouldn’t surpass your income and thus, you need to make the best investment decision when selecting your property.

To do this, you need reliable STR software like Airbtics to guide you in finding the best ROI rental markets for your Airbnb business. You can use the Airbtics Estimator to list down your expenses and calculate your revenue potential. For instance, let’s say you are thinking of setting up an Airbnb listing in the United Kingdom, then you should target cities with the highest Airbnb occupancy rates in the UK.

The cost to run your Airbnb might be high but once you find the right property through Airbtics’ accurate market data and actionable analytics, you can generate an income that will make all your expenses worth it!