airbnb property investment Portland

If you want to invest in the largest city in the State, then Portland is the right city for you! Aside from this city’s various fascinating landscapes and forests, Portland also brags its rain forests where outdoor activities can be enjoyed by tourists.

Before deciding to buy a property in Portland, Oregon, it’s certainly important to consider the major costs and revenue. While rental arbitrage in Portland is fairly popular and does not require you to purchase a property, it’s still recommended to learn about buying a property for Airbnb in the future and making sure that it’s profitable.

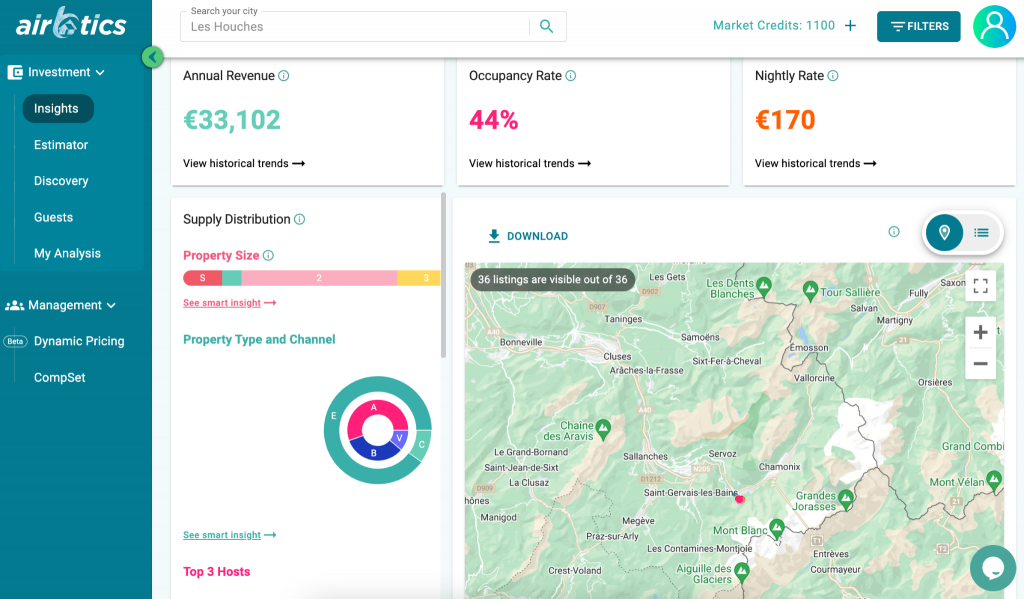

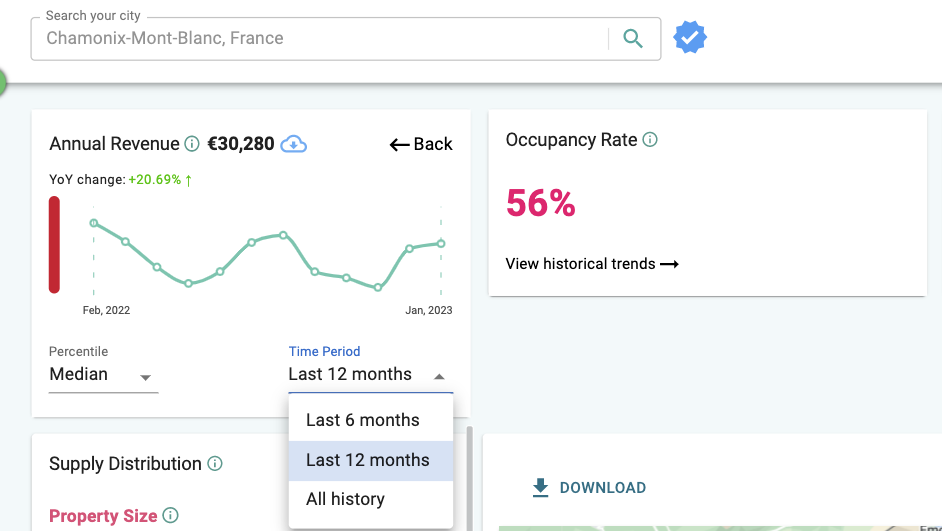

Airbnb occupancy rates by city state that an average host in Portland can earn up to $33,348 during the peak seasons from July – August. With over 3,342 Airbnb listings in Portland, it’s certainly a catch for property investors!

.

“Portland, Oregon has a hot housing market in 2022. It’s a seller’s market for sure, but Portland’s real estate market isn’t overly competitive, making it one of the best places to invest in real estate.”

– Lima One Capital on Portland Property Investments

Feel free to listen and learn more about Airbnb hosting in Portland with our podcast, Into The Airbnb:

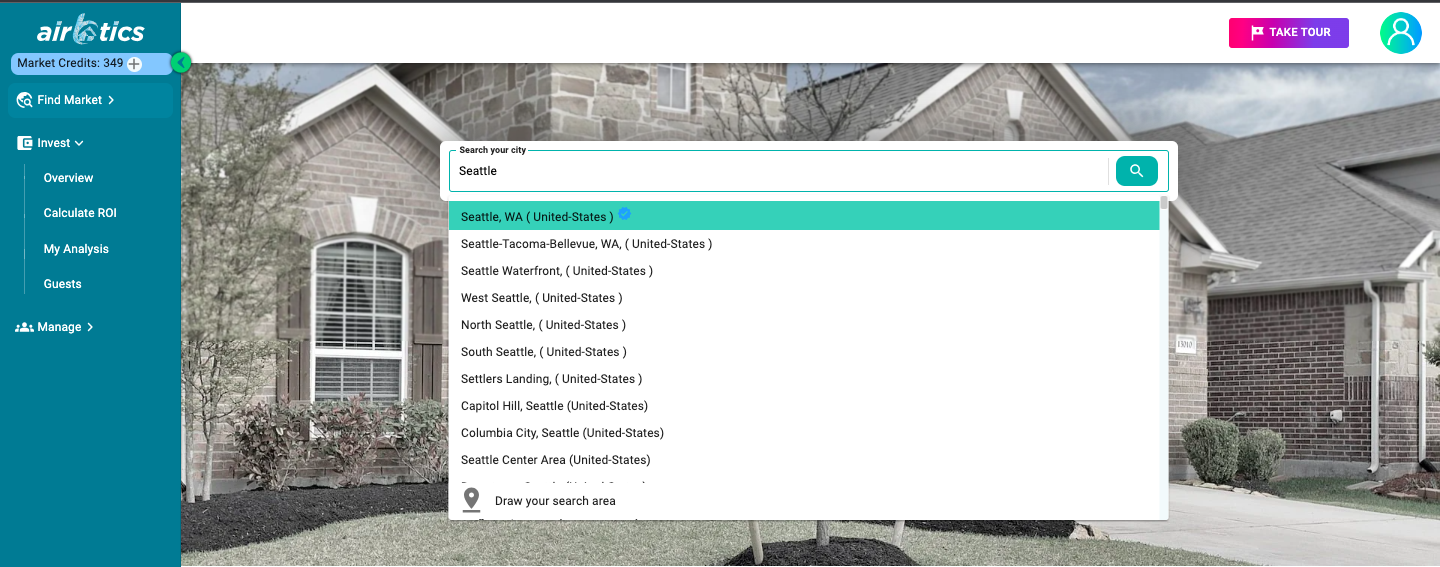

Aside from looking at a property’s fascinating architectural design, proximity to major tourist areas, and accessibility to the best go-to places, the primary step is to determine profitability. In this article, we’ll discuss the metrics in order to gauge the best property investment.

This includes the best website recommendations for property investment, defining property gross rental yield, cash-on-cash return, and annual revenue, along with some of the most ideal and profitable properties according to their location. Stoked to learn more? Continue reading!

Top reasons for buying an Airbnb Property in Portland

Also known as the City of Roses, Portland offers striking natural surroundings, a creative cultural scene and an exquisite gastronomy that will make your mouth water. However, there’s more to learn as to why we recommend purchasing a property in this city. Here are some of the major reasons why you should consider buying a property for Airbnb in Portland:

1. Portland is an international tourist destination

It’s a given fact that Portland became a renowned touristy city that welcomes a great number of international and national travelers alike. This is one of the greenest cities in the US and offers around 300 parks for people to enjoy. In fact, Portland welcomes around 11M visitors annually.

2. Housing market: Relatively affordable

The housing market in Portland offers a wide variety of property types as well as prices! While Portland’s real estate market went through a sudden increment in prices, it remains among the cheapest major West Coast cities to buy a house according to Norada Real Estate. Currently, the median housing value is $525K with a 1-year change value 0f 3.1%.

3. No shortage of job opportunities

Portland is home to many big businesses that have set up their HQs here, to name a few, we have Nike, Columbia, IBM and Intel! In addition to this, there are many startups and tech-based companies. We also must highlight that the tourism and hospitality sectors play an important role in the city’s economy. Thus, Portland attracts many people that are interested in its booming job market as well as entrepreneurs and self-starters.

Expectations When Buying A Property in Portland

Aside from the pros of investing in a property in Portland, let’s discuss some of the cons so you can know what to expect when living in this fascinating city. It’s always better to look at the two sides of each coin in order to properly set your expectations!

1. It’s not a cheap city

In Portland, the cost of living is 27% higher than the national average and 8% more expensive than in other cities in the State. But the positive aspect here is that in Portland there’s no sales tax.

2. Crime rate: Higher than the average

Not everything can be rosy and one of the biggest downsides in Portland is its significantly high crime rate. This aspect taints the great atmosphere of Portland a bit because is higher than the national average as there’s a crime rate of 66 per 1,000 residents. When it comes to property crime, the chance of becoming a victim is 1 in 17 based on NeighborhoodScout report.

3. Be mentally prepared for the traffic

We can deny that getting stuck in traffic is a headache and you can expect to get many with Portland’s congestion, things like this can become quite overwhelming. Drivers lose around 72hrs in congestion per year here and the bad news is that it gets worse as time passes.

airbnb property investment Portland

Is Property Investment Profitable in Portland, OR?

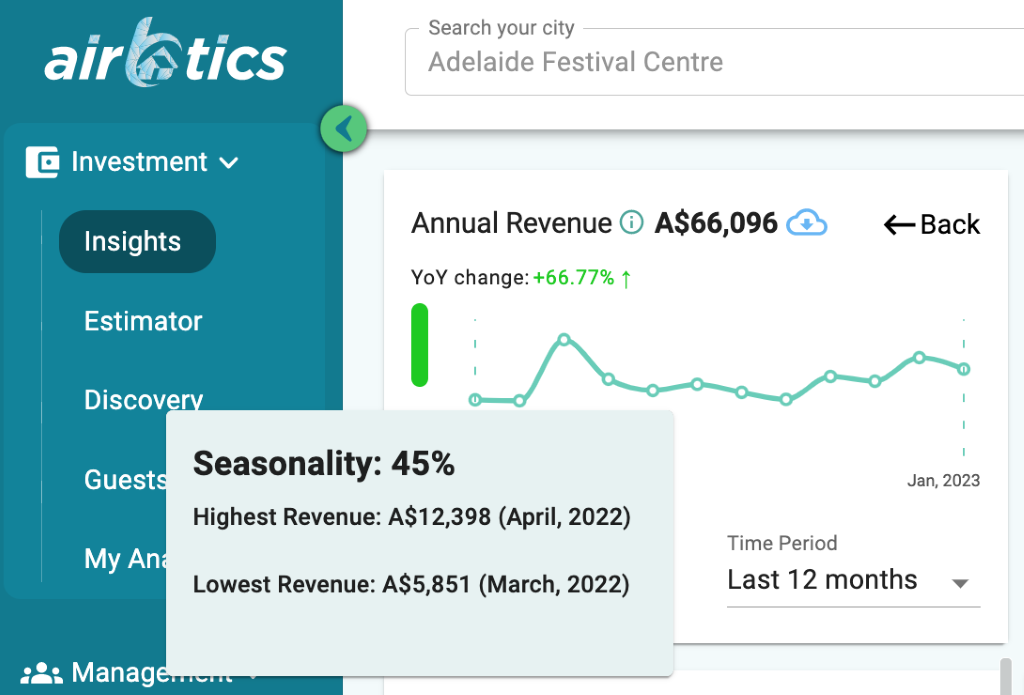

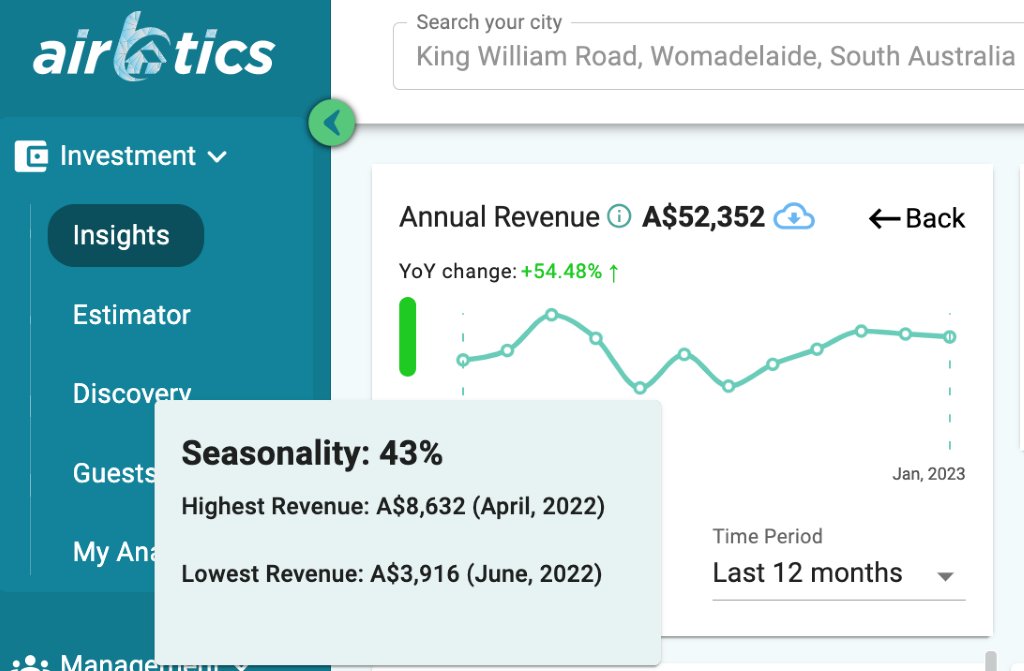

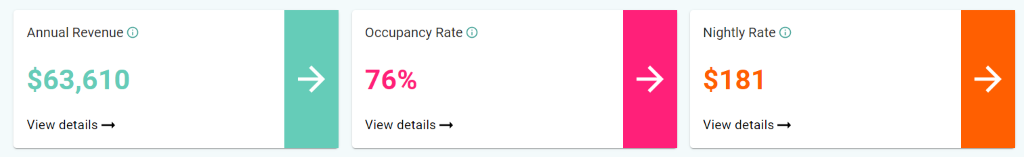

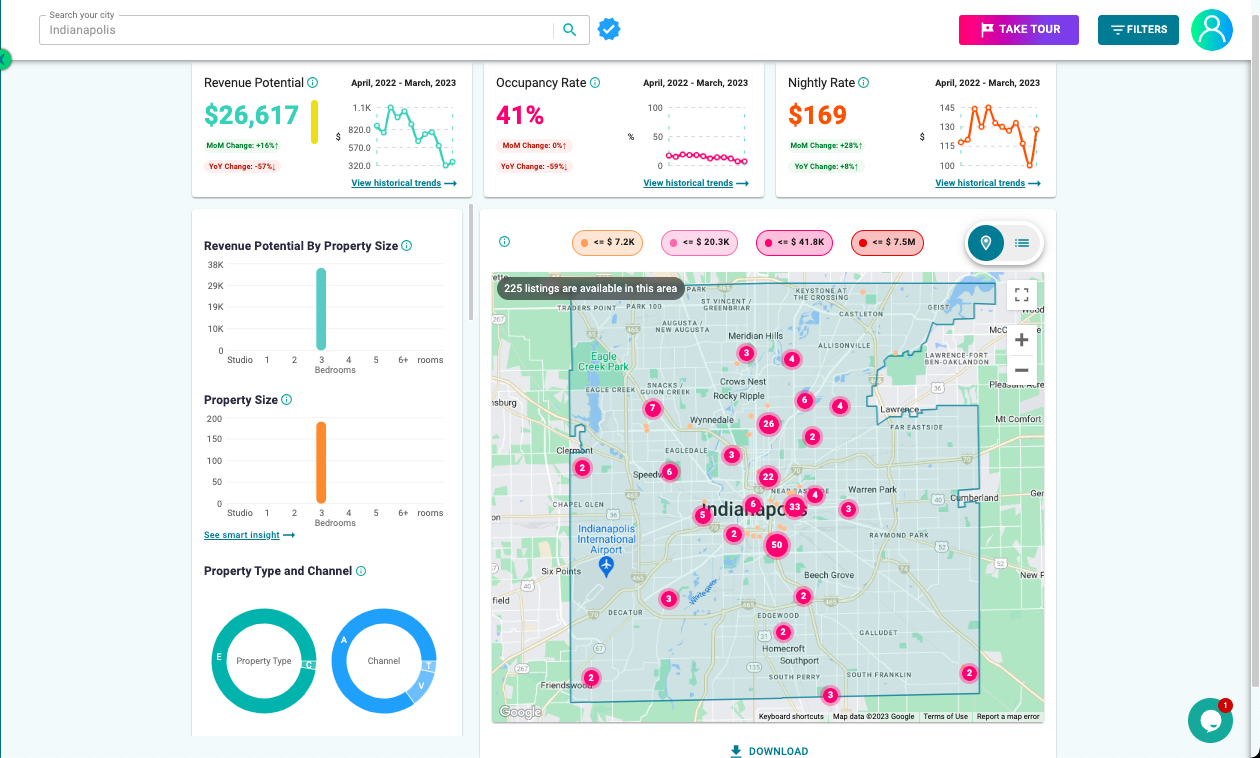

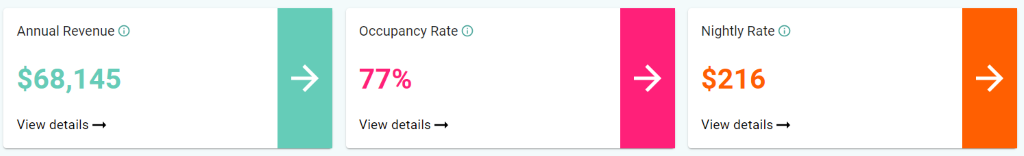

Using an Airbnb profit estimator, it was discovered that a 2-bedroom apartment in Portland can generate an annual revenue of $68,145 with a steady occupancy rate of 77% and a nightly rate of $216.

airbnb property investment Portland

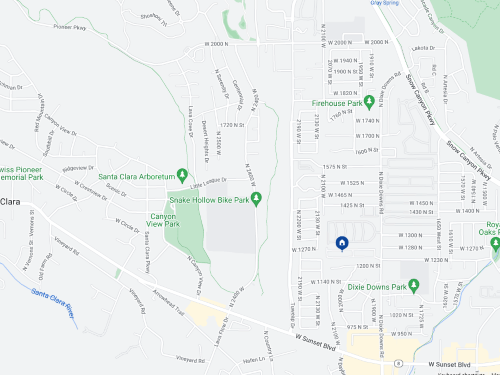

Houses for sale around Portland, Oregon

Finding the best properties that have the potential to produce high yields and capital growth are certainly some of the preferences of major investors. It’s always best to ask for assistance from real estate agents to access exclusive and unique properties during the development stage.

At the same time, it’s even better when a property investor like you conducts research about predicted growths and market forecasts. Here are some of the profitable properties in Portland along with the calculated gross rental yield, cash-on-cash return, and annual revenue:

20 NW 16th Ave Apt 112, Portland, OR 97209

1. Studio-type Property for Sale Portland

- 0.3 miles to Lincoln High School

- Asking Price: $133,000

| GROSS RENTAL YIELD | 17.78% |

| ANNUAL REVENUE | $23,646 |

| CASH ON CASH RETURN | 27.57% |

4101 N Marine Dr Slip 9, Portland, OR 97217

2. 1-Bedroom Type Property for Sale Portland

- 2.3 miles Roosevelt High School

- Asking Price: $115,000

| GROSS RENTAL YIELD | 18.01% |

| ANNUAL REVENUE | $27,914 |

| CASH ON CASH RETURN | 28.26% |

10028 SE Ellis St, Portland, OR 97266

3. 2-Bedroom Type Property for Sale Portland

- 0.3 miles to Lent Elementary School

- Asking Price: $159,000

| GROSS RENTAL YIELD | 22.52% |

| ANNUAL REVENUE | $35,800 |

| CASH ON CASH RETURN | 41.78% |

4802 SE 133rd Ave Unit 105, Portland, OR 97236

4. 3-Bedroom Type Property for Sale Portland

- 0.4 miles Gilbert Heights Elementary School

- Asking Price: $189,000

| GROSS RENTAL YIELD | 25.73% |

| ANNUAL REVENUE | $48,623 |

| CASH ON CASH RETURN | 51.41% |

4704 NE 106th Ave, Portland, OR 97220

5. 4-Bedroom Type Property for Sale Portland

- 0.2 miles to Prescott Elementary School

- Asking Price: $275,000

| GROSS RENTAL YIELD | 25.81% |

| ANNUAL REVENUE | $70,989 |

| CASH ON CASH RETURN | 51.68% |

Summary

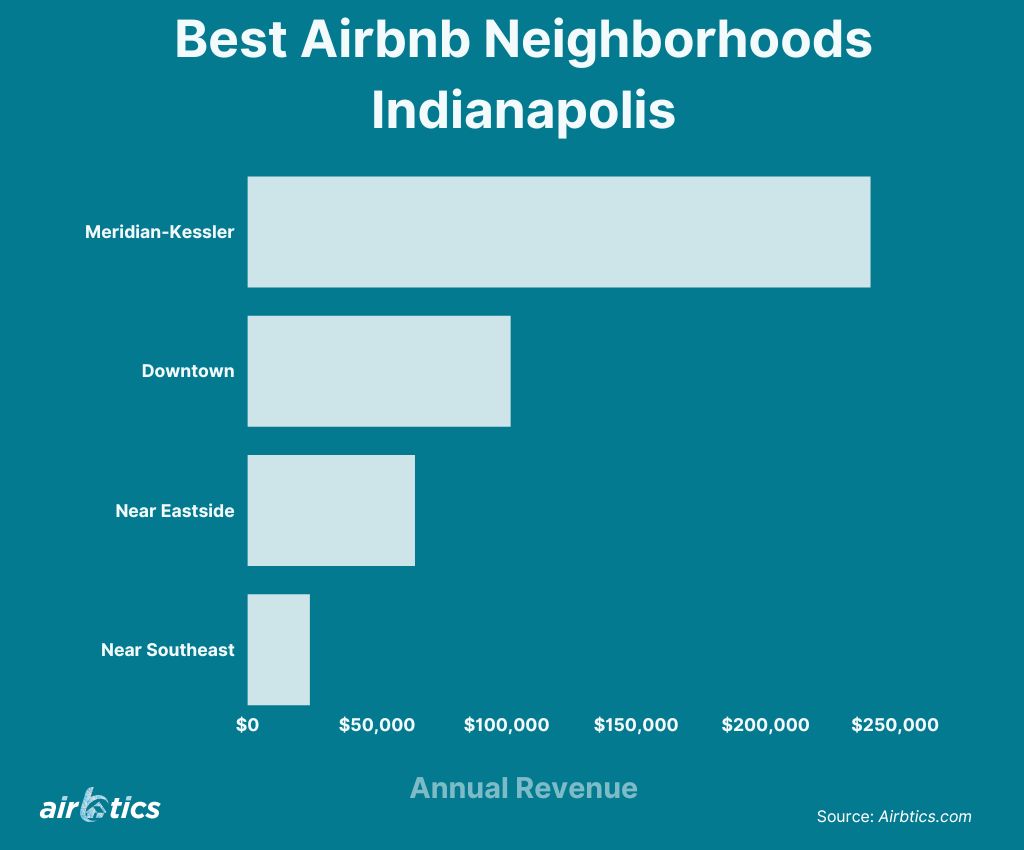

An Airbnb property in Portland can generate a nice cash flow for property investors as long as the right neighborhood is targeted and potential revenue is calculated using an Airbnb rental arbitrage calculator.

While there are many other profitable locations in the US to invest in aside from Portland, it’s definitely worth the time & effort to speak with a short-term rental expert to make the wisest decision for property investment. But it’s certainly important to think deeply about your preferred area and consider getting a reliable security system for your home.