airbnb property for sale Birmingham City Centre

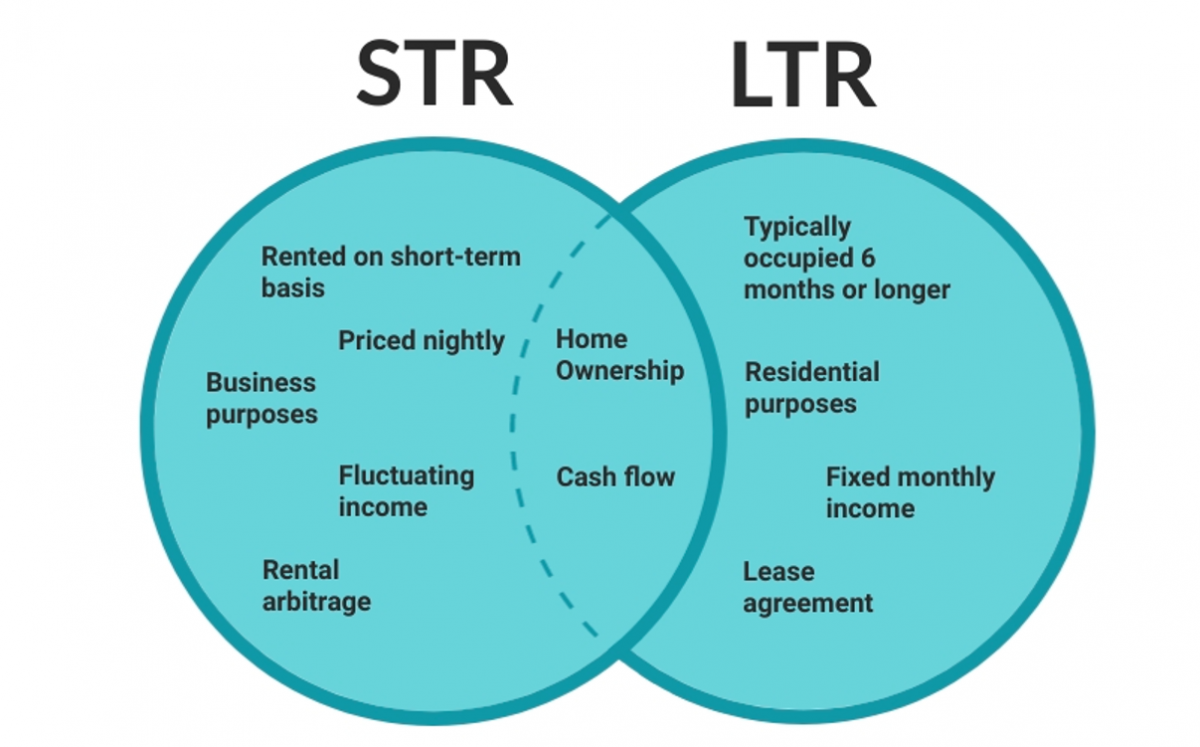

Are you looking to invest in a property where you can maximize profitability in a particular region? If yes, then it’s certainly a must to consider the major things to look out for when buying a property for Airbnb. While rental arbitrage in the UK is fairly popular and does not require you to purchase a property, it’s still the best to learn about buying a property for Airbnb and making sure that it’s profitable.

Aside from a property’s fascinating architectural design, proximity to major tourist areas, and accessibility to the best go-to places, the primary step is to determine profitability. It’s also good to know that Airbnb rules in Birmingham are not too strict, as they only prohibit short-term rentals less than 30 days. In this article, we’ll discuss the metrics in order to gauge the best property investment, specifically when buying a property investment in the UK.

This includes the best website recommendations for property investment, defining property gross rental yield, cash-on-cash return, and monthly revenue, along with some of the most ideal and profitable properties according to their location. Stoked to learn more about starting an Airbnb business in the UK? Continue reading to learn more!

Is Property Investment Profitable in Birmingham City Centre?

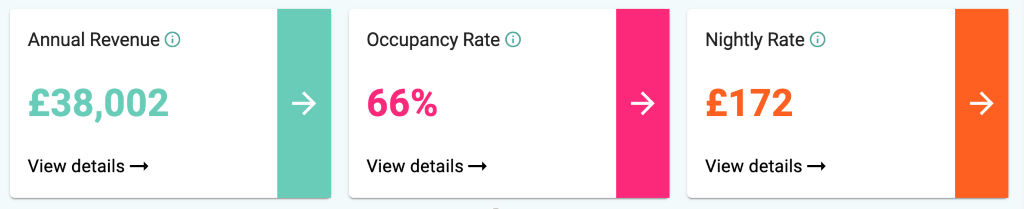

Since the UK has the fastest-growing property markets across the globe, there is a wide variety of profitable property investments offering higher yields. Using an Airbnb calculator, it was discovered that a 3-bedroom apartment in Birmingham City Centre can generate an annual revenue of £38,002 with a steady occupancy rate of 66% and a nightly rate of £172.

airbnb property for sale Birmingham City Centre

Profitable Properties for Sale in Birmingham City Centre

Finding the best properties that have the potential to produce high yields and capital growth are certainly some of the preferences of major investors. It’s always best to ask for assistance from real estate agents to access exclusive and unique properties during the development stage.

At the same time, it’s even better when a property investor like you conducts research about predicted growths and market forecasts. Here are some of the profitable properties in Birmingham City Centre along with the calculated gross rental yield, cash-on-cash return, and annual revenue:

Great Horton Road, Great Horton, Bradford BD7

1. Studio-type Property for Sale Birmingham

0.8 Miles to Loughborough

Asking Price: £39,000

| GROSS RENTAL YIELD | 24.78% |

| ANNUAL REVENUE | £9,665 |

| CASH ON CASH RETURN | 48.58% |

Manor House Close, Birmingham B29

2. 1-Bedroom Property for Sale Birmingham

1.9 miles to University (Birmingham)

Asking Price: £60,000

| GROSS RENTAL YIELD | 26.01% |

| ANNUAL REVENUE | £15,607 |

| CASH ON CASH RETURN | 52.27% |

3. 2-Bedroom Property for Sale Birmingham

0.8 miles to Sandwell & Dudley

Asking Price: £85,000

| GROSS RENTAL YIELD | 24.74% |

| ANNUAL REVENUE | £21,033 |

| CASH ON CASH RETURN | 48.47% |

Telford Gardens, Wolverhampton WV3

4. 3-Bedroom Property for Sale Bermingham

2.4 miles to Wolverhampton

Asking Price: £85,000

| GROSS RENTAL YIELD | 25.44% |

| ANNUAL REVENUE | £21,620 |

| CASH ON CASH RETURN | 50.54% |

5. 4-Bedroom Property for Sale Bermingham

0.8 miles to Evesham

Asking Price: £136,000

| GROSS RENTAL YIELD | 24.97% |

| ANNUAL REVENUE | £33,954 |

| CASH ON CASH RETURN | 49.13% |

Conclusion

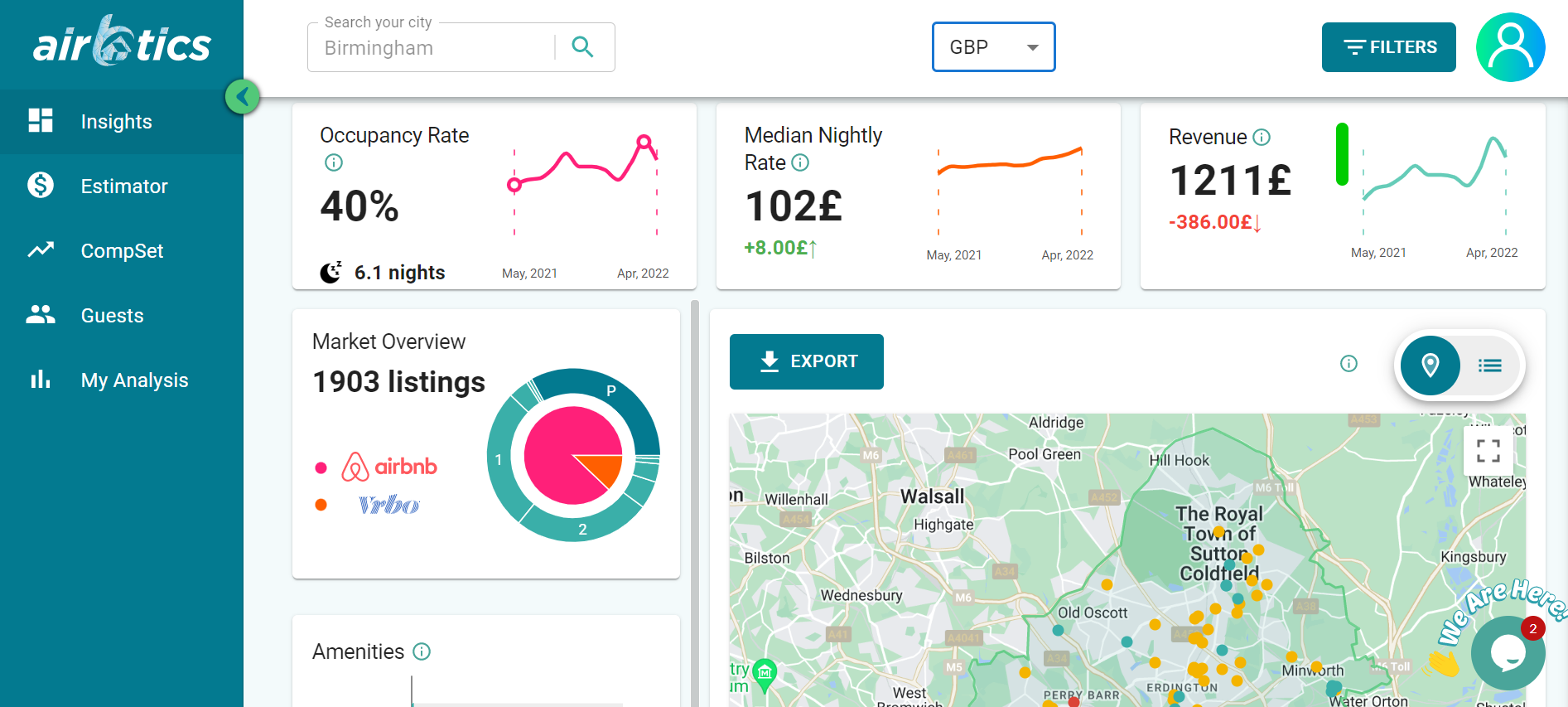

Since Airbnb is rapidly increasing and constantly changing for each city in the world, it is crucial to make decisions based on wild guesses. The data points mentioned in this article for Birmingham such as Airbnb occupancy rates, annual revenue, and average daily rate should be the primary basis before investing in a property.

Hence, if the data presented above has given you ideas to boost your strategic pricing plan for your business, then an Airbnb rental arbitrage calculator is certainly what you need for success in the long run. It’s a fact that some of the STR investors are also considering Airbnb Rental Arbitrage, but they still need to have a reliable data tool on to base their conclusions!

As we live in a digital era, an accurate data analytics tool can help your business stand out among your surrounding competitors and benchmark your property by tracking the occupancy rates of competing listings in your preferred city.