Last updated on January 4th, 2024

Is Investing in Studio Apartments for Airbnb a Great Idea?: Investing in studio apartments for Airbnb is a great idea for both seasoned and newbie investors due to their low cost and high revenue potential.

Home > Resources > Airbnb Investment >

Is Investing in Studio Apartments for Airbnb a Great Idea?

Is Investing in Studio Apartments for Airbnb a Great Idea?

Investing in studio apartments for Airbnb is a great idea for both seasoned and newbie investors due to their low cost and high revenue potential.

- Last updated on

- January 4, 2024

Key Takeaways

- You can benefit from investing in studio apartments for Airbnb due to their low cost, central location, and scalability.

- Know the best cities to own studio apartments and their potential revenue if you list one on Airbnb.

Introduction

Do you have a dream of trying out the exciting world of real estate investment by owning a property? Don’t let your limited capital discourage you because you can start by owning a studio apartment! This article will guide you on how the perfect mix of versatility, affordability, and desirability will benefit real estate investors at any stage of their real estate journey.

Whether you’re a veteran investor considering to diversify your Airbnb rentals or a newbie looking for your first short-term rental property, we will show you how a studio apartment fits the bill. In this article, we will tackle the following:

• The benefits of investing in studio apartments

• The 10 best Airbnb cities for investing in studio apartments:

1. Los Angeles

2. Chicago

3. Seattle

4. Denver

5. Charlotte

6. Phoenix

7. Boston

8. Philadelphia

9. Hoboken

10. Jacksonville

Is It Good to Invest in a Studio Apartment?

According to Airbtics, studio Airbnbs in 10 US cities have an average annual revenue potential of $35,084 from charging an average nightly rate of $110. Their average gross rental yield is 14.21%.

Why invest in studio apartments?

Choosing the best number of bedrooms for short-term rentals is important to ensure profit maximization in any given market. However, it is also a reality in short-term rentals that investing in a studio apartment is a cost-efficient and also profitable way to earn a steady passive income. Here’s why?

1. Low Cost

Compared to larger properties, studio apartments have a lower purchase price. This gives a very affordable entry point to a lot of first-time Airbnb investors. And because of their small size, studio apartments require less cost compared to bigger properties like houses or multi-bedroom apartments.

Maintenance expenses for utilities, repairs, and upkeep are significantly reduced because of lesser space and fewer amenities. These lower costs play a crucial role in boosting the overall profitability of your investment, allowing you to keep expenses in check while generating steady rental income.

2. Central Location

While studio apartments are small in size, being in prime locations is their best selling point. They are usually situated in the most vibrant and energetic parts of cities where there is a variety of leisure activities.

Studio apartments are usually smacked in the middle of business centers and tourist attractions. These locations are usually well-connected to different transportation networks such as airports, roads, and public transportation. Being centrally located offers a higher chance of visibility and accessibility, making it more appealing to potential guests.

3. Adaptability

A studio apartment has its own charm, yet it’s flexible to different guest demographics. These small units can cater to various segments of guests, such as solo travelers, couples, young professionals, and even small families.

A key advantage of catering to a diverse range of guest segments is the potential to maintain consistently high occupancy rates throughout the year. During periods when one segment may be less active, there are still other guest segments eager to book the property. This diversified demand helps to stabilize occupancy rates and minimizes the impact of seasonal fluctuations or market trends that may affect a specific guest segment.

4. Scalability and Diversification

Investing in studio apartments for Airbnb can jump-start the journey to financial independence of budding real estate investors. Due to their lower purchase price, studios offer an excellent return on investment and yet demand less financial commitment from the get-go.

After establishing a successful Airbnb studio apartment, gradually expanding your property portfolio could be your next step. You can consider buying more studio units for Airbnb. Even investing in bigger properties or those with more sophisticated amenities is well within your reach. By adopting this gradual expansion approach, you can naturally develop and expand your Airbnb rental business, leveraging your expertise, available resources, and the demand in the market.

Best Airbnb Cities for Investing in Studio Apartments

The benefits of investing in studio apartments are indeed enticing. But if you’re wondering where to start buying a studio unit for Airbnb, this section will offer leads. Here is our ultimate guide on Airbnb market research to find the best locations to start an Airbnb.

|

||||||

|---|---|---|---|---|---|---|

| Location | Number of Airbnb Listings | Average Occupancy Rate | Average Nightly Rate | Average Revenue Potential | Median Property Price (studio apartment) | GRY |

| Los Angeles, CA | 1,181 | 59% | $88 | $37,712 | $554,500 | 6.8% |

| Chicago, IL | 248 | 51% | $109 | $30,781 | $199,000 | 15.47% |

| Seattle, WA | 462 | 56% | $105 | $36,252 | $349,950 | 10.36% |

| Denver, CO | 245 | 52% | $95 | $34,946 | $450,000 | 7.77% |

| Charlotte, NC | 53 | 64% | $102 | $35,356 | $185,000 | 19.11% |

| Phoenix, AZ | 272 | 40% | $87 | $21,649 | $168,750 | 12.83% |

| Boston, MA | 254 | 57% | $177 | $54,314 | $499,000 | 10.88% |

| Philadelphia, PA | 350 | 44% | $90 | $21,192 | $209,000 | 10.14% |

| Hoboken, NJ | 6 | 59% | $156 | $49,805 | $299,000 | 16.66% |

| Jacksonville, FL | 179 | 52% | $91 | $28,834 | $89,900 | 32.07% |

Airbnb Location

Airbnb Dataset

- Active Studio Airbnb Listings: 1,181

- Average Occupancy Rate: 59%

- Average Nightly Rate: $88

- Average Revenue Potential: $37,712

- Median Property Price (studio apartment): $554,500

- Gross Rental Yield: 6.8%

- Active Studio Airbnb Listings: 248

- Average Occupancy Rate: 51%

- Average Nightly Rate: $109

- Average Revenue Potential: $30,781

- Median Property Price (studio apartment): $199,000

- Gross Rental Yield: 15.47%

- Active Studio Airbnb Listings: 462

- Average Occupancy Rate: 56%

- Average Nightly Rate: $105

- Average Revenue Potential: $36,252

- Median Property Price (studio apartment): $349,950

- Gross Rental Yield: 10.36%

- Active Studio Airbnb Listings: 53

- Average Occupancy Rate: 64%

- Average Nightly Rate: $102

- Average Revenue Potential: $35,356

- Median Property Price (studio apartment): $185,000

- Gross Rental Yield: 19.11%

- Active Studio Airbnb Listings: 272

- Average Occupancy Rate: 40%

- Average Nightly Rate: $89

- Average Revenue Potential: $21,649

- Median Property Price (studio apartment): $168,750

- Gross Rental Yield: 12.83%

7. Boston, MA

- Active Studio Airbnb Listings: 254

- Average Occupancy Rate: 57%

- Average Nightly Rate: $177

- Average Revenue Potential: $54,314

- Median Property Price (studio apartment): $499,000

- Gross Rental Yield: 10.88%

- Active Studio Airbnb Listings: 350

- Average Occupancy Rate: 44%

- Average Nightly Rate: $90

- Average Revenue Potential: $21,192

- Median Property Price (studio apartment): $209,000

- Gross Rental Yield: 10.14%

9. Hoboken, NJ

- Active Studio Airbnb Listings: 6

- Average Occupancy Rate: 59%

- Average Nightly Rate: $156

- Average Revenue Potential: $49,805

- Median Property Price (studio apartment): $299,000

- Gross Rental Yield: 16.66%

10. Jacksonville, FL

- Active Studio Airbnb Listings: 179

- Average Occupancy Rate: 52%

- Average Nightly Rate: $91

- Average Revenue Potential: $28,834

- Median Property Price (studio apartment): $89,900

- Gross Rental Yield: 32.07%

Small Property Size but Big Returns

In this article, we have learned that investing in Airbnb for beginners and pro can include a small rental unit. A studio apartment investment is a great starting point due to its lower cost, great demand, and promising investment return. Airbnb studio units are also an excellent addition to the property portfolio of veteran investors. All these are often overlooked until Airbnb investors see the figures using short-term rental analytics.

Do you have multiple rental properties in mind that you’re considering to buy? Check out each of their revenue potentials from the most powerful Airbnb Profit Calculator available online.

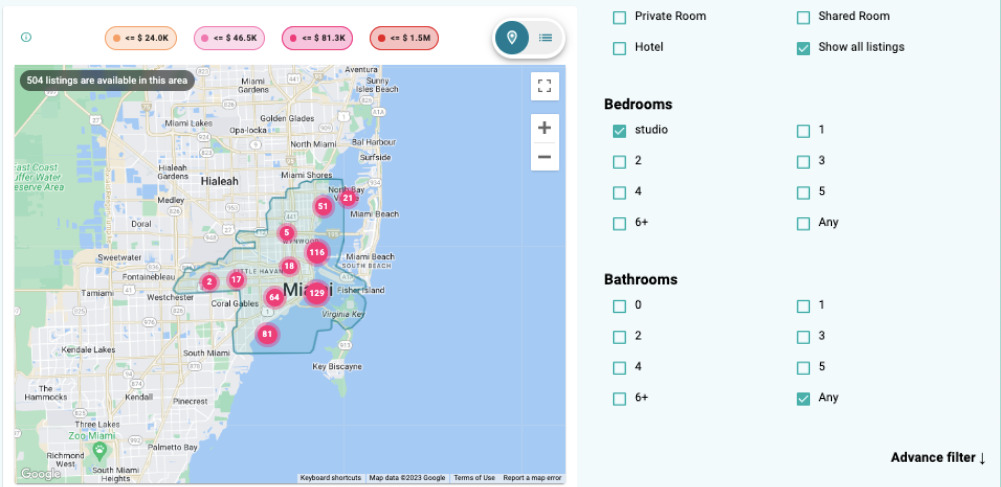

Filter the Data According to Property Size & See the Profitability of

Studio Apartments in Your Next Airbnb Market!

Short-Term Rental Data

Short-Term Rental Data

-

Quick Links

Keep Reading

Annual Airbnb Revenue in Worcester massachusetts, USA

Last updated on April 30th, 2024 Worcester, Massachusetts| Airbnb Market Data & Overview | USA Worcester, Massachusetts Airbnb Market Data & Overview USA Is it …

Annual Airbnb Revenue In Cape Town South Africa

Last updated on April 30th, 2024 Cape Town| Airbnb Market Data & Overview | South Africa Cape Town Airbnb Market Data & Overview South Africa …

Annual Airbnb Revenue in West berkshire, UK

Last updated on April 30th, 2024 West Berkshire| Airbnb Market Data & Overview | UK West Berkshire Airbnb Market Data & Overview UK Is it …

Best Airbnb Markets in California

Last updated on April 22nd, 2024 Best Airbnb Markets in California Best Places to Buy an Airbnb in California Last updated on: 15th April, 2024 …

Annual Airbnb Revenue in Wilmington north carolina, USA

Last updated on April 30th, 2024 Wilmington, North Carolina| Airbnb Market Data & Overview | USA Wilmington, North Carolina Airbnb Market Data & Overview USA …

Is Airbnb Property Investment in Lake Arrowhead Profitable?

Last updated on June 21st, 2023airbnb property investment Lake Arrowhead Located in the “The Alps of Southern California”, Lake Arrowhead is a small mountain resort …