Best areas in Houston for Airbnb

Key Takeaways

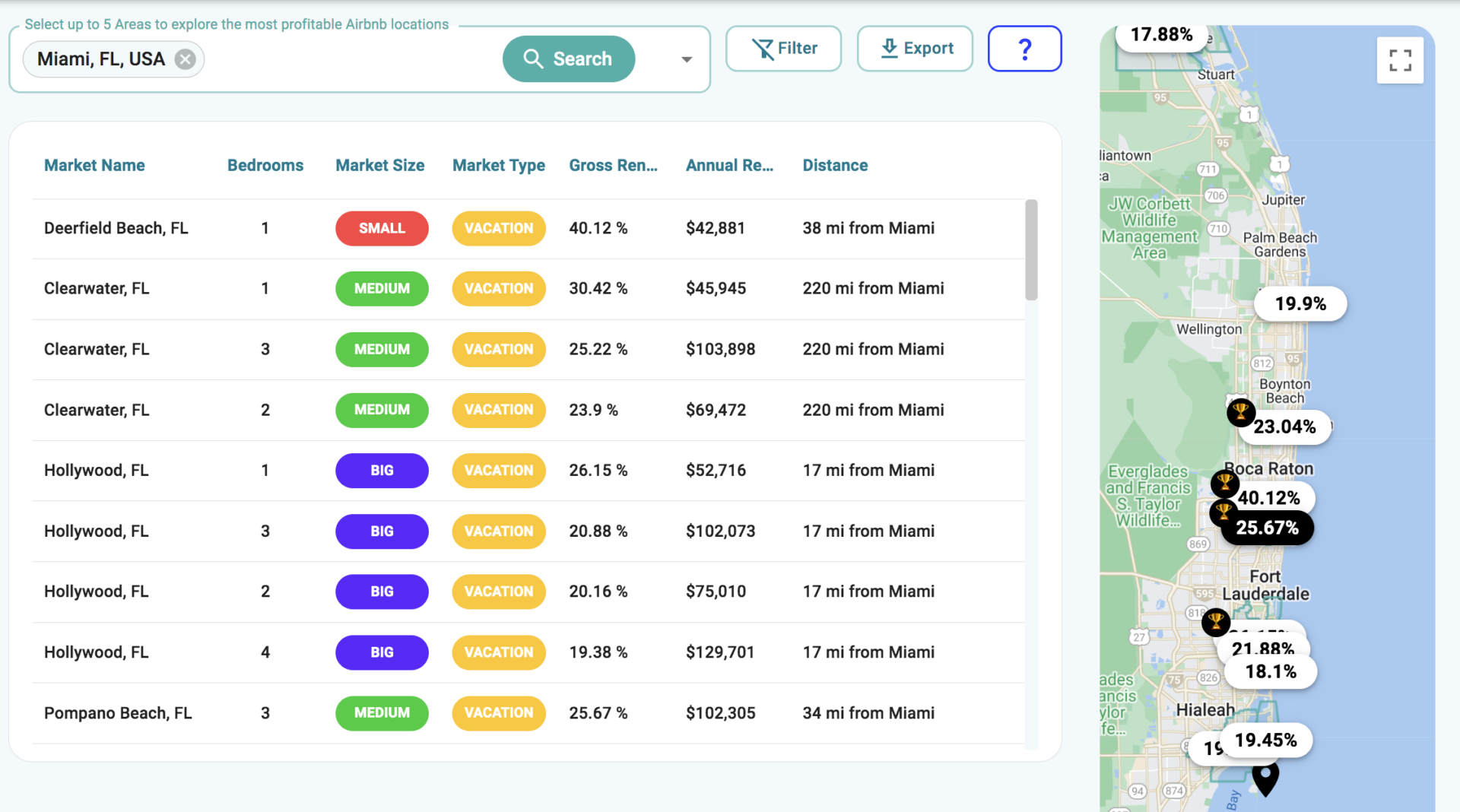

- Learn about the profitability of property investment, the best property types, and the most recommended cities with the highest gross rental yield. You will also learn how to find the best areas near Houston, Texas.

- Discover expert tips for first-time real estate investors and Airbnb requirements for hosting in Houston.

- The top 10 Areas for Airbnb nearby Houston are revealed – along with their median property prices, Airbnb annual revenue, occupancy rates, and more.

Introduction

Houston is the 4th largest city in the US and has one of the strongest economies. Several investors in the market have their eye on Houston properties because of its booming international trade and population growth.

The quality of education and employment opportunities in Houston is also expected to be on an upward trend. This gives more practical reasons for investors to dig in.

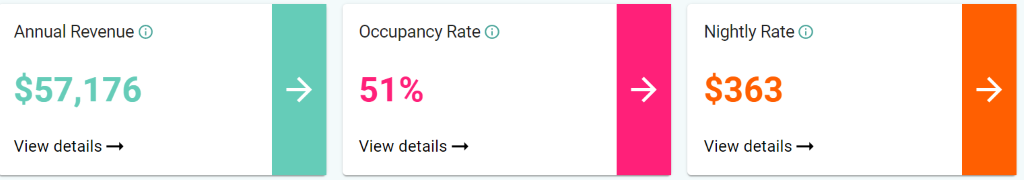

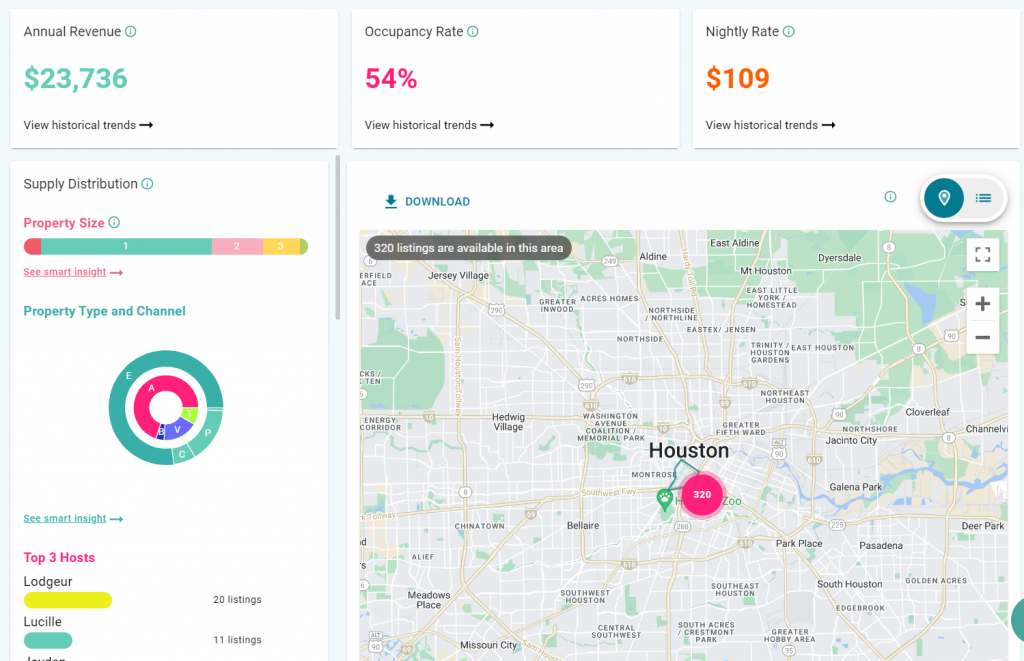

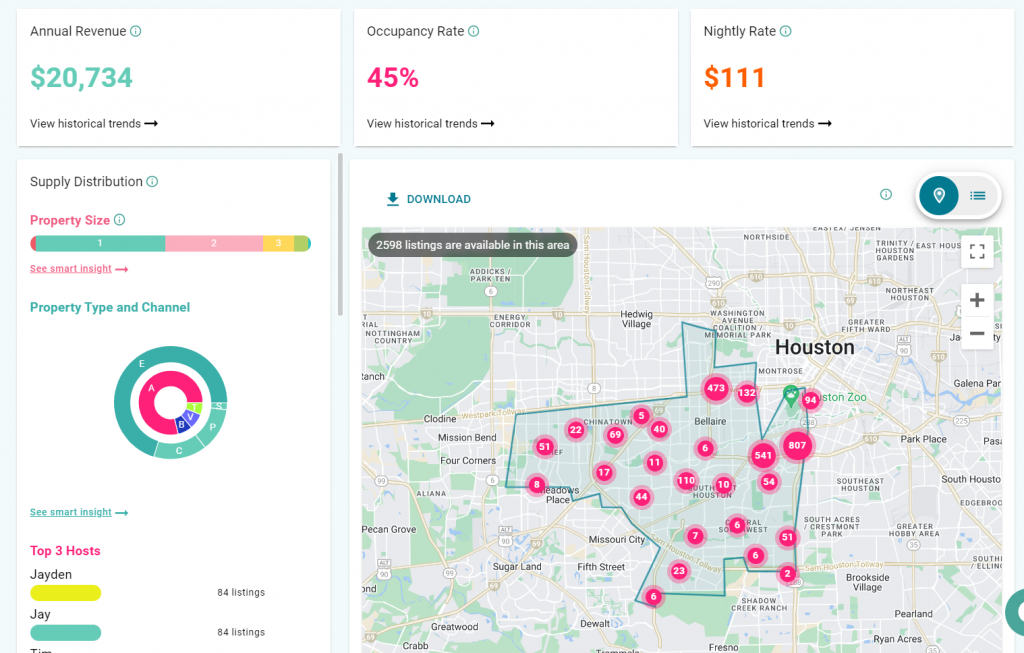

In fact, according to Airbtics, an Airbnb host can expect to earn $25,190 annual revenue in Houston. And this is just for operating a 2-bedroom property alone with shows a solid 49% occupancy rate.

But where are the best areas in Houston for Airbnb? – which are the most profitable locations for investment?

In this article, we’ll discuss the data about buying investment property in Texas and reveal the most profitable areas for Airbnb nearby Houston. Continue reading to learn more!

Is Airbnb profitable in Houston, Texas?

The good news is that Airbnb is profitable in Houston! This varies according to your target location, property type, amenities, and hosting skills among the rest.

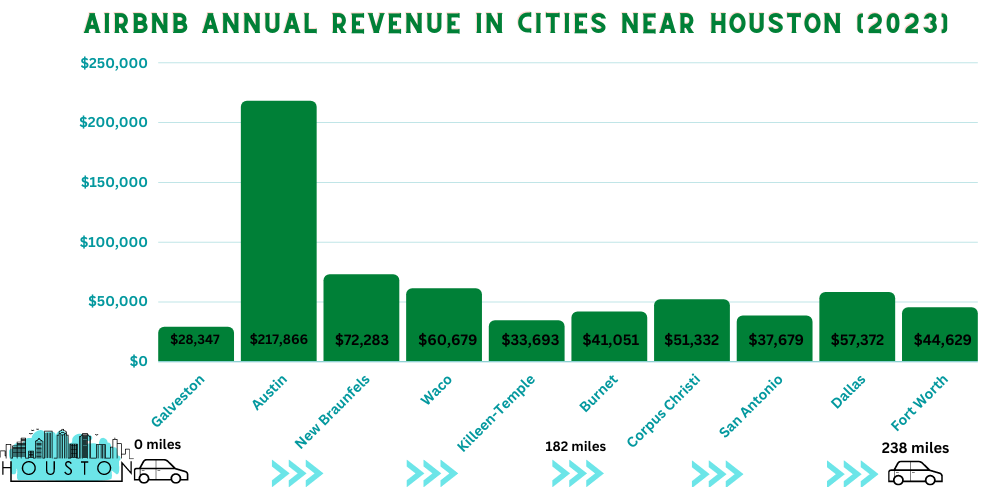

Airbtics’ data confirm that Austin is the highest Airbnb annual revenue of nearby cities in Houston. An Airbnb host can expect to earn an average annual revenue of $217,866 with a promising gross rental yield of 17.27%. Houston’s Airbnb occupancy rate is also a solid %.

There’s also no denying that Houston offers a natural charm that attracts tourist arrivals. Its vast job sectors from aerospace to aviation also contribute to more students and professionals visiting the city. Apart from this, there are plenty of various investment properties available that one can take advantage of.

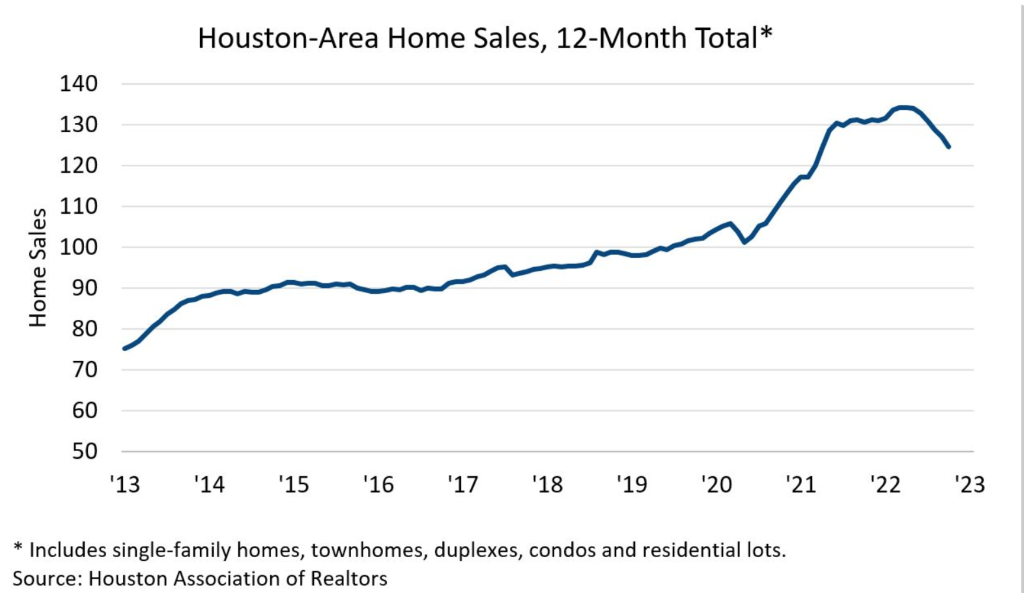

Property Investment in Houston, Texas

Houston’s real estate market is generally known for its affordability. In fact, Houston Association of Realtors confirmed that despite the elevated interest rates and low inventory, the market remained on an upward trend. Property investment Texas can certainly generate profitability in the long run. Here are some expert tips for first-time real estate investors:

1. Plan out your budget

Airbnb host expenses can be more overwhelming in the long run so it’s important to track your initial budget and recurring expenses. At the same time, you can also look for properties that are undervalued to have extra cash reserves.

2. Conduct research

Using an Airbnb analytics tool will not only help you determine your profitability but will also lead you to the right investments. Conducting research using Airbtics will help you make the wisest investment decisions by looking at accurate data & market trends.

3. Speak with real estate agents

Most local real estate agents are aware of the short-term rental business and can give you hands-on advice to achieve your goal. Whether you’re looking into various property types, speaking with real estate agents can help you choose the best property available.

Note: According to Airbnb, Houston does not have specific short-term rental regulations. However, Airbnb hosts should be aware of the 6% state hotel occupancy tax on Texas short-term rentals and housing standards.

Top 10 Best Areas to Airbnb near Houston, Texas

Where to invest in Texas? You can also get the idea here. Check out the nearby cities in Houston that are highly recommended for starting an Airbnb business:

1. Galveston

- Recommended bedroom size: 1 bedroom

- Median property price (1-bedrooms): $197,000

- Airbnb Annual revenue: $28,347

- Gross Rental Yield: 14.39%

- Located 40 miles from Houston (1-hour drive)

2. Corpus Christi

- Recommended bedroom size: 2 bedrooms

- Median property price (2 bedrooms): $156,674

- Airbnb Annual revenue: $51,332

- Gross Rental Yield: 32.76%

- Located 186 miles from Houston (3 hours & 15 mins drive)

3. Waco

- Recommended bedroom size: 3 bedrooms

- Median property price (3-bedroom): $218,326

- Airbnb Annual revenue: $60,679

- Gross Rental Yield: 27.79%

- Located 165 miles from Houston (2 hours & 49 mins drive)

4. Fort Worth

- Recommended bedroom size: 2 bedrooms

- Median property price (2-bedroom): $209,815

- Airbnb Annual revenue: $44,629

- Gross Rental Yield: 21.27%

- Located 238 miles from Houston (3 hours & 56 mins drive)

5. New Braunfels

- Recommended bedroom size: 3 bedrooms

- Median property price (3-bedroom): $358,676

- Airbnb Annual revenue: $72,283

- Gross Rental Yield: 20.15%

- Located 165 miles from Houston (2 hours & 44 mins drive)

6. San Antonio

- Recommended bedroom size: 2 bedrooms

- Median property price (2-bedroom): $191,940

- Airbnb Annual revenue: $37,679

- Gross Rental Yield: 19.63%

- Located 187 miles from Houston (2 hours & 59 mins drive)

7. Dallas

- Recommended bedroom size: 3 bedrooms

- Median property price (3-bedroom): $305,533

- Airbnb Annual revenue: $57,372

- Gross Rental Yield: 18.78%

- Located 224 miles from Houston (3 hours & 31 mins drive)

8. Austin

- Recommended bedroom size: 5 bedrooms

- Median property price (5-bedroom): $1,188,690

- Airbnb Annual revenue: $217,866

- Gross Rental Yield: 18.33%

- Located 147 miles from Houston (2 hours & 46 mins drive)

9. Killeen-Temple

- Recommended bedroom size: 3 bedrooms

- Median property price (3-bedroom): $195,080

- Airbnb Annual revenue: $33,693

- Gross Rental Yield: 17.27%

- Located 175 miles from Houston (3 hours & 7 mins drive)

10. Burnet

- Recommended bedroom size: 2 bedrooms

- Median property price (2-bedroom): $262,732

- Airbnb Annual revenue: $41,051

- Gross Rental Yield: 15.62%

- Located 182 miles from Houston (3 hours & 23 mins drive)

Takeaway

Cities nearby Houston have several promising property investments with high gross rental yields. If you’re looking to invest in a new city or nearby neighborhoods, it’s advisable to look at other options and compare each market. Now that you have an idea of the best areas in Houston for Airbnb and the best places for Airbnb in Texas, take the next step to profitability!

You should also consider investing in a property in close proximity to your primary residence, tourist areas, or your work office for easy management. In the digital era, you no longer need to conduct manual research that is time-consuming.

By simply using an Airbnb profit calculator, you can easily get ahead of your competitors and make the wisest investment decisions.