Where to invest in France

France is known for several world-renowned tourist attractions. Since the pandemic restrictions have been lifted around the globe, more tourists have traveled here and there. And while it’s too cliche to say that it’s known for being the city of love – it also offers the best cities for Airbnb investment in Europe!

In fact, Airbnb revealed some of the top destinations in 2022 and discovered that most international guests are from France. And because of fully booked Airbnb cities like Paris, investors are taking advantage of available undervalued properties.

But the real question is, where to invest in France? What are the best places that can generate excellent income?

This article will guide you through the most recommended Airbnb locations for investment, rules and regulations, and anticipate annual revenue in France. Continue reading to learn more!

Airbnb Rules France: Laws for Airbnb Hosts

Airbnb rules in France vary per city and it can be a challenge if you don’t speak their language. But the good news is that you can reach out to municipal services in France and be guided by their instructions.

Here are some of the general Airbnb rules in France:

- Primary Residence – allowed to rent a room without any duration limit for 365 days per year.

- Secondary Residence – this includes holiday houses and pied-à-terres (small living units – apartments), where you can live for less than 4 months in a year. This is also allowed as long as your rental activity is declared to the city.

- Registration is necessary if you rent an entire primary or secondary residence or a commercial space. However, if you only rent a single room in your primary residence, rent for long-term stays, or on bail mobilité (mobility lease), then registration is not necessary.

On March 2022, Airbnb news shared a mandatory registration for short-term rental hosts in 10 French cities.

This includes the following cities: Albi, Troyes, Ahetze, Arcangues, Acain, Bassussary, Bocau, Saint-Pierre-d’lrube et à Urrugne, and Montpellier. To register as an Airbnb host in these cities, all you need to do is request registration online on their local municipality’s website.

Is Buying Property in France a Good Investment?

As long as you target the right neighborhood and market, investment property in France can certainly be a good investment! Aside from the fact that you’ll live in one of the dreamiest countries in Europe, you can also earn a good source of income.

So what is it like when buying property in France for foreigners? To date, there are no restrictions for foreign investors to purchase a property in France. Here are some of the requirements that you will need to prepare for:

- Local French bank account

- A valid government ID

- Notaire’s fees + deposit

- Stamp duty (5.8% for properties over 5+ old and 0.7% + VAT for new homes)

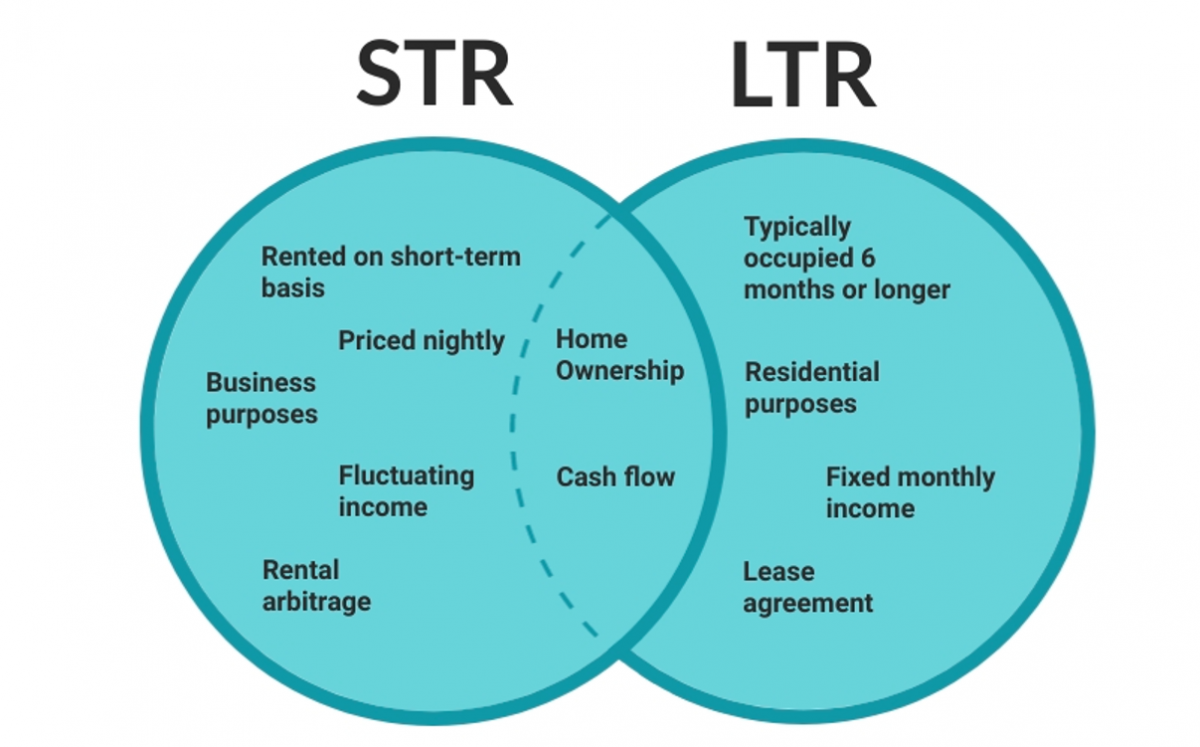

Starting an Airbnb business in France can be easier with the help of a local real estate agent’s help. For beginners, you can also consider doing rental arbitrage in France. As long as the landlord and lease contract allows you to do so, then it’s a good idea to do so!

How much can you make on Airbnb in France?

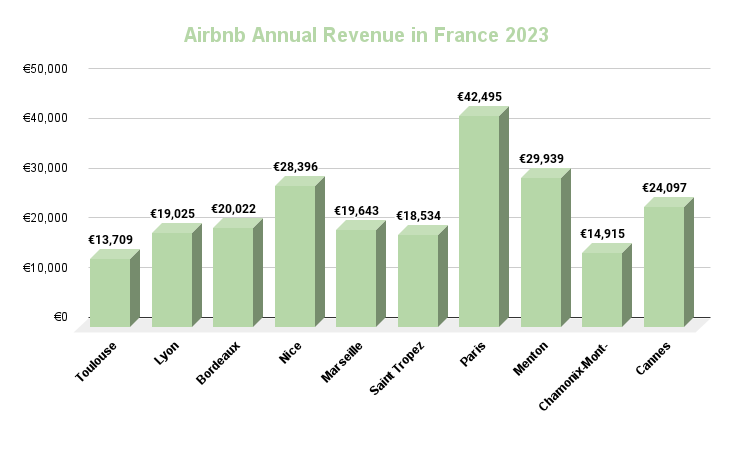

According to Airbtics, an Airbnb host can expect to earn the highest annual revenue of €42,295 in Paris, France. The revenue for each city and neighborhood varies depending on the location, property type, and accessibility to local amenities among others.

Let’s take a look at some of the best examples of property investments in France! Creuse in Nouvelle-Aquitaine region offers the most affordable properties. Popular for its farmland and small villages, Creuse has beautiful natural landscapes across the region.

- Average property price for a 1-bedroom apartment: €74,383

- Average Airbnb annual revenue: €10,951

- Gross rental yield: 14.72%

Where to Invest in France: Top 10 Profitable Airbnb Cities in France

So let’s get down to the chase! Here are the profitable areas to do Airbnb in France:

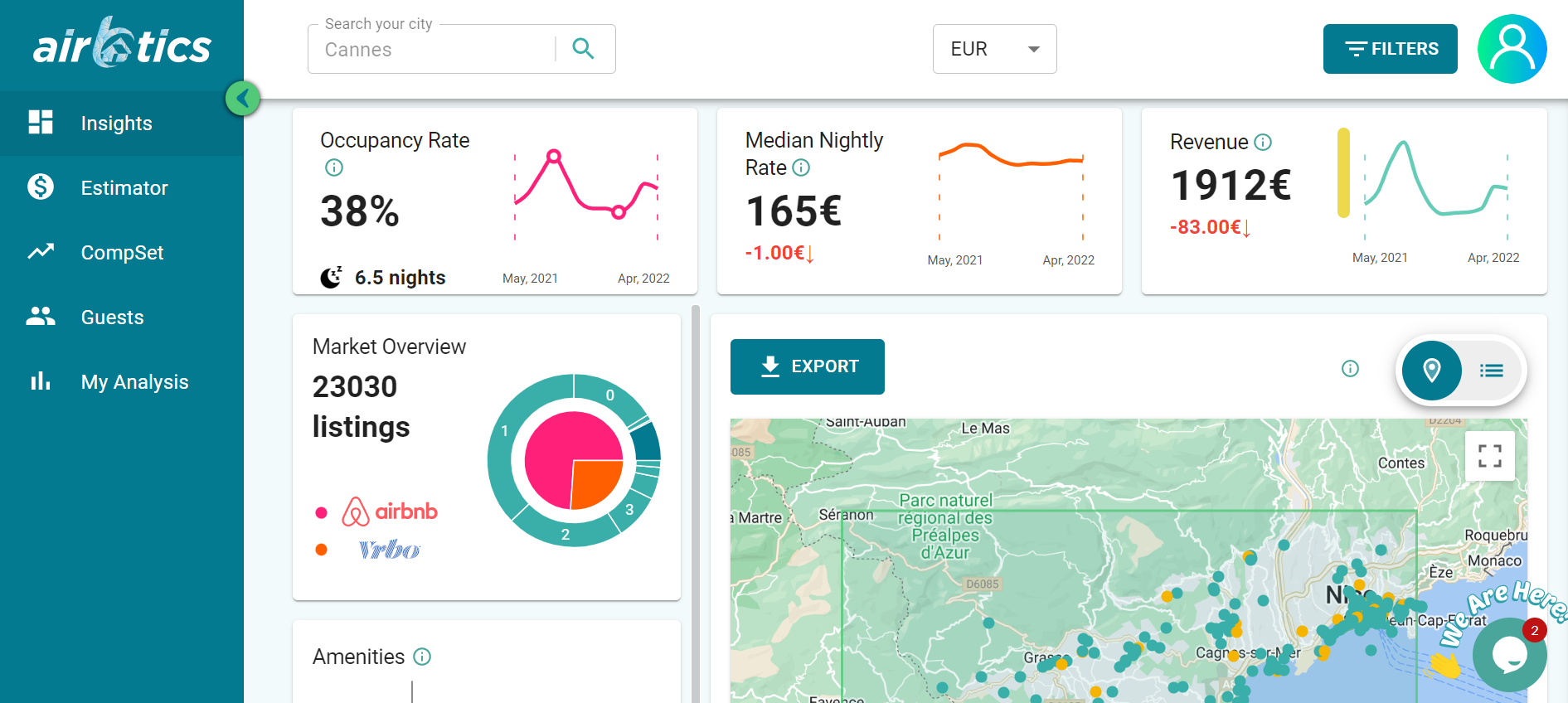

1. Cannes

- Average property price (1-bedroom apartment): €495,000

- Airbnb annual revenue: €24,097

- Gross rental yield: 4.86%

- Average Daily Rate: €108

- Occupancy Rate: 56%

2. Chamonix-Mont-Blanc

- Average property price (1-bedroom apartment): €600,000

- Airbnb annual revenue: €14,915

- Gross rental yield: 2.49%

- Average Daily Rate: €84

- Occupancy Rate: 45%

3. Menton

- Average property price (1-bedroom apartment): €695,000

- Airbnb annual revenue: €29,939

- Gross rental yield: 4.31%

- Average Daily Rate: €173

- Occupancy Rate: 44%

4. Paris

- Average property price (1-bedroom apartment): €530,000

- Airbnb annual revenue: €42,495

- Gross rental yield: 8.01%

- Average Daily Rate: €136

- Occupancy Rate: 92%

5. Saint Tropez

- Average property price (1-bedroom apartment): €766,750

- Airbnb annual revenue: €18,534

- Gross rental yield: 2.42%

- Average Daily Rate: €105

- Occupancy Rate: 41%

6. Marseille

- Average property price (1-bedroom apartment): €499,000

- Airbnb annual revenue: €19,643

- Gross rental yield: 3.94%

- Average Daily Rate: €79

- Occupancy Rate: 67%

7. Nice

- Average property price (1-bedroom apartment): €695,000

- Airbnb annual revenue: €28,396

- Gross rental yield: 4.09%

- Average Daily Rate: €98

- Occupancy Rate: 76%

8. Bordeaux

- Average property price (1-bedroom apartment): €310,900

- Airbnb annual revenue: €20,022

- Gross rental yield: 6.44%

- Average Daily Rate: €83

- Occupancy Rate: 70%

9. Lyon

- Average property price (1-bedroom apartment): €355,000

- Airbnb annual revenue: €19,025

- Gross rental yield: 5.36%

- Average Daily Rate: €75

- Occupancy Rate: 74%

10. Toulouse

- Average property price (1-bedroom apartment): €229,000

- Airbnb annual revenue: €13,709

- Gross rental yield: 5.99%

- Average Daily Rate: €59

- Occupancy Rate: 66%

Conclusion

Now that you have a clear overview of what it’s like to become an Airbnb host in France, don’t settle! There are other several profitable French areas that you can easily discover using an Airbnb analytics tool. Aside from learning about emerging markets, you can also spy on your competitors’ performance and strategize your investment.

Not only that – but you will also get to predict your revenue using an Airbnb profit calculator. Using historical, current, and forecasted rental data, you can take advantage of your leverage in the industry. Try Airbtics now and stand out among the rest!