Last updated on June 21st, 2023

airbnb property investment New Orleans

Located by the banks of the Mississippi river, New Orleans stands outs as one of the most interesting cities in the US with a rich history, unique gastronomy and an incredible music scene. Although this city has gone through a lot of catastrophes, such as Hurricane Katrina, this did not stop it from resurfacing stronger and becoming even more captivating.

It’s understandable if you are considering investing in the beautiful city of New Orleans, but before deciding to purchase a property here, it is important to analyze the major costs, revenue and yield accurately. In addition, it is also a good idea to learn more about the Airbnb rules in New Orleans to avoid major problems while running your listing.

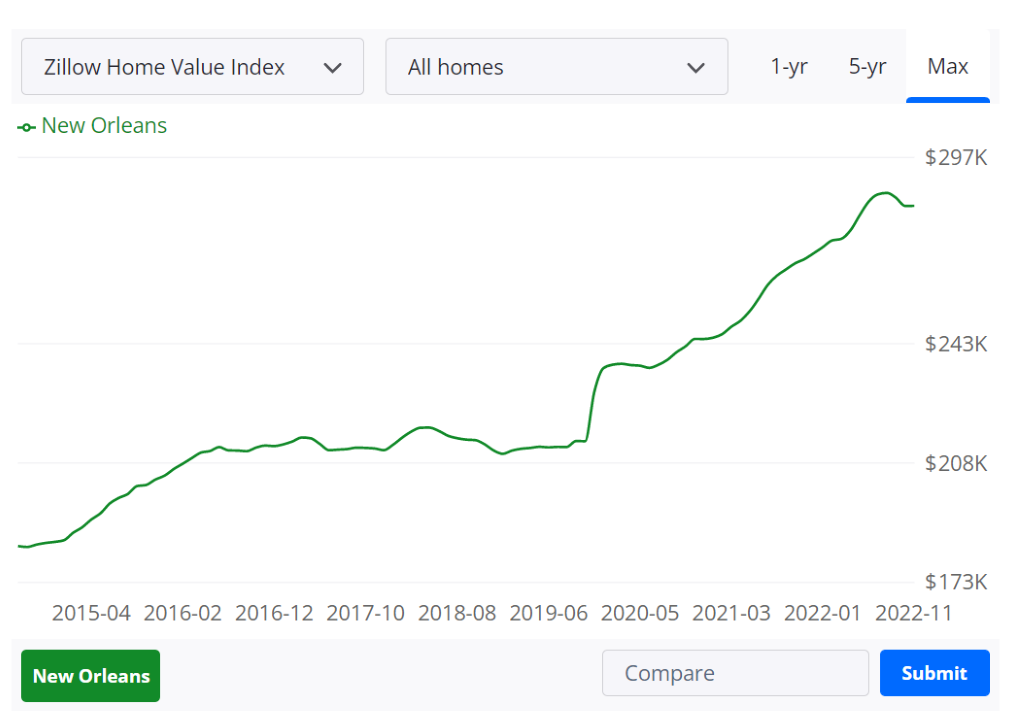

Based on Zillow Home Value, home values in New Orleans have gone up 5.8% compared to last year and the average price is $283K.

Airbnb occupancy rates by city declare that an average host in New Orleans can earn up to $3,078 during the peak season of February. With over 5,396 Airbnb listings in New Orleans, it’s certainly a catch for property investors!

Aside from looking at a property’s proximity to major tourist areas, and accessibility to the best go-to places, the primary step is to determine profitability.

In this article, we’ll discuss the metrics in order to gauge the best property investment in New Orleans. This includes the best website recommendations for property investment, defining property gross rental yield, cash-on-cash return, and annual revenue, along with some of the most ideal and profitable properties according to their location. Continue reading to learn more!

airbnb property for sale Scranton

Pros of Buying An Airbnb Property in New Orleans

1. Low Living Cost

New Orleans’ cost of living is considerably lower than popular cities like Baltimore and Atlanta. Although the real estate market became competitive after the Hurricane Katrina calamity, people can still find properties for a reasonable price. Based on Zumper, the average rental prices are $1,520 and $1,800 for one and two bedrooms respectively.

2. Consolidated Touristic Market

When we talk about New Orleans, the first thing that possibly comes to our minds is its exquisite gastronomy, lively nightlife and exciting festivals. Thanks to this enjoyable atmosphere, visitors arrive in the city all year round. As a matter of fact, New Orleans welcomes around 19M visitors annually, no wonder it earned the third place as a top destination for city lovers in the US for 2022

Cons of Buying A Property in New Orleans

1. Prone to natural disasters

Sadly, not everything can be ideal and rosy in this world, right? Because New Orleans is susceptible to hurricanes and tropical storms each year. Plus, the city is also vulnerable to flooding due to New Orleans’ intense rains.

2. High Crime Rate

Unfortunately, New Orleans doesn’t have the best reputation when it comes to crime rates. In fact, the city ranks in the top 10 of almost all crime categories. Neighborhoods like Central City, South Seventh, Desire and Saint Roch are usually considered the most dangerous places here.

Is Property Investment Profitable in New Orleans?

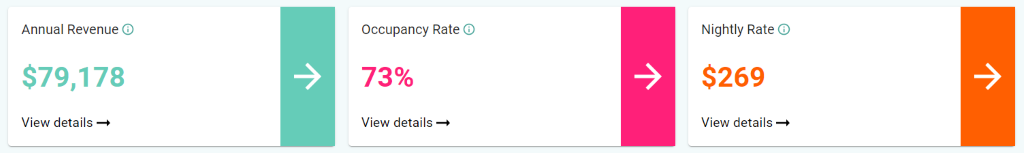

Using an Airbnb profit estimator, it was discovered that a 2-bedroom apartment in New Orleans can generate an annual revenue of $79,178 with a steady occupancy rate of 73% and a nightly rate of $269.

airbnb property investment New Orleans

Modern Houses for Sale in New Orleans, LA

Finding the best properties that have the potential to produce high yields and capital growth are certainly some of the preferences of major investors. You can find properties for sale in popular New Orleans neighborhoods like French Quarter, Garden District and Marigny. However, it’s always best to ask for assistance from real estate agents to access exclusive and unique properties during the development stage.

At the same time, it’s even better when a property investor like you conducts research about predicted growths and market forecasts. Here are some of the houses for sale in New Orleans along with the calculated gross rental yield, cash-on-cash return, and annual revenue.

1205 St. Charles Ave #608, New Orleans, LA 70130

1. Studio-type Property for Sale New Orleans

- 3.4 miles Audubon Charter School

- Asking Price: $139,900

| GROSS RENTAL YIELD | 20.56% |

| ANNUAL REVENUE | $28,770 |

| CASH ON CASH RETURN | 35.93% |

2601 Carondelet St Unit K, New Orleans, LA 70130

2. 1-Bedroom Type Property for Sale New Orleans

- 1.7 miles Lusher Charter School

- Asking Price: $155,000

| GROSS RENTAL YIELD | 20.52% |

| ANNUAL REVENUE | $31,804 |

| CASH ON CASH RETURN | 35.79% |

15 Petit Bayou Ln, New Orleans, LA 70129

3. 2-Bedroom Type Property for Sale New Orleans

- Walking distance to Hartkopf Park

- Asking Price: $165,000

| GROSS RENTAL YIELD | 25.52% |

| ANNUAL REVENUE | $42,116 |

| CASH ON CASH RETURN | 50.81% |

6307 Pauline Dr, New Orleans, LA 70126

4. 3-Bedroom Type Property for Sale New Orleans

- 1.8 miles to Benjamin Franklin High School

Asking Price: $211,500

| GROSS RENTAL YIELD | 25.27% |

| ANNUAL REVENUE | $53,451 |

| CASH ON CASH RETURN | 50.05% |

1806 08 Ursulines Ave, New Orleans, LA 70116

5. 4-Bedroom Type Property for Sale New Orleans

- 3.0 miles to Edward Hynes Charter School

- Asking Price: $315,000

| GROSS RENTAL YIELD | 25.08% |

| ANNUAL REVENUE | $78,993 |

| CASH ON CASH RETURN | 49.46% |

Conclusion

Generally speaking, New Orleans can be a good place to live and invest in Airbnb property since it’s a tourist destination as well as a major commercial and economic hub. The data points mentioned in this article for New Orleans such as Airbnb occupancy rates, annual revenue, and average daily rate should be your primary basis before investing in a property.

To make sure that a property can generate a good cash flow, the right neighborhood should be studied and potential revenue should be calculated using an Airbnb income calculator. This is certainly what you need for success in the long run and to stand out among your competitors!