Best Areas in Atlanta for Airbnb Investment: Get the best areas in Atlanta for Airbnb Investment from this article guided by short-term rental data analytics.

Home > Resources > Airbnb Investment >

Best Areas in Atlanta for Airbnb Investment

Best Areas in Atlanta for Airbnb Investment

Get the best areas in Atlanta for Airbnb Investment from this article guided by short-term rental data analytics.

- Last updated on

- August 17, 2023

Key Takeaways

- Before buying rental property in Atlanta, it is best to know the profitability of its Airbnb market. Such a market can be broken down into smaller ones for you to analyze further the numbers.

- Learn the tools that can help you find the best Atlanta real estate investing leads for your next Airbnb venture.

Introduction

If you’re wondering about the best places for Airbnb investments in Atlanta, then wonder no more! By using short-term rental analytics, we can easily find the Airbnb markets that offer the highest gross rental yields.

How profitable are Atlanta investment properties? Read on to find out. We’re not pulling data out of thin air – we based them using accurate short-term rental analytics!

Can I Airbnb my apartment in Atlanta GA?

You can definitely Airbnb your apartment and make your property among 4,491 listings in Atlanta! You just need to register your property in accordance with the local ordinance on short-term rentals. To start your Airbnb in Atlanta, you can register via this gateway and pay the $150 application fee.

How much do Airbnb hosts make in Atlanta?

An Airbnb host with a one-bedroom property can earn $28,400 annually. Using Airbtics, we find out that they can charge a nightly rate of $117 for the said property size, which has an average occupancy rate of 59%.

Source: Airbtics Dashboard

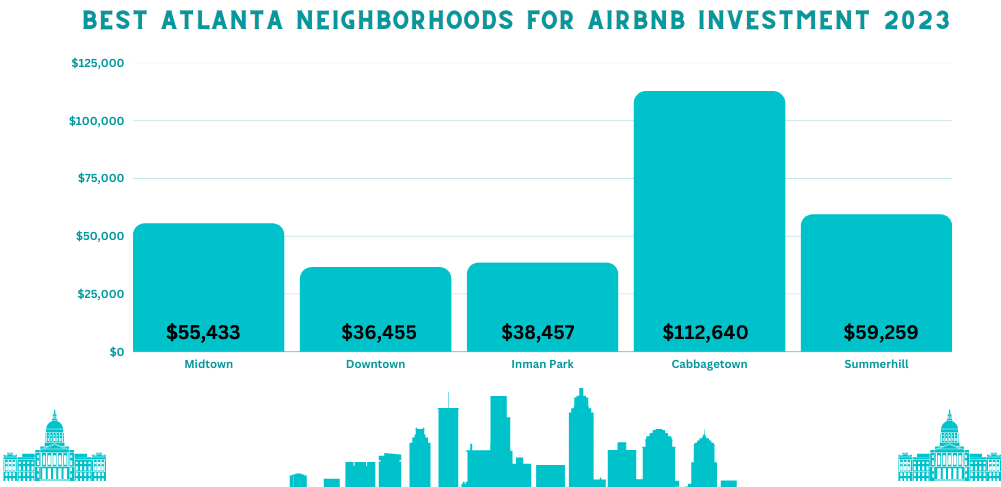

Best Atlanta Neighborhoods for Airbnb Investment

With its revenue heatmap, Airbtics’ Insights Tool can help you see the profitable areas in your chosen neighborhood. Be guided with this as you drag the map: the redder the dots, the more profitable they are!

Once a place has enticed you, you can then create a custom market to see further its relevant data. Following these easy steps, we have learned that the following neighborhoods are the best for Airbnb investments in Atlanta:

|

|||||

|---|---|---|---|---|---|

| Location | Number of Airbnb Listings | Best Number of Bedrooms | Median Property Price | Airbnb Annual Revenue | GRY |

| Midtown | 433 | 2 Bedrooms | $249,000 | $55,433 | 22.26% |

| Downtown | 582 | 2 Bedrooms | $195,000 | $36,455 | 18.69% |

| Inman Park | 74 | 1 Bedroom | $325,000 | $38,457 | 11.83% |

| Cabbagetown | 47 | 3 Bedrooms | $655,000 | $112,640 | 17.08% |

| Summerhill | 68 | 3 Bedrooms | $365,000 | $59,259 | 16.24% |

Airbnb Location

Airbnb Dataset

- Airbnb listings: 74

- Best bedroom size: 1 bedroom

- Property price: $325,000

- Airbnb annual revenue: $38,457

- Gross rental yield: 11.83%

- Airbnb listings: 47

- Best bedroom size: 3 bedrooms

- Property price: $655,000

- Airbnb annual revenue: $112,640

- Gross rental yield: 17.08%

- Airbnb listings: 68

- Best bedroom size: 3 bedrooms

- Property price: $365,000

- Airbnb annual revenue: $59,259

- Gross rental yield: 16.24%

Source: Airbtics Dashboard

What are the most popular areas for Airbnb near Atlanta?

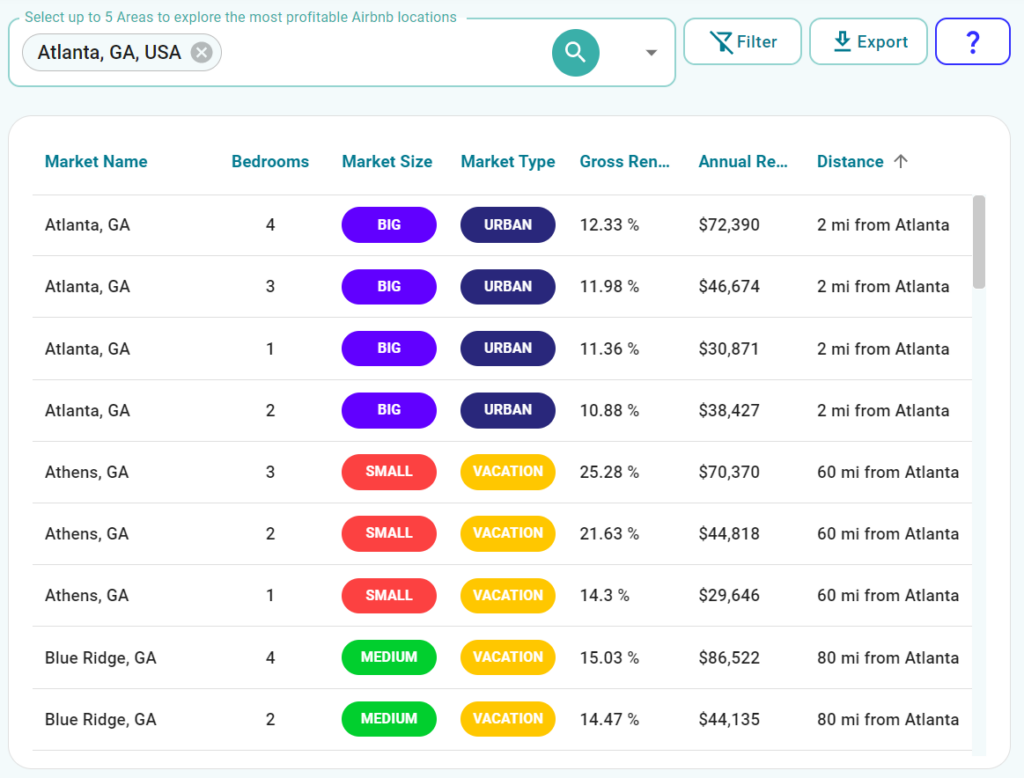

If you are not too keen on investing in Atlanta, you can always try to look beyond this city. Airbtics’ Discovery tool can give you nearby profitable Airbnb markets after you type in the city of your choice. With advanced filters, here are the cities near Atlanta that give the highest gross rental yields:

|

|||||

|---|---|---|---|---|---|

| Location | Number of Airbnb Listings | Best Number of Bedrooms | Median Property Price | Airbnb Annual Revenue | GRY |

| Birmingham, AL (139 mi away) | 573 | 2 Bedrooms | $65,396 | $33,340 | 50.98% |

| Savannah, GA (225 mi away) | 2,452 | 4 Bedrooms | $366,519 | $155,416 | 42.4% |

| Augusta, GA (136 mi away) | 801 | 3 Bedrooms | $161,919 | $50,357 | 31.1% |

| Columbia, SC (200 mi away) | 441 | 2 Bedrooms | $132,023 | $33,586 | 25.44% |

| Athens, GA (60 mi away) | 632 | 3 Bedrooms | $278,335 | $70,370 | 25.28% |

Airbnb Location

Airbnb Dataset

- Distance from Atlanta: 139 miles

- Airbnb listings: 573

- Best property size: 2 bedrooms

- Median Property price: $65,396

- Airbnb annual revenue: $33,340

- Gross rental yield: 50.98%

- Distance from Atlanta: 225 miles

- Airbnb listings: 2,452

- Best property size: 4 bedrooms

- Median Property price: $366,519

- Airbnb annual revenue: $155,416

- Gross rental yield: 42.4%

- Distance from Atlanta: 136 miles

- Airbnb listings: 801

- Best property size: 3 bedrooms

- Median Property price: $161,919

- Airbnb annual revenue: $50,357

- Gross rental yield: 31.1%

- Distance from Atlanta: 200 miles

- Airbnb listings: 441

- Best property size: 2 bedrooms

- Median Property price: $132,023

- Airbnb annual revenue: $33,586

- Gross rental yield: 25.44%

- Distance from Atlanta: 60 miles

- Airbnb listings: 632

- Best property size: 3 bedrooms

- Median Property price: $278,335

- Airbnb annual revenue: $70,370

- Gross rental yield: 25.28%

- Total Number of Airbnb Listings: 51

- Best bedroom size: 2 bedrooms

- Median property price (2 bedrooms): C$264,900

- Airbnb Annual revenue: C$28,444

- Gross rental yield: 10.74%

Source: Airbtics Dashboard

Conclusion

These figures help you get closer to financial stability – because admit it: we all want to make the most out of our hard-earned money. By using short-term rental analytics, all figures that we can get to help us reach the most profitable investment decisions become available to us. It can even expand our prospective markets for us to see more investment opportunities.

Curious if you’re maximizing your Airbnb revenue? Then check out this Free Airbnb Profit Calculator!

Explore The Most Profitable Airbnb Locations in Atlanta and Nearby Cities!

Short-Term Rental Data

Short-Term Rental Data

-

Quick Links

Keep Reading

Annual Airbnb Revenue in Kalama washington, USA

Kalama, Washington| Airbnb Market Data & Overview | USA Kalama, Washington Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Kalama, …

Annual Airbnb Revenue in Westcliffe colorado, USA

Westcliffe, Colorado| Airbnb Market Data & Overview | USA Westcliffe, Colorado Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Westcliffe, …

Annual Airbnb Revenue in South pasadena florida, USA

South Pasadena, Florida| Airbnb Market Data & Overview | USA South Pasadena, Florida Airbnb Market Data & Overview USA Is it profitable to do Airbnb …

Annual Airbnb Revenue in Mount crested butte colorado, USA

Mount Crested Butte, Colorado| Airbnb Market Data & Overview | USA Mount Crested Butte, Colorado Airbnb Market Data & Overview USA Is it profitable to …

Annual Airbnb Revenue in Lisburn and castlereagh, UK

Lisburn and Castlereagh| Airbnb Market Data & Overview | UK Lisburn and Castlereagh Airbnb Market Data & Overview UK Is it profitable to do Airbnb …

Annual Airbnb Revenue in Dana point california, USA

Dana Point, California| Airbnb Market Data & Overview | USA Dana Point, California Airbnb Market Data & Overview USA Is it profitable to do Airbnb …