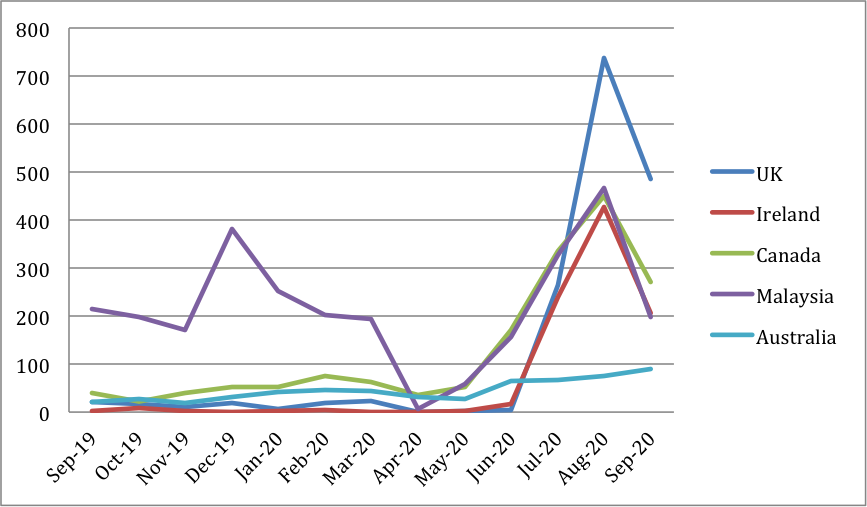

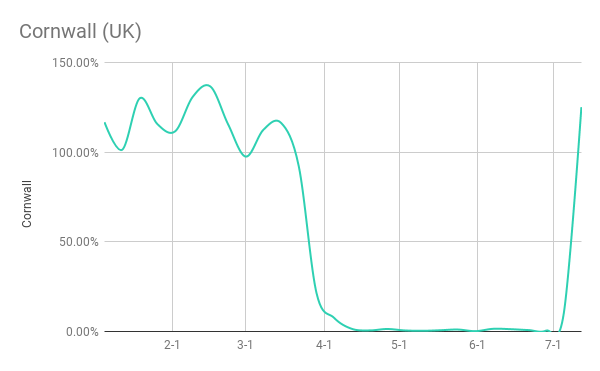

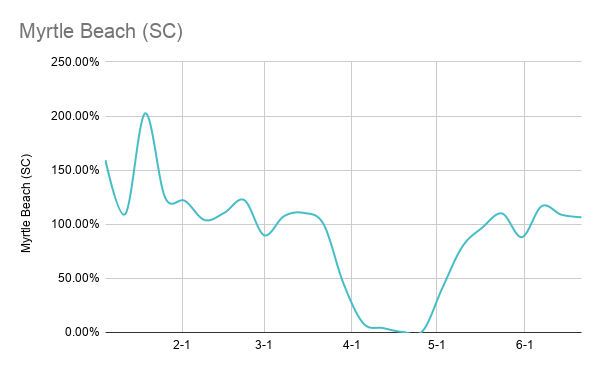

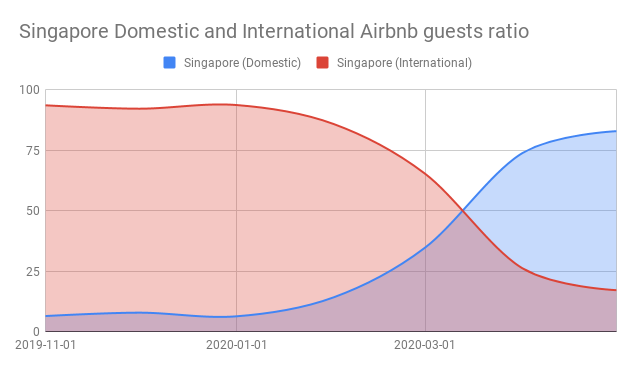

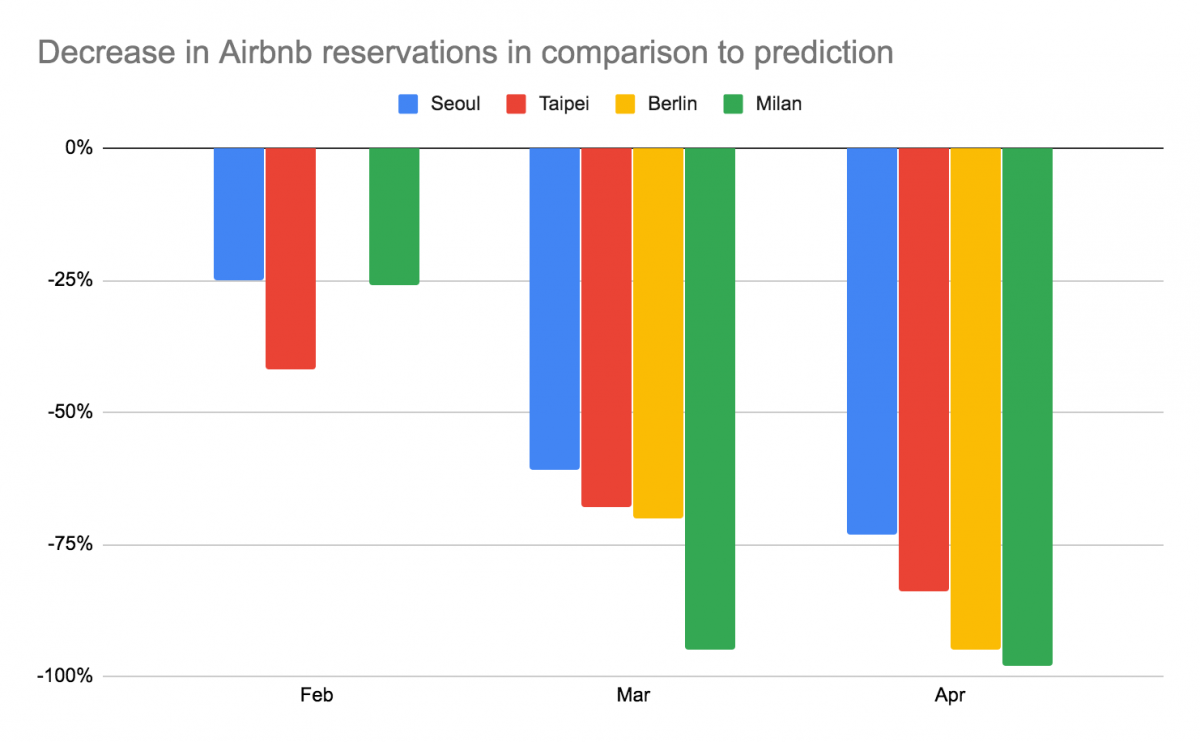

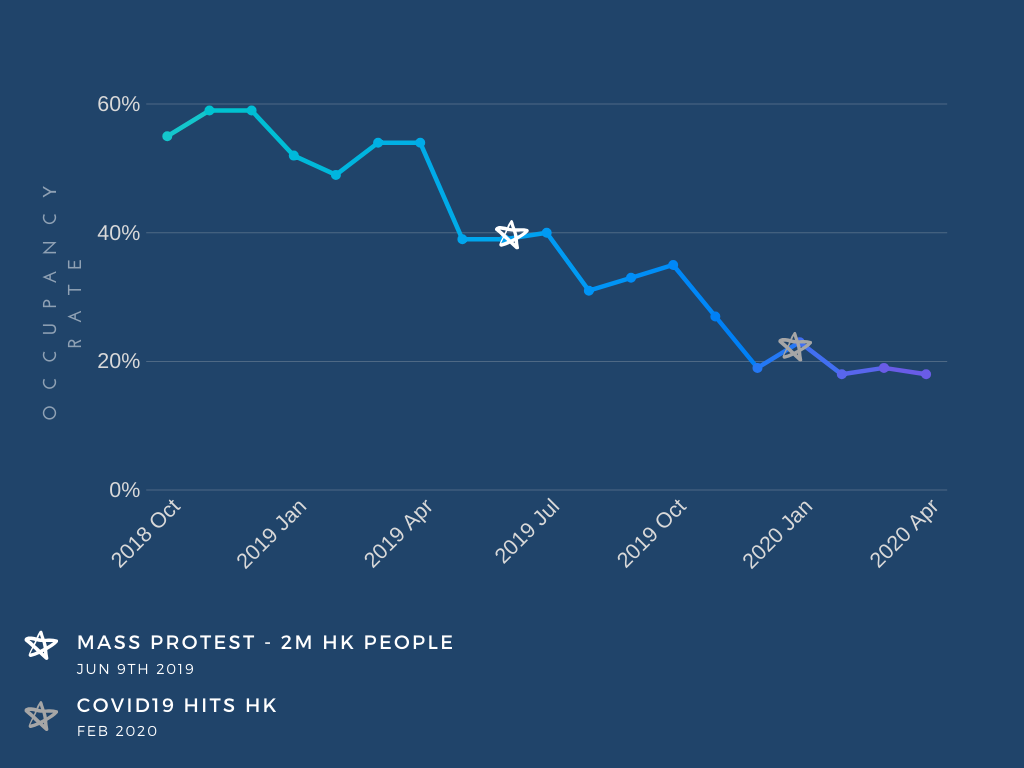

Table of Contents How has Covid-19 affected international tourism? There is an estimated decline of 58% to 78% on international tourist arrival this year due to the Covid-19 pandemic, as stated by UNWTO. With planes forced to stop flying and borders closed between countries, people have no choice but to stay put. Looking at the […]