best places to airbnb in oregon

Key Takeaways

- The relatively affordable real estate market and strong economy of the Portland area have allowed many Airbnb hosts to generate a nice passive income with rental properties.

- Explore the advantages of investing in rental properties in Portland, Oregon, and nearby cities.

- Get to know the most profitable neighborhoods and nearby cities in Portland along with their recommended property types, gross rental yields, and respective Airbnb data.

Introduction

The port city of Portland sits at the confluence of the Willamette and Columbia rivers, allowing this destination to offer striking natural landscapes. The city is widely known for its innovative business environment, quirky nature and fascinating culture. This is why it owns the slogan “Keep Portland Weird”.

Portland has many attractive opportunities when it comes to real estate investments since it has a strong tourist & student market. We can’t also avoid the fact that a lot of people move to the city for its attractive job market or because they’re looking to experience the lively environment!

If you’re targeting to start an Airbnb business in Portland, you may be wondering which areas are the most attractive for investment, right?

In this article, we feature the best places to do Airbnb in Portland, Oregon, and some of the perks for Airbnb investment properties in the city. Continue reading to learn more.

Benefits of buying an investment property in Portland, Oregon

Starting an Airbnb business in Portland or nearby cities in Oregon is a great way of achieving financial freedom because it offers fruitful opportunities for real estate investors.

As a place with breathtaking natural surroundings and a great cultural scene, Portland surely sounds like a dreamy city, right? Yet, you may be wondering what are the perks offered by this location in Oregon to real estate investors. Check out some of the major benefits that Portland offers:

Portland’s real estate market

Portland’s overall economy and job market are growing rather quickly, and thanks to this, more people are immigrating to this city. For that reason, the demand for housing is steadily increasing. The average property price is currently $525K while the median sold price is $467K as confirmed by Realtor.

Based on Norada Real Estate report, Portland’s housing prices faced a sudden increment during the past few years, yet, it still offers one of the cheapest markets among all the cities located on the West Coast.

Strong economy with a booming job market

Portland enjoys a strong and diversified economy in which the tech and tourism sectors greatly contribute to the city’s economic situation. In fact, many major companies have placed their HQs in Portland, such as Intel, IBM, Nike and Daimler. Thanks to this, the city’s employment market grows rather quickly as it offers a plethora of job opportunities that attract many professionals.

International tourist destination

Did you know that Portland welcomes nearly 11M tourist arrivals every year? This surely sounds interesting to real estate investors looking to cater to tourist accommodations. Portland is one of the greenest cities in the country that offers plenty of natural options as well as an outstanding cultural scene, thus, it is easy to understand why people are eager to visit this city.

Is Airbnb Profitable in Portland, Oregon?

Let’s cut to the chase! Airbtics confirms that Airbnb investment properties in Portland Oregon are certainly financially rewarding. But investors should still, take into account that the level of profitability depends on the property type and location.

According to Airbnb occupancy rates by city, an average Airbnb host in Portland can earn up to $33,348 with an average occupancy rate of 60% during the peak seasons (July – August). With over 3,342 Airbnb listings in Portland, it’s certainly a catch for property investors!

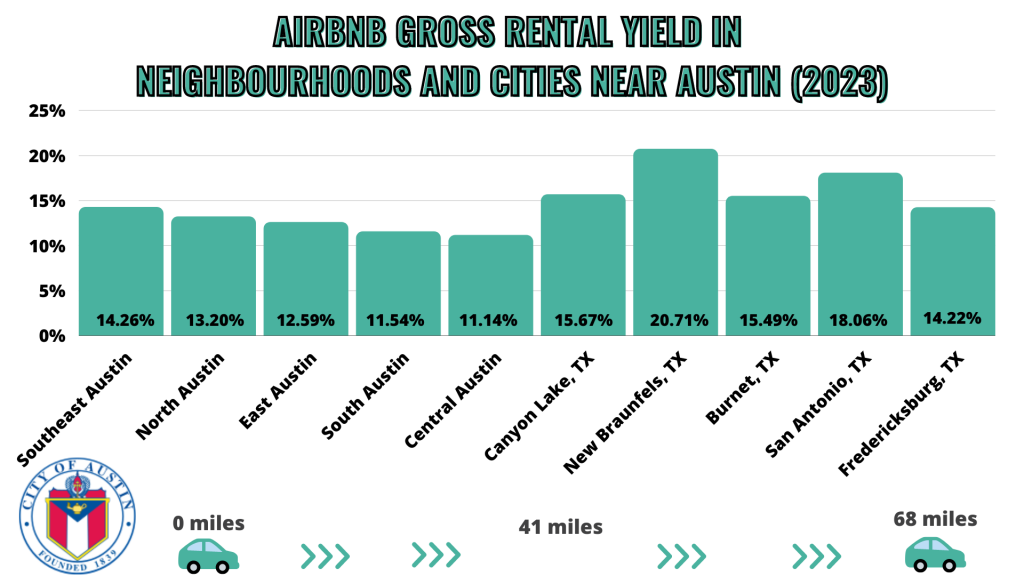

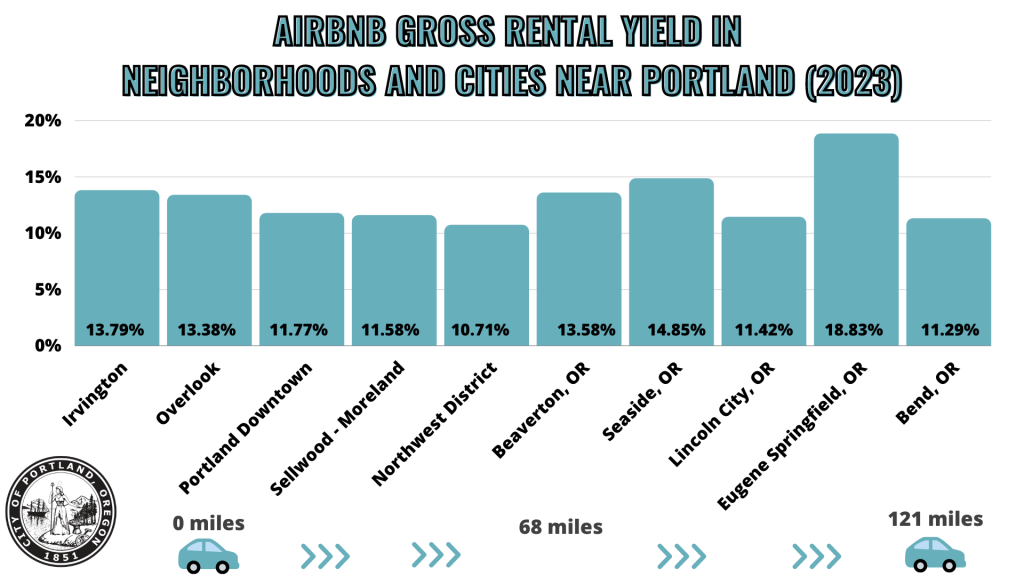

10 Most Profitable Places to Airbnb near Portland, Oregon

Portland is the largest city in the state of Oregon and has more than 90 lively neighborhoods. Aside from that, there are a variety of nearby cities that are attractive as well so it’s easy to understand why you may be having a hard time choosing the perfect location for your Airbnb listing in Portland!

Check out the best neighborhoods and nearby cities in Portland, Oregon, that are highly recommended for starting an Airbnb business:

1. Irvington, Portland

- Total Number of Airbnb Listings: 71

- Best bedroom size: 3 bedrooms

- Median property price (3 bedrooms): $489,900

- Airbnb Annual revenue: $67,548

- Gross rental yield: 13.79%

2. Overlook, Portland

- Total Number of Airbnb Listings: 41

- Best bedroom size: 2 bedrooms

- Median property price (2 bedrooms): $429,000

- Airbnb Annual revenue: $57,438

- Gross rental yield: 13.38%

3. Portland Downtown

- Total Number of Airbnb Listings: 108

- Best bedroom size: 2 bedrooms

- Median property price (2 bedrooms): $410,000

- Airbnb Annual revenue: $48,274

- Gross rental yield: 11.77%

4. Sellwood – Moreland, Portland

- Total Number of Airbnb Listings: 72

- Best bedroom size: 2 bedrooms

- Median property price (2 bedrooms): $440,000

- Airbnb Annual revenue: $50,949

- Gross rental yield: 11.58%

5. Northwest District, Portland

- Total Number of Airbnb Listings: 167

- Best bedroom size: 3 bedrooms

- Median property price (3 bedrooms): $745,000

- Airbnb Annual revenue: $79,760

- Gross rental yield: 10.71%

6. Beaverton, OR

- Distance from Portland: 6 miles

- Total Number of Airbnb Listings: 129

- Best bedroom size: 2 bedrooms

- Median property price (2 bedrooms): $379,889

- Airbnb Annual revenue: $51,626

- Gross rental yield: 13.58%

7. Seaside, OR

- Distance from Portland: 68 miles

- Total Number of Airbnb Listings: 368

- Best bedroom size: 3 bedrooms

- Median property price (3 bedrooms): $489,000

- Airbnb Annual revenue: $72,625

- Gross rental yield: 14.85%

8. Lincoln City, OR

- Distance from Portland: 75 miles

- Total Number of Airbnb Listings: 197

- Best bedroom size: 3 bedrooms

- Median property price (3 bedrooms): $550,000

- Airbnb Annual revenue: $62,848

- Gross rental yield: 11.42%

9. Eugene-Springfield, OR

- Distance from Portland: 109 miles

- Total Number of Airbnb Listings: 760

- Best bedroom size: 4 bedrooms

- Median property price (4 bedrooms): $575,000

- Airbnb Annual revenue: $108,284

- Gross rental yield: 18.83%

10. Bend, OR

- Distance from Portland: 121 miles

- Total Number of Airbnb Listings: 855

- Best bedroom size: 3 bedrooms

- Median property price (3 bedrooms): $689,000

- Airbnb Annual revenue: $77,748

- Gross rental yield: 11.29%

Summary

Portland has plenty of neighborhoods and nearby cities that can bring attractive rental yields and annual revenue. Thanks to this, it also has many lucrative areas that offer good investment opportunities to Airbnb hosts. Still, we encourage Airbnb hosts like you to analyze each of the options carefully.

Discovering the best places to Airbnb in Portland, Oregon is indeed a great way to start your journey and now you should go further. Check our Airbtics’ Airbnb income calculator and stand out among your competitors now!