best places to airbnb in rhode island

Key Takeaways

● Providence’s growing economy, reasonable real estate prices, and solid tourist market have allowed many Airbnb hosts & investors to create a nice passive income.

● Discover the top reasons why investing in rental properties in Providence, Rhode Island, can turn into a financially rewarding experience for real estate investors.

● Get to know the most lucrative neighborhoods and nearby cities in Providence, along with their Airbnb data and recommended property types.

Introduction

The friendly capital city of Rhode Island, Providence, is situated at the head of Narragansett Bay on the Providence River. Thanks to its location, the city developed as an important and busy port in the state.

The city of Providence may be small compared to other metropolitan areas in the US, but don’t let its size fool you because it offers much more than what first meets the eye. The city owns a vibrant culture with a fascinating culinary scene. Moreover, you can explore its historic neighborhoods, theatres and museums on foot!

Providence is also known for its great colleges such as the RI School of Design, Brown University, and Providence College. For this reason, the city attracts a great number of students which greatly impacts the housing market.

In this article, you will discover the best places to invest in Airbnb in Providence, Rhode Island, and some of the reasons why investing in real estate in this city is a profitable option. Interested in learning more? Then continue reading.

Pros of buying a rental property in Providence, RI

Investing in short-term rentals in Providence or nearby cities is an excellent way of achieving financial freedom since it offers a variety of opportunities to real estate investors.

Undoubtedly, Providence is a beautiful city with plenty of history, but what kind of advantages does this city offer to real estate investors? Check out some of the top reasons why you should consider investing in Providence’s real estate market:

Growing economy

Providence enjoys a stable economy that is mainly driven by industries like tourism, education, trade, transportation, and healthcare. The city is also home to many major companies like United Natural Foods, Citizens Financial Group, and Trexton.

While Providence’s economy suffered a recession during the pandemic, its GDP grew 5.3% in the New England region according to Boston Globe.

Reasonable housing prices

Providence has a stable economy that is steadily growing and great higher education institutes, hence, more people are interested in relocating to this sophisticated city. Considering this, its rental market experiments a strong demand.

The median housing price is currently $334K with a 1-year value change of 5.8% as confirmed by Zillow. If we compare the property values with other northeastern areas, Providence’s market cost is fairly cheap.

Great location

Providence enjoys a prime location and those who relocated to this city can agree with this since they can have access to almost anything. The city is located close to major cities like Boston, New Haven and New York! So whether you’re going out of the city for a weekend gateway or business matters, Providence allows you to do it without any problems.

Moreover, if you want to travel longer distances, you also have access to the Rhode Island T. F. Green International Airport, which is just 13 minute drive from the city’s downtown.

No shortage of leisure activities

Providence owns a rich history, so if you’re someone who loves historical places, then this city will certainly win your heart. There are plenty of interesting places throughout the city such as the John Brown House Museum, The Stephen Hopkins house and Swan Point Cemetery.

In addition to this, Providence is bordered by the Atlantic Ocean, which allows the city to offer a breathtaking coastline with bays, and beaches that you can visit anytime. The city also enjoys a temperate climate with plenty of sunshine throughout the year that opens the door to a plethora of outdoor activities.

Is Airbnb Profitable in Providence, RI?

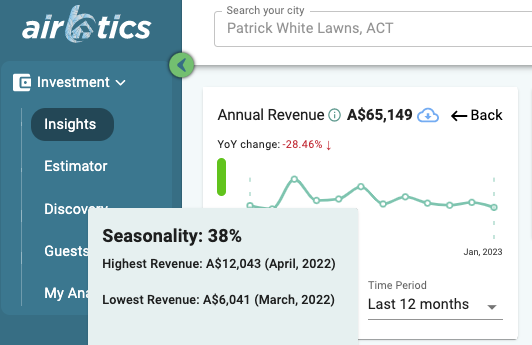

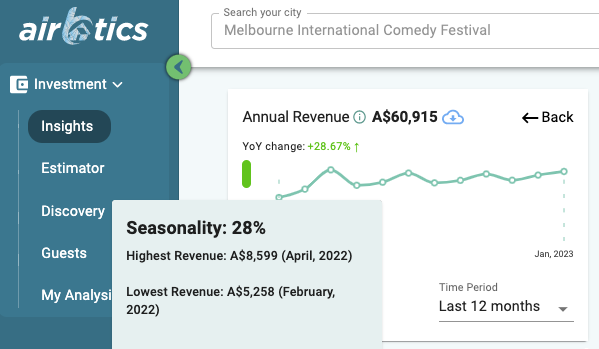

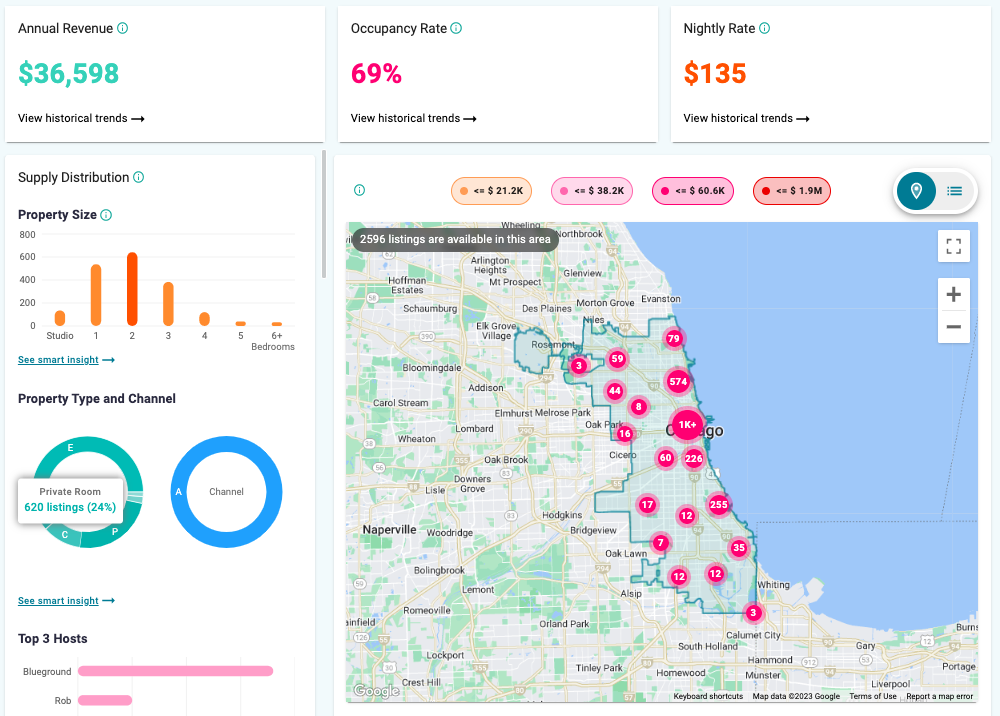

Wondering if Airbnb real estate investments are worth it? Don’t worry because Airbtics confirms that investment properties in Providence, RI are indeed a great wait to create a passive income that will allow you to achieve financial freedom. However, analyzing factors like finding the ideal property type and location are essential to generate high profitability.

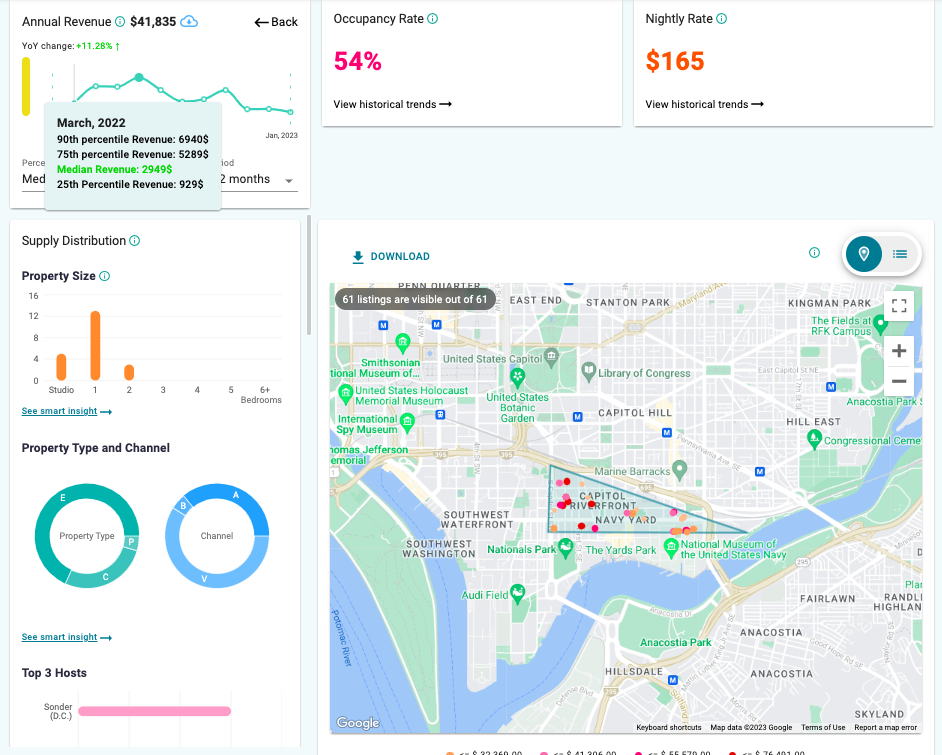

Based on Airbtics’ data, an average Airbnb host can earn up to $37,887 with an average occupancy rate of 76% for managing a 1-bedroom property in Providence.

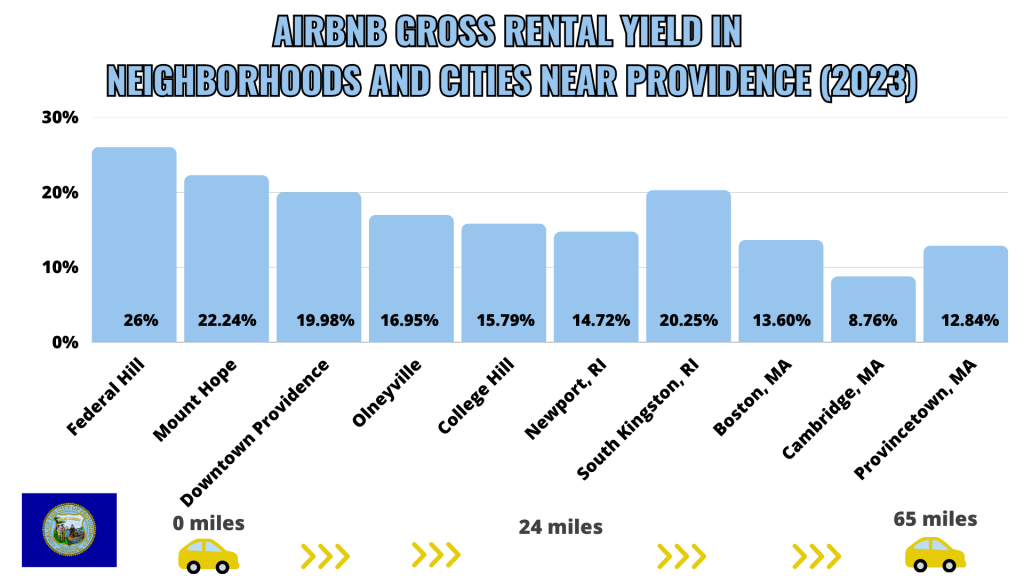

Top Areas to Buy an Investment Property in Providence, Rhode Island

Providence is one of the oldest cities in the New England region and is also the larger community in the state of Rhode Island. The city has 25 designated neighborhoods and each of them carries its own interesting aspect. Hence, it can be challenging to choose the right location for your rental property.

Check out the best neighborhoods and nearby cities in Providence, Rhode Island, that are highly recommended for starting an Airbnb business:

1. Federal Hill, Providence

- Total Number of Airbnb Listings: 111

- Best bedroom size: 2 bedrooms

- Median property price (2 bedrooms): $175,000

- Airbnb Annual revenue: $45,500

- Gross rental yield: 26%

2. Mount Hope, Providence

- Total Number of Airbnb Listings: 29

- Best bedroom size: 2 bedrooms

- Median property price (2 bedrooms): $259,900

- Airbnb Annual revenue: $57,800

- Gross rental yield: 22.24%

3. Downtown Providence, Providence

- Total Number of Airbnb Listings: 36

- Best bedroom size: 1 bedroom

- Median property price (1 bedroom): $199,000

- Airbnb Annual revenue: $39,768

- Gross rental yield: 19.98%

4. Olneyville, Providence

- Total Number of Airbnb Listings: 35

- Best bedroom size: 3 bedrooms

- Median property price (3 bedrooms): $219,900

- Airbnb Annual revenue: $37,280

- Gross rental yield: 16.95%

5. College Hill, Providence

- Total Number of Airbnb Listings: 35

- Best bedroom size: 2 bedrooms

- Median property price (2 bedrooms): $409,000

- Airbnb Annual revenue: $64,572

- Gross rental yield: 15.79%

6. Newport, RI

- Distance from Providence: 24 miles

- Total Number of Airbnb Listings: 621

- Best bedroom size: 1 bedroom

- Median property price (1 bedroom): $475,000

- Airbnb Annual revenue: $69,923

- Gross rental yield: 14.72%

7. South Kingston, RI

- Distance from Providence: 32 miles

- Total Number of Airbnb Listings: 223

- Best bedroom size: 3 bedrooms

- Median property price (3 bedrooms): $400,000

- Airbnb Annual revenue: $81,007

- Gross rental yield: 20.25%

8. Boston, MA

- Distance from Providence: 39 miles

- Total Number of Airbnb Listings: 1,810

- Best bedroom size: 3 bedrooms

- Median property price (3 bedrooms): $734,900

- Airbnb Annual revenue: $99,932

- Gross rental yield: 13.60%

9. Cambridge, MA

- Distance from Providence: 41 miles

- Total Number of Airbnb Listings: 484

- Best bedroom size: 1 bedroom

- Median property price (1 bedroom): $625,000

- Airbnb Annual revenue: $54,659

- Gross rental yield: 8.76%

10. Provincetown, MA

- Distance from Providence: 65 miles

- Total Number of Airbnb Listings: 504

- Best bedroom size: 1 bedroom

- Median property price (1 bedroom): $525,000

- Airbnb Annual revenue: $67,435

- Gross rental yield: 12.84%

Takeaway

We can conclude that there are a variety of profitable neighborhoods and cities nearby Providence. The best places to Airbnb in Providence, Rhode Island, offer interesting investment opportunities with good rental yields and revenue to investors and hosts.

While knowing the top areas to buy a rental property in Providence is a great way to start your journey, it’s always important to deeply consider analyzing each of the options.

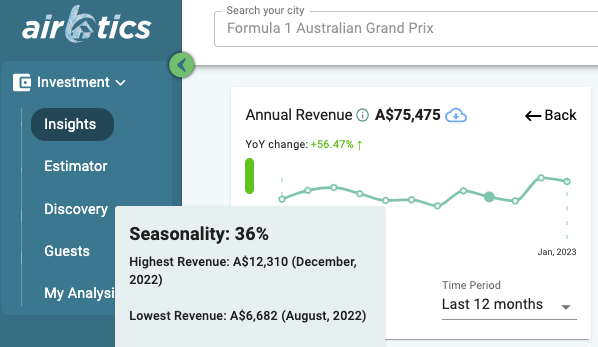

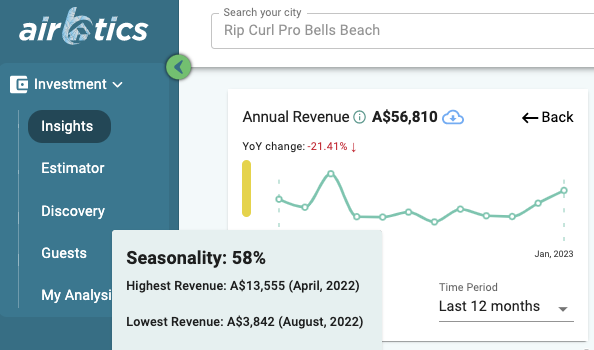

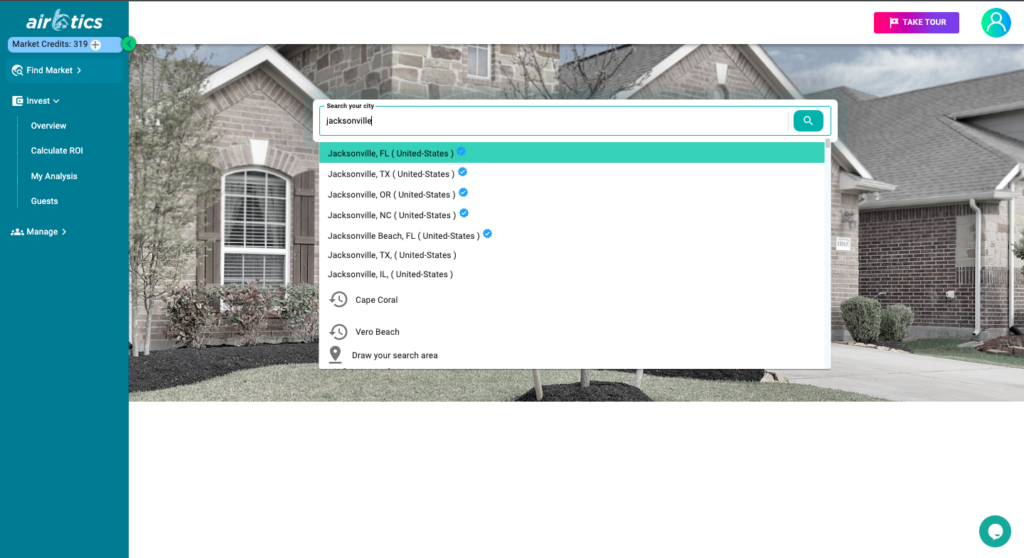

Take advantage of the digital era and go further in your journey by making use of the best analytics tools available to increase your profitability. Check our Airbnb profit estimator and stand among your competitors now!