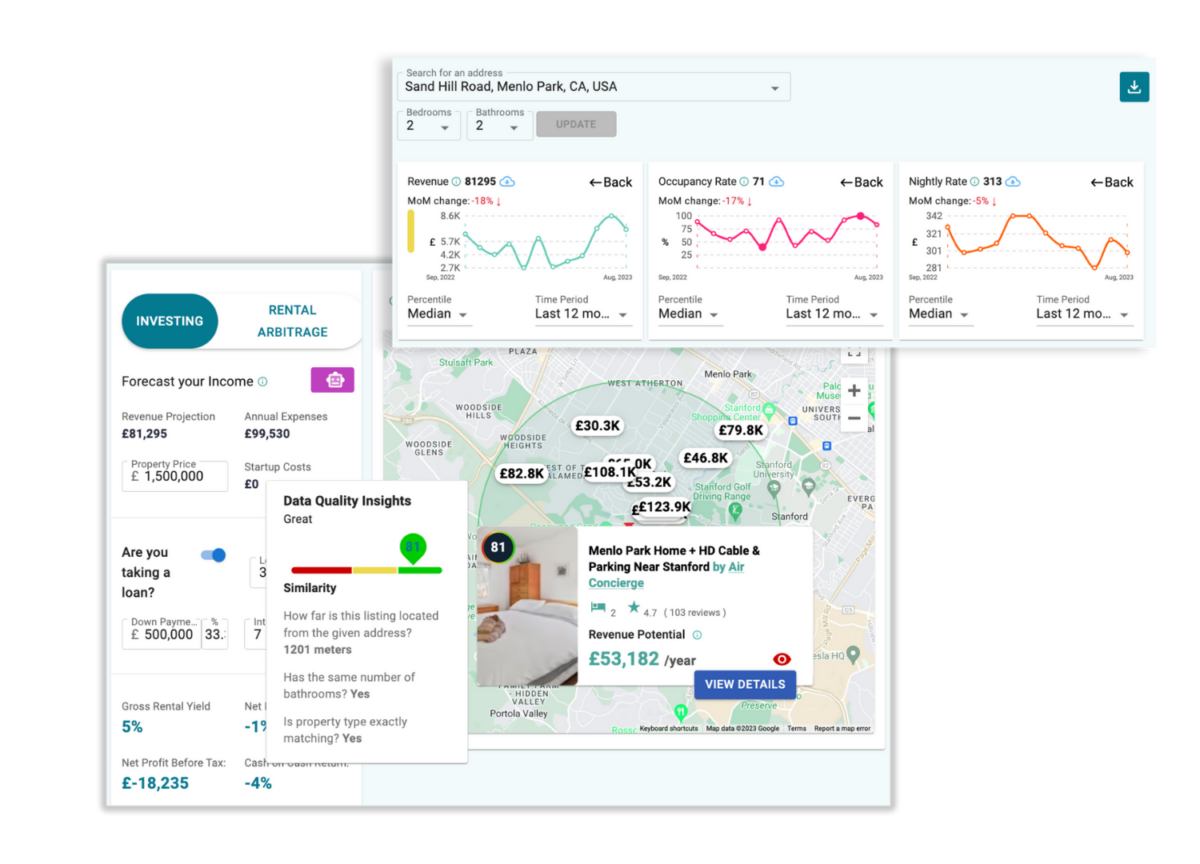

Airbnb Calculator Instantly See Your Airbnb’s Estimated Revenue The leading Airbnb profit calculator in the short-term rental industry. Discover your Airbnb earnings potential. Estimate Bedrooms − 1 + What is your goal? Buy Rent Manage Calculate Trusted by 50,000+ Short-Term Rental Businesses Check out our Free Airbnb Calculator Wondering how to make the most money […]