30 Markets – Enterprise Plan Deal for Existing Users: Before $599 | Black Friday Coupon: Only for $299 Full dashboard access to 30 markets with 12 months of historical data of up to 600,000 short-term rentals. Consult with our team for an exclusive property sourcing service giving you at least 5 high-income potential property deals […]

Author: jae an

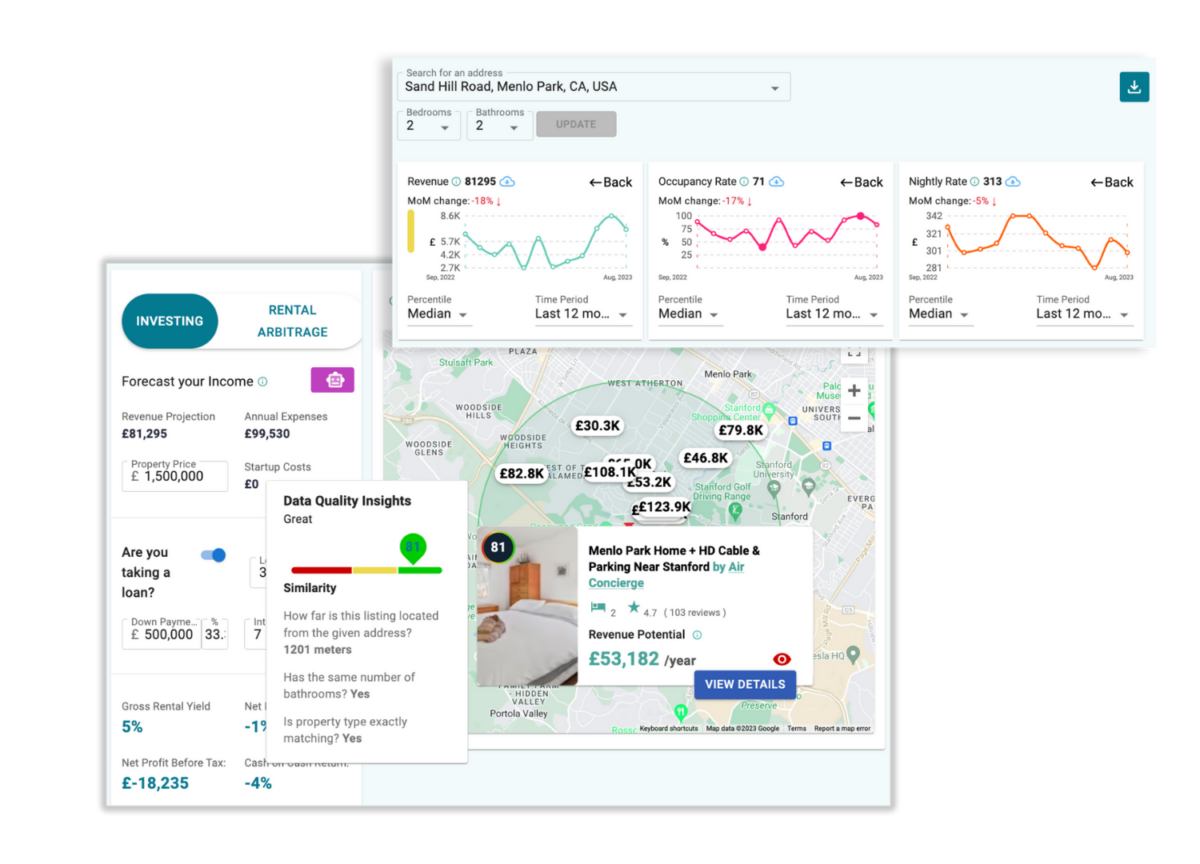

Airbnb Investment Sourcing As A Service

What is property sourcing by Airbtics? It is a free service for our Enterprise subscription users ($599.95/mo). Our team of data analyst and real estate expert will identify & vet high return Airbnb investment opportunities for you. You can expect to receive at least 5 deals with contact addresses of realtors. All deals will be […]

Here’s the objective of this blog: To build a property search filter to accurately identify high-return rental arbitrage properties repeatedly. Being able to identify the right opportunities will help you to achieve the ultimate financial freedom by scaling your Airbnb business. How long does it take to build such filters? It will take about 10 […]

Florida Rental Yield Hotspots Airbnb & Short-term rental market data on the best rental yields in Florida Click the city name to see detailed market data. Used Home Values data from Zillow to calculate Gross Rental Yields. Used 1-bedroom Airbnb revenue data from Airbtics App. House Price Annual Revenue Airbnb Occupancy Rate Average Yield Miami […]

Airbnb Calculator Instantly See Your Airbnb’s Estimated Revenue The leading Airbnb profit calculator in the short-term rental industry. Discover your Airbnb earnings potential. Estimate Bedrooms − 1 + What is your goal? Buy Rent Manage Calculate Trusted by 50,000+ Short-Term Rental Businesses Check out our Free Airbnb Calculator Wondering how to make the most money […]

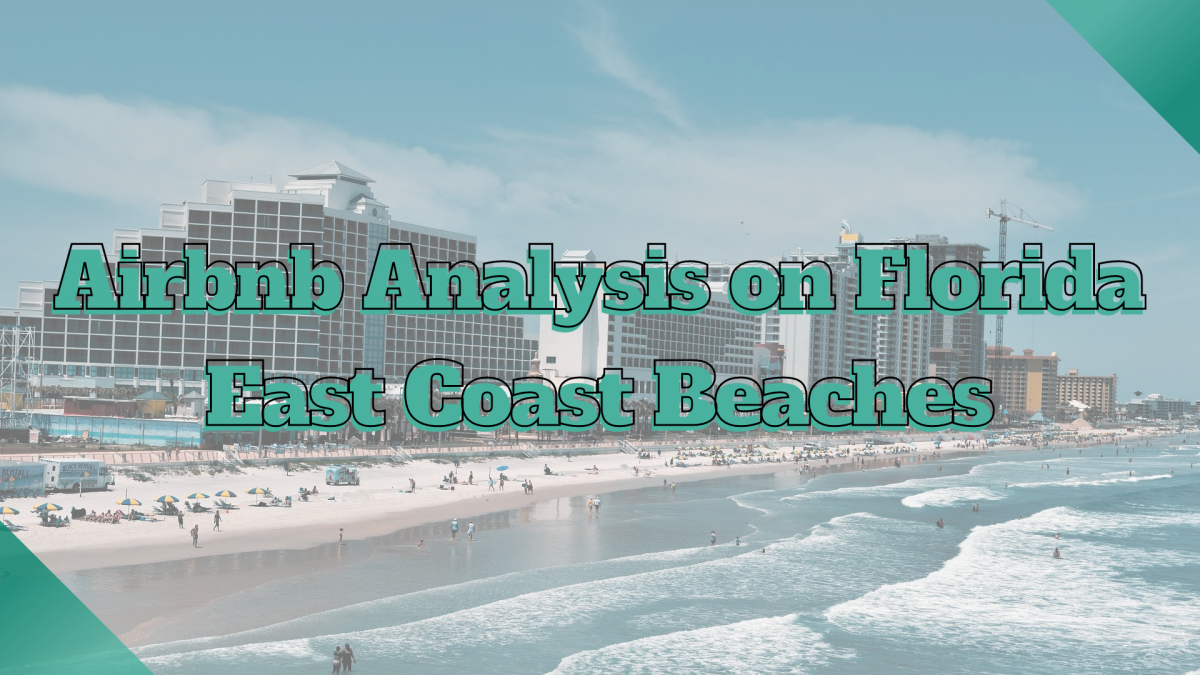

Florida is the short-term rental heaven, one of the most touristy states in the US. If you are sick of the cold winter, operating a vacation home in Florida may be a good excuse to visit there every winter. Of course, all while generating profitable cash flow to sustain your mortgage fees and all. It’s […]

Table of Contents Add a header to begin generating the table of contents 에어비앤비가 2008년에 생긴 이후로, 매해 마다 점점 더 많은 수의 호스트들이 에어비앤비를 통해 제태크 수입을 내고있습니다. 투잡으로 에어비앤비를 관리하는 사람들이 대부분이지만 에어비앤비를 통해 전문적인 사업을 하는 사람들도 많이 늘어나고 있는데요. 오늘 이 블로그에서는, 에어비앤비 데이터 분석을 통해, 국내에서 에어비앤비를 하기 가장 좋은 […]

Best Cities to Start Airbnb Rental Arbitrage Business The pandemic has hit short-term rental businesses all over the world, but it’s not the case in the US. It’s backed by data that many of the remote US destinations have experienced the most profitable Summer in 2020 and are looking for another profitable Summer in 2021. […]

Pricing Short-term rentals correctly for this upcoming (2021) Summer became a challenging thing as the supply-demand of rentals in your market has never been like this before. This post describes how a revenue manager could use vacation rental data to price your listing efficiently. After reading the post, you will learn what type of vacation […]

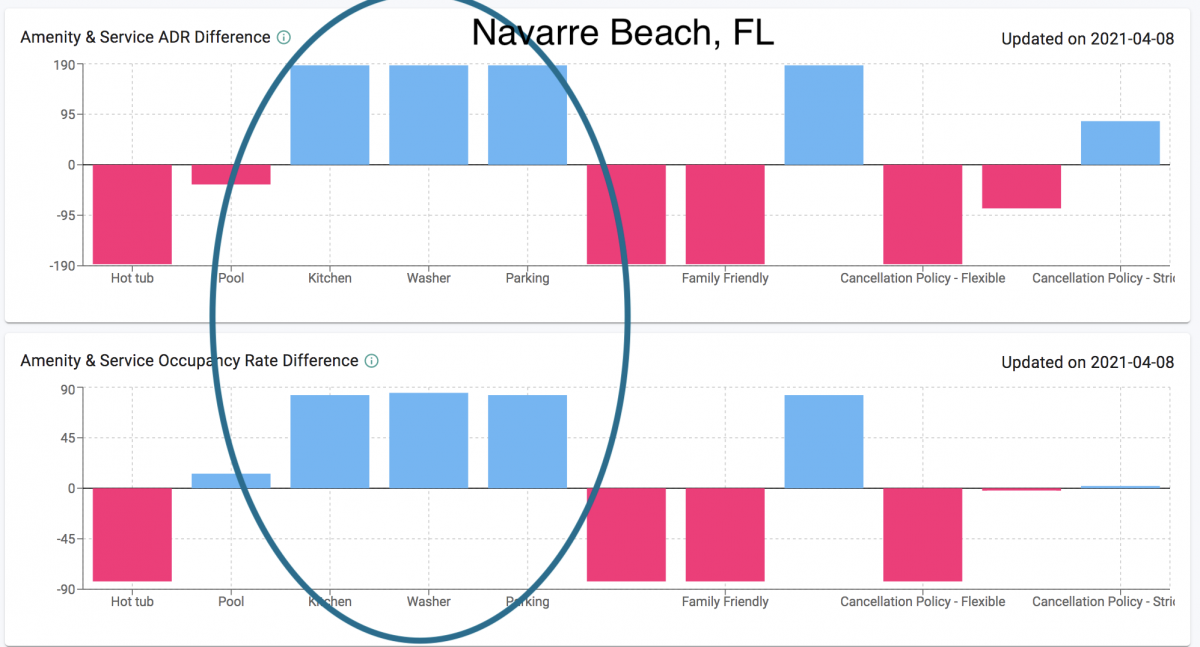

How to increase the daily rate of your Airbnb listing while keeping your occupancy rate? Our team has been doing a crazy experiment using Airbnb data for the last couple of months. We wanted to see if we can make Airbnb hosts charge 20-30% more daily rate while maintaining their occupancy rates and without investing a hefty fee.