Last updated on January 31st, 2024

10 Best States To Buy Rental Property For Airbnb: Don’t know where to start buying properties? Start with the Best States to Buy Rental Property for Airbnb!

Home > Resources > Airbnb Investment >

10 Best States To Buy Rental Property For Airbnb

10 Best States To Buy Rental Property For Airbnb

Don’t know where to start buying properties? Start with the Best States to Buy Rental Property for Airbnb!

- Last updated January 31, 2024

We live in a time when wanderlust meets entrepreneurship, and the short-term rental industry has become a lucrative means for real estate investors wanting to benefit from the booming travel and tourism industry.

From homey cabins found at the heart of natural landscapes to chic modern apartments in bustling city centers, Airbnb has enhanced the experience of many travelers worldwide. This is why it isn’t surprising that savvy investors turn to this user-friendly platform as an opportunity to generate a substantial income.

In this article, we will sweep through the United States to cover the best states to buy rental property for Airbnb. So whether you’re a seasoned real estate investor aiming to diversify your portfolio or a budding newbie having already mustered the courage to do short-term rentals, this article will serve as your roadmap to Airbnb success. So, join us as we explore the lucrative Airbnb opportunities in the land of stars and stripes!

Our Methodology: How did we come up with the 10 Best States?

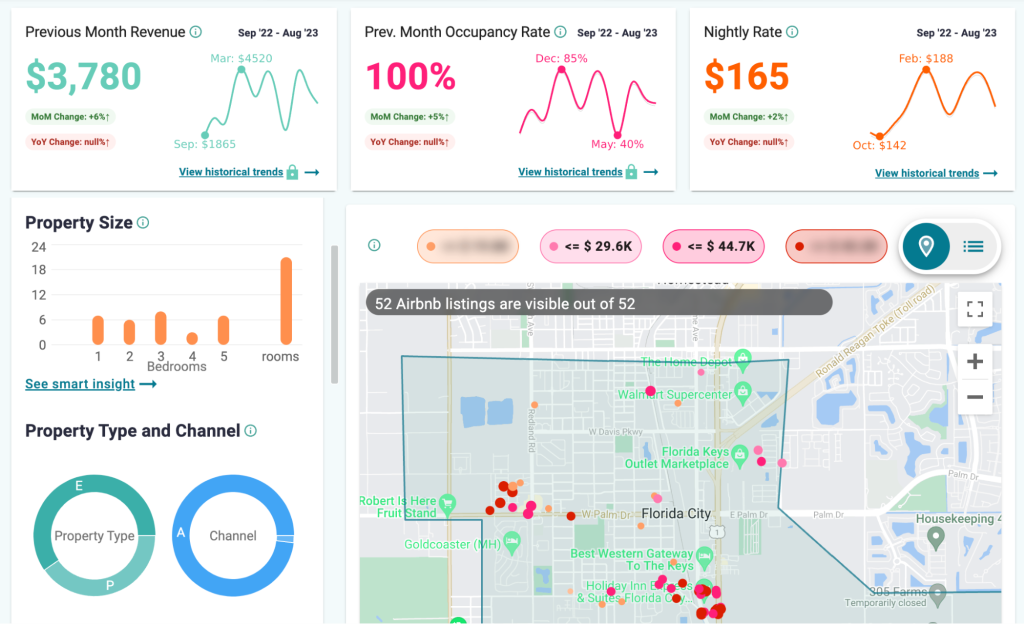

We began by collecting comprehensive short-term rental data on the profitability of investment properties using the Airbtics Dashboard. This powerful tool provides invaluable insights into the performance of short-term rental listings.

These include the markets’

- average occupancy rates,

- nightly rates

- annual revenues

- gross rental yield

- revenue per property size

- seasonality

- active listings (both VRMs & Hosts)

All these are crucial for assessing the potential return on Airbnb investments.

Best States To Buy Rental Property For Airbnb

We also relied on Redfin to gain a wider perspective on various real estate markets in the US. We sourced from the site the

- median property prices,

- median days on market, and

- average price per square foot.

Its data have been useful for us to understand the affordability of properties across multiple states.

And since we know that state-level leads are too wide to pinpoint the lucrative Airbnb hotspots, we have included the top 5 cities in each of them. This gives investors more specific leads to their short-term rental success.

10 Best States to Buy Rental Property for Airbnb (With Top 5 Cities)

The United States offers a diverse landscape of Airbnb investment opportunities: from the affordability of Indiana to the allure of California, the warmth of Georgia, the growth in Florida, the diversity in North Carolina, the hidden gem that is Nebraska, the business-friendly environment of Tennessee, the tourism powerhouse in Minnesota, the huge population of Texas, and the promise of property appreciation in Colorado.

Now here is the list of best states to buy rental property for Airbnb, along with their respective short-term rental metrics:

1. Indiana

- Median Property Price – $258,300

- Median Days on Market – 16

- Price / Square Foot – $149.85

- Average Nightly Rate – $117

- Annual Revenue – $27,079

- Gross Rental Yield – 12.09%

Indiana has the lowest median property price on this list, but don’t let that lead you to think that its return is just as low. In fact, Indiana is a rising star in the Airbnb investment scene. The state boasts one of the most affordable real estate in the US. This low price allows aspiring real estate investors to purchase properties at a fraction of the cost compared to well-known markets.

Indiana is home to various colleges, universities, and emerging industries. With more than 70 million tourists annually, this only leads to diverse yet consistent rental demand throughout the year. So the favorable mix of low property prices, strong short-term rental demand, and, not to mention, property appreciation over the years only results in a healthy cash flow for Airbnb investors.

Best Airbnb Markets in Indiana in 2023

|

|||||||

|---|---|---|---|---|---|---|---|

| City Name | Total Listings | Occupancy Rates | Nightly Rate | Annual Revenue | Median Property Price | GRY | |

| South Bend | 817 | 54% | $225 | $40,700 | $146,500 | 27.78% | |

| Terre Haute | 66 | 70% | $92 | $25,449 | $122,400 | 20.79% | |

| Evansville | 162 | 67% | $88 | $22,928 | $144,900 | 15.82% | |

| Indianapolis | 3,087 | 58% | $126 | $27,975 | $235,000 | 11.90% | |

| Hammond | 31 | 66% | $82 | $19,507 | $182,900 | 10.67% | |

City Name

Airbnb Dataset

- Total Listings: 817

- Occupancy Rate: 54%

- Nightly Rate: $225

- Annual Revenue: $40,700

- Median Property Price: $146,500

- GRY: 27.78%

- Total Listings: 66

- Occupancy Rate: 70%

- Nightly Rate: $92

- Annual Revenue: $25,449

- Median Property Price: $122,400

- GRY: 20.79%

- Total Listings: 162

- Occupancy Rate: 67%

- Nightly Rate: $88

- Annual Revenue: $22,928

- Median Property Price: $144,900

- GRY: 15.82%

- Total Listings: 3,087

- Occupancy Rate: 58%

- Nightly Rate: $1236

- Annual Revenue: $27,975

- Median Property Price: $235,000

- GRY: 11.90%

- Total Listings: 31

- Occupancy Rate: 66%

- Nightly Rate: $82

- Annual Revenue: $$19,507Median Property Price: $182,900

- GRY: 10.67%

2. California

- Median Property Price – $783,300

- Median Days on Market – 25

- Price / Square Foot – $644.55

- Average Nightly Rate – $258

- Annual Revenue – $53,662

- Gross Rental Yield – 10.71%

Let not the high median property price dissuade you from entering the California real estate market. With a mix of compelling factors that can turn your Airbnb venture into success, the Golden State likewise provides a golden opportunity for rental investments. Investors can never run out of property types to choose from. Beachfront property? Apartments? Single-detached homes? This variety can cater to your plans, budget, and preferences.

It has a huge and steady tourist population all year round. In fact, it is the most visited state in America! Thanks to its accommodating climate for the most part, it seems that there is no off-season for vacation rentals.

Best Airbnb Markets in California in 2023

|

|||||||

|---|---|---|---|---|---|---|---|

| City Name | Total Listings | Occupancy Rates | Nightly Rate | Annual Revenue | Median Property Price | GRY | |

| Indio | 2,302 | 52% | $416 | $81,197 | $599,400 | 13.55% | |

| Palm Springs | 5,582 | 56% | $367 | $72,755 | $562,000 | 12.95% | |

| Yucca Valley | 825 | 55% | $209 | $45,209 | $349,950 | 12.92% | |

| Joshua Tree | 1,018 | 57% | $187 | $43,006 | $374,500 | 11.48% | |

| Madera | 1,377 | 55% | $213 | $45,204 | $487,498 | 9.27% | |

City Name

Airbnb Dataset

- Total Listings: 2,302

- Occupancy Rate: 52%

- Nightly Rate: $416

- Annual Revenue: $81,197

- Median Property Price: $599,400

- GRY: 13.55%

- Total Listings: 5,582

- Occupancy Rate: 56%

- Nightly Rate: $367

- Annual Revenue: $72,755

- Median Property Price: $562,000

- GRY: 12.95%

- Total Listings: 825

- Occupancy Rate: 55%

- Nightly Rate: $209

- Annual Revenue: $45,209

- Median Property Price: $349,950

GRY: 12.92%

- Total Listings: 1,018

- Occupancy Rate: 57%

- Nightly Rate: $187

- Annual Revenue: $43,006

- Median Property Price: $374,500

- GRY: 11.48%

- Total Listings: 1,377

- Occupancy Rate: 57%

- Nightly Rate: $187

- Annual Revenue: $45,204

- Median Property Price: $487,498

- GRY: 9.27%

3. Georgia

- Median Property Price – $367,500

- Median Days on Market – 28

- Price / Square Foot – $216.30

- Average Nightly Rate – $191

- Annual Revenue – $47,562

- Gross Rental Yield – 10.65%

A lot of Airbnb investors have been reaping the benefits of southern hospitality, a trait that Georgia is known for. The local real estate market is just as welcoming as the state itself. Lower than the national average, its median property price is $367,500. This price allows investors to achieve a quicker return on their Airbnb investment.

Best Airbnb Markets in Georgia in 2023

|

|||||||

|---|---|---|---|---|---|---|---|

| City Name | Total Listings | Occupancy Rates | Nightly Rate | Annual Revenue | Median Property Price | GRY | |

| Augusta | 1,206 | 53% | $125 | $26,507 | $177,088 | 14.97% | |

| Savannah | 3,355 | 73% | $197 | $58,258 | $449,820 | 12.95% | |

| Athens | 943 | 60% | $168 | $38,046 | $399,999 | 9.51% | |

| Tybee Island | 1,782 | 70% | $247 | $66,780 | $810,000 | 8.24% | |

| Blue Ridge | 1,942 | 53% | $216 | $48,219 | $636,944 | 7.57% | |

City Name

Airbnb Dataset

- Total Listings: 1,206

- Occupancy Rate: 53%

- Nightly Rate: $125

- Annual Revenue: $26,507

- Median Property Price: $177,088

- GRY: 14.97%

- Total Listings: 3,355

- Occupancy Rate: 73%

- Nightly Rate: $197

- Annual Revenue: $58,258

- Median Property Price: $449,820

- GRY: 12.95%

- Total Listings: 943

- Occupancy Rate: 60%

- Nightly Rate: $168

- Annual Revenue: $38,046

- Median Property Price: $399,999

- GRY: 9.51%

- Total Listings: 1,782

- Occupancy Rate: 70%

- Nightly Rate: $247

- Annual Revenue: $66,780

- Median Property Price: $810,000

- GRY: 8.24%

- Total Listings: 1,942

- Occupancy Rate: 53%

- Nightly Rate: $216

- Annual Revenue: $48,219

- Median Property Price: $636,944

- GRY: 7.57%

4. Florida

- Median Property Price – $404,100

- Median Days on Market – 40

- Price / Square Foot – $308.60

- Average Nightly Rate – $170.00

- Annual Revenue – $41,806.00

- Gross Rental Yield – 10.56%

This list will not be complete without Florida. The state has always been attractive to both traditional and short-term rental investors due to the strong demand for commercial and residential real estate. Another reason behind this is Florida is among the fastest-growing states in terms of population.

The state’s conducive climate makes it an appealing state to visit, with plenty of attractions to choose from. Its extensive and attractive coastline serves as a magnet that pulls beach lovers from all over the world. Aside from that, it is a family-friendly state with major theme parks that create a strong demand for short-term rentals.

Best Airbnb Markets in Florida in 2023

|

|||||||

|---|---|---|---|---|---|---|---|

| City Name | Total Listings | Occupancy Rates | Nightly Rate | Annual Revenue | Median Property Price | GRY | |

| Deerfield Beach | 770 | 67% | $187 | $47,463 | $310,000 | 15.31% | |

| Jacksonville | 12,129 | 67% | $167 | $42,596 | $325,000 | 13.11% | |

| Clearwater | 2,750 | 68% | $170 | $44,536 | $399,949 | 11.14% | |

| Daytona Beach | 2,107 | 65% | $155 | $37,361 | $349,950 | 10.68% | |

| Hollywood | 7,595 | 65% | $198 | $50,132 | $549,900 | 9.12% | |

City Name

Airbnb Dataset

- Total Listings: 770

- Occupancy Rate: 67%

- Nightly Rate: $187

- Annual Revenue: $47,463

- Median Property Price: $310,000

- GRY: 15.31%

- Total Listings: 12,129

- Occupancy Rate: 67%

- Nightly Rate: $167

- Annual Revenue: $42,596

- Median Property Price: $325,000

- GRY: 13.11%

- Total Listings: 2,750

- Occupancy Rate: 68%

- Nightly Rate: $170

- Annual Revenue: $44,536

- Median Property Price: $399,949

- GRY: 11.14%

- Total Listings: 2,107

- Occupancy Rate: 65%

- Nightly Rate: $155

- Annual Revenue: $37,361

- Median Property Price: $349,950

- GRY: 10.68%

- Total Listings: 7,595

- Occupancy Rate: 65%

- Nightly Rate: $198

- Annual Revenue: $50,132

- Median Property Price: $549,900

- GRY: 9.12%

5. North Carolina

- Median Property Price – $373,300

- Median Days on Market – 33

- Price / Square Foot – $221.15

- Average Nightly Rate – $154

- Annual Revenue – $37,066

- Gross Rental Yield – 9.59%

North Carolina offers a diverse scenery that appeals to a wide range of nature-enthusiast travelers. This means that your Airbnb property can draw guests throughout the year and can ensure a consistent stream of income. Let’s also not forget that North Carolina is home to numerous universities and colleges that also create short-term rental demand from visiting students, parents, and faculties.

Generally, North Carolina is known as a business-friendly state, handing out favorable tax policies and incentives for businesses. Luckily, short-term rentals have enjoyed this amiable business environment, which is very hard to see anywhere else. Not to mention, its relatively low median property price allows you to enter its local Airbnb market without putting a dent in your bank account.

Best Airbnb Markets in North Carolina in 2023

|

|||||||

|---|---|---|---|---|---|---|---|

| City Name | Total Listings | Occupancy Rates | Nightly Rate | Annual Revenue | Median Property Price | GRY | |

| Beech Mountain | 1,354 | 49% | $195 | $38,951 | $279,000 | 13.96% | |

| Winston-Salem | 1,105 | 60% | $118 | $27,783 | $292,000 | 9.51% | |

| Kill Devil Hills | 1,137 | 68% | $217 | $55,298 | $599,990 | 9.22% | |

| Greensboro | 823 | 61% | $114 | $27,526 | $303,650 | 9.07% | |

| Wilmington | 1,324 | 61% | $150 | $36,479 | $427,450 | 8.53% | |

City Name

Airbnb Dataset

- Total Listings: 1,354

- Occupancy Rate: 49%

- Nightly Rate: $195

- Annual Revenue: $38,951

- Median Property Price: $279,000

- GRY: 13.96%

- Total Listings: 1,105

- Occupancy Rate: 60%

- Nightly Rate: $118

- Annual Revenue: $27,783

- Median Property Price: $292,000

- GRY: 9.51%

- Total Listings: 1,137

- Occupancy Rate: 68%

- Nightly Rate: $217

- Annual Revenue: $55,298

- Median Property Price: $599,990

- GRY: 9.22%

- Total Listings: 823

- Occupancy Rate: 61%

- Nightly Rate: $114

- Annual Revenue: $27,526

- Median Property Price: $303,650

- GRY: 9.07%

- Total Listings: 1,324

- Occupancy Rate: 61%

- Nightly Rate: $150

- Annual Revenue: $36,479

- Median Property Price: $427,450

- GRY: 8.53%

6. Nebraska

- Median Property Price – $290,800

- Median Days on Market – 13

- Price / Square Foot – $147.10

- Average Nightly Rate – $110

- Annual Revenue – $26,468

- Gross Rental Yield – 8.63%

Nebraska is not usually seen as a haven for real estate opportunities, and this preconception only makes the state a hidden gem. Firstly, it offers one of the most affordable real estate markets in the US. And in just a matter of time, it is also easy to earn much more than you have initially spent via short-term rentals, particularly in niche markets catering to outdoor enthusiasts.

Similar to North Carolina, Nebraska offers a business-friendly environment for all types of investors. Most of its cities have adopted lenient Airbnb regulations, making it easier for many hosts to operate their short-term rental businesses legally.

Best Airbnb Markets in Nebraska in 2023

|

|||||||

|---|---|---|---|---|---|---|---|

| City Name | Total Listings | Occupancy Rates | Nightly Rate | Annual Revenue | Median Property Price | GRY | |

| Nebraska City | 8 | 61% | $118 | $26,654 | $142,450 | 18.71% | |

| Omaha | 1,295 | 65% | $123 | $30,302 | $299,998 | 10.10% | |

| Bellevue | 34 | 70% | $125 | $31,739 | $319,500 | 9.93% | |

| Grand Island | 37 | 72% | 103 | $26,814 | $293,400 | 9.14% | |

| Kearney | 74 | 65% | $120 | $30,124 | $348,450 | 8.65% | |

City Name

Airbnb Dataset

- Total Listings: 8

- Occupancy Rate: 61%

- Nightly Rate: $118

- Annual Revenue: $26,654

- Median Property Price: $142,450

- GRY: 18.71%

- Total Listings: 1,295

- Occupancy Rate: 65%

- Nightly Rate: $123

- Annual Revenue: $30,302

- Median Property Price: $299,998

- GRY: 10.10%

- Total Listings: 34

- Occupancy Rate: 70%

- Nightly Rate: $125

- Annual Revenue: $31,739

- Median Property Price: $319,500

- GRY: 9.93%

- Total Listings: 37

- Occupancy Rate: 72%

- Nightly Rate: $103

- Annual Revenue: $26,814

- Median Property Price: $293,400

- GRY: 9.14%

- Total Listings: 74

- Occupancy Rate: 65%

- Nightly Rate: $120

- Annual Revenue: $30,124

- Median Property Price: $348,450

- GRY: 8.65%

7. Tennessee

- Median Property Price – $384,200

- Median Days on Market – 46

- Price / Square Foot – $230.50

- Average Nightly Rate – $159

- Annual Revenue – $42,524

- Gross Rental Yield – 8.92%

Another business-friendly state, Tennessee thrives on a diverse economy including manufacturing, healthcare, agriculture, and, of course, music and entertainment. In fact, the state is so business-friendly that it has one of the lowest income taxes in the US.

These conditions also allow its short-term rental industry to thrive. Not to mention, its low median property price can afford you to gain a faster return on investment. So be among the hosts who welcome more than 10 million guests per year to the Volunteer State.

Best Airbnb Markets in Tennessee in 2023

|

|||||||

|---|---|---|---|---|---|---|---|

| City Name | Total Listings | Occupancy Rates | Nightly Rate | Annual Revenue | Median Property Price | GRY | |

| Memphis | 1,639 | 61% | $118 | $28,715 | $180,000 | 15.95% | |

| Nashville | 9,430 | 65% | $217 | $54,055 | $575,000 | 9.40% | |

| Sevierville | 571 | 71% | $192 | $52,704 | $582,500 | 9.05% | |

| Knoxville | 937 | 68% | $118 | $31,280 | $350,000 | 8.94% | |

| Chattanooga | 2,463 | 63% | $127 | $30,953 | $365,000 | 8.48% | |

City Name

Airbnb Dataset

- Total Listings: 1,639

- Occupancy Rate: 61%

- Nightly Rate: $118

- Annual Revenue: $28,715

- Median Property Price: $180,000

- GRY: 15.95%

- Total Listings: 9,430

- Occupancy Rate: 65%

- Nightly Rate: $217

- Annual Revenue: $54,055

- Median Property Price: $575,000

- GRY: 9.40%

- Total Listings: 571

Occupancy Rate: 71% - Nightly Rate: $192

Annual Revenue: $52,704 - Median Property Price: $582,500

- GRY: 9.05%

- Total Listings: 937

Occupancy Rate:68%

Nightly Rate: $118

Annual Revenue: $31,280

Median Property Price: $350,000

GRY: 8.94%

- Total Listings: 2,463

- Occupancy Rate: 63%

Nightly Rate: $127 - Annual Revenue: $30,953

- Median Property Price: $365,000

- GRY: 8.48%

8. Minnesota

- Median Property Price – $347,300

- Median Days on Market – 18

- Price / Square Foot – $199.85

- Average Nightly Rate – $132

- Annual Revenue – $34,369

- Gross Rental Yield – 6.96%

Another hidden gem for real estate investments, Minnesota is also a powerhouse in tourism in the tourism sector. The state welcomes more than 70 million visitors annually. And why wouldn’t they visit Minnesota? It offers attractive tourist destinations all year round – regardless of the state’s changing seasons. From summer activities to winter sports, this ensures a steady stream of income via Airbnb.

And it’s not hard to operate short-term rentals in the state, as Minnesota has seen the industry helpful in accommodating the tourism industry. So, the “Land of 10,000 Lakes” also offers tens of thousands of dollars in Airbnb annual revenue.

Best Airbnb Markets in Minnesota in 2023

|

|||||||

|---|---|---|---|---|---|---|---|

| City Name | Total Listings | Occupancy Rates | Nightly Rate | Annual Revenue | Median Property Price | GRY | |

| Maple Grove | 19 | 71% | $188 | $44,036 | $474,900 | 9.27% | |

| St. Paul | 684 | 69% | $102 | $27,191 | $297,000 | 9.16% | |

| Minneapolis | 1,896 | 67% | $118 | $31,353 | $350,000 | 8.96% | |

| Woodbury | 27 | 82% | $116 | $45,009 | $569,900 | 7.90% | |

| Minnetonka | 56 | 57% | $193 | $43,890 | $625,000 | 7.02% | |

City Name

Airbnb Dataset

- Total Listings: 19

- Occupancy Rate: 71%

- Nightly Rate: $188

- Annual Revenue: $44,036

- Median Property Price: $474,900

- GRY: 9.27%

- Total Listings: 684

- Occupancy Rate: 69%

- Nightly Rate: $102

- Annual Revenue: $27,191

- Median Property Price: $297,000

- GRY: 9.16%

- Total Listings: 1,896

- Occupancy Rate: 67%

- Nightly Rate: $118

- Annual Revenue: $31,353

- Median Property Price: $350,000

- GRY: 8.96%

- Total Listings: 27

- Occupancy Rate: 82%

- Nightly Rate: $116

- Annual Revenue: $45,009

- Median Property Price: $569,900

- GRY: 7.90%

- Total Listings: 56

- Occupancy Rate: 57%

- Nightly Rate: $193

- Annual Revenue: $43,890

- Median Property Price: $625,000

- GRY: 7.02%

9. Texas

- Median Property Price – $356,600

- Median Days on Market – 34

- Price / Square Foot – $214.60

- Average Nightly Rate – $137

- Annual Revenue – $32,990

- Gross Rental Yield – 6.97%

Another population powerhouse, this only makes Texas real estate a coveted property. This continues to grow due to domestic and international migration. Aside from the increasing demand for real estate in Texas, properties can also turn into a viable Airbnb investment opportunity.

Texas enjoys a stable climate that encourages the inflow of tourists all year round. So, whether the travelers’ interests are in beaches, sports, business, or education, your rental property can cater to a wide range of guests wanting to enjoy “The Lone Star State.”

Best Airbnb Markets in Texas in 2023

|

|||||||

|---|---|---|---|---|---|---|---|

| City Name | Total Listings | Occupancy Rates | Nightly Rate | Annual Revenue | Median Property Price | GRY | |

| San Antonio | 6,320 | 60% | $128 | $28,872 | $298,900 | 9.66% | |

| Fort Worth | 2,094 | 64% | $125 | $29,695 | $355,000 | 8.36% | |

| Plano | 736 | 68% | $160 | $39,494 | $559,000 | 7.07% | |

| Houston | 10,986 | 60% | $110 | $26,253 | $374,900 | 7.00% | |

| Mckinney | 217 | 67% | $154 | $39,556 | $567,900 | 6.97% | |

City Name

Airbnb Dataset

- Total Listings: 6,320

- Occupancy Rate: 60%

- Nightly Rate: $128

- Annual Revenue: $28,872

- Median Property Price: $298,900

- GRY: 9.66%

- Total Listings: 2,094

- Occupancy Rate: 64%

- Nightly Rate: $125

- Annual Revenue: $29,695

- Median Property Price: $355,000

- GRY: 8.36%

- Total Listings: 736

- Occupancy Rate: 68%

- Nightly Rate: $160

- Annual Revenue: $39,494

- Median Property Price: $559,000

- GRY: 7.07%

- Total Listings: 10,986

- Occupancy Rate: 60%

- Nightly Rate: $110

- Annual Revenue: $26,253

- Median Property Price: $374,900

- GRY: 7.00%

- Total Listings: 217

- Occupancy Rate: 67%

- Nightly Rate: $154

- Annual Revenue: $39,556

- Median Property Price: $567,900

- GRY: 6.97%

10. Colorado

- Median Property Price – $584,800

- Median Days on Market – 22

- Price / Square Foot – $274.40

- Average Nightly Rate – $341

- Annual Revenue – $79,347

- Gross Rental Yield – 5.39%

The Colorado real estate market has seen consistent growth over the years. This makes residential real estate a promising investment in terms of property appreciation. And just to put the icing on the cake, Colorado short-term rental hosts have made a profitable business by catering to a little less than 100 million tourists annually!

Best Airbnb Markets in Colorado in 2023

|

|||||||

|---|---|---|---|---|---|---|---|

| City Name | Total Listings | Occupancy Rates | Nightly Rate | Annual Revenue | Median Property Price | GRY | |

| Fort Collins | 3,126 | 67% | $197 | $51,943 | $590,000 | 8.80% | |

| Colorado Springs | 3,043 | 71% | $123 | $34,979 | $462,227 | 7.57% | |

| Mount Crested Butte | 1,175 | 56% | $261 | $56,255 | $850,000 | 6.62% | |

| Boulder | 1,003 | 78% | $181 | $53,385 | $1,147,500 | 4.65% | |

| Vail | 2,839 | 56% | $533 | $112,545 | $2,625,000 | 4.29% | |

City Name

Airbnb Dataset

- Total Listings: 3,126

- Occupancy Rate: 67%

- Nightly Rate: $197

- Annual Revenue: $51,943

- Median Property Price: $590,000

- GRY: 8.80%

- Total Listings: 3,043

- Occupancy Rate: 71%

- Nightly Rate: $123

- Annual Revenue: $34,979

- Median Property Price: $462,227

GRY: 7.57%

- Total Listings: 1,175

- Occupancy Rate: 56%

- Nightly Rate: $261

- Annual Revenue: $56,255

- Median Property Price: $850,000

GRY: 6.62%

- Total Listings: 1,003

- Occupancy Rate: 78%

- Nightly Rate: $181

- Annual Revenue: $53,385

- Median Property Price: $1,147,500

- GRY: 4.65%

- Total Listings: 2,839

- Occupancy Rate: 56%

- Nightly Rate: $533

- Annual Revenue: $112,545

- Median Property Price: $2,625,000

- GRY: 4.29%

Remember that the Airbnb’s revenue is only the average in these markets. If you choose the optimal number of bedrooms and combine that with the best property type in these places, this winning combination will give you a bang for your buck in the best states to buy a rental property for Airbnb!

Airbtics Pro Report: Deeper STR Insights. Broader Investment Opportunities.

When it comes to smart decision-making, data is king. After exploring the top states and their best cities for Airbnb investments in the US, feel free to go deeper with in-depth data findings such as population, crime, and unemployment rate. Having access with these data can literally help you make the right and smartest decision with high ROI.

Airbtics is offering an exclusive short-term rental report from Airbnb statistics to Real Estate data–all in one report to help Airbnb investors like you to effortlessly find the best places to invest in Airbnb. Get the report in just 3 business days!

Deeper STR Insights. Broader Investment Opportunities.

Want to go deeper, broader, and faster? Supercharge your Airbnb Investment by accessing the most in-depth Airbnb & real estate insights with our exclusive STR report.

- Vital vacation rental data from 50 Markets – Airbnb Occupancy Rate, ADR, Revenue, and Listings! Access 2-year data from June 2021 to June 2023.

- Uncover 5-year real estate investability metrics for 50 markets including population, property prices, income levels, Google travel interest, crime, and unemployment trends 2017 - 2021)!

- All yours in 3 business days!

Short-Term Rental Data

Short-Term Rental Data

-

Quick Links

Keep Reading

Annual Airbnb Revenue in Woodward oklahoma, USA

Last updated on April 30th, 2024 Woodward, Oklahoma| Airbnb Market Data & Overview | USA Woodward, Oklahoma Airbnb Market Data & Overview USA Is it …

A Case Study: Property Sourcing for Best Airbnb Investment

Last updated on June 21st, 2023Best Airbnb Investment Before buying an Airbnb property, it’s important to do your research and conduct property sourcing. While most …

Annual Airbnb Revenue In George Town Malaysia

Last updated on April 30th, 2024 George Town| Airbnb Market Data & Overview | Malaysia George Town Airbnb Market Data & Overview Malaysia Is it …

Annual Airbnb Revenue in Auburn new york, USA

Last updated on April 30th, 2024 Auburn, New York| Airbnb Market Data & Overview | USA Auburn, New York Airbnb Market Data & Overview USA …

Annual Airbnb Revenue in North platte nebraska, USA

Last updated on April 30th, 2024 North Platte, Nebraska| Airbnb Market Data & Overview | USA North Platte, Nebraska Airbnb Market Data & Overview USA …

Annual Airbnb Revenue in Abilene texas, USA

Last updated on April 30th, 2024 Abilene, Texas| Airbnb Market Data & Overview | USA Abilene, Texas Airbnb Market Data & Overview USA Is it …