Discover the best place to buy a rental property in Edmonton to maximize the return on your property investment!

Home > Resources > Airbnb Investment >

Best Place to Buy Rental Property in Edmonton

Best Place to Buy Rental Property in Edmonton

Discover the best places to buy a rental property in Edmonton to maximize the return on your property investment!

- Last updated January 31, 2024

Key Takeaways

- The stable economy, growing rental market, and affordable cost of living in Edmonton provide investors with the opportunity to make a good return on their investment and enjoy the benefits of a thriving business.

- With the help of Airbtics, we are able to provide an overview of Edmonton’s top Airbnb markets, as well as their associated Airbnb data, including recommended property types, gross rental yields, and more.

Exploring the Thriving Rental Market in Edmonton

The dynamic capital city of Alberta Province, Edmonton, is located on the North Saskatchewan River, a city that is renowned for its natural beauty, strong oil industry and superb living conditions. This destination features a mix of modern and traditional architecture with a variety of heritage buildings that showcase the city’s rich history.

Also known as Canada’s Festival City, Edmonton owns a vibrant cultural scene, hosting numerous festivals throughout the year that attract a high influx of tourists yearly. Thanks to this and many other factors, the rental market has been steadily growing, drawing the attention of more and more property investors.

Looking for the best place to buy a rental property in Edmonton? We got you! In this article, you’ll find the top rental markets as well as some of the key benefits that investors can look forward to when investing in real estate in this city. Keep reading!

Top reasons to invest in Edmonton real estate

Real estate investors in Edmonton have the potential to gain great benefits from owning a rental property such as the chance to achieve financial freedom in the long run. But, the question remains: what are the benefits of owning an investment property in Edmonton?

Check out some of the reasons why investing in real estate in Edmonton is a great idea:

Steady rental demand

Edmonton is a great place to invest in real estate if you’re looking for a steady rental income stream. It’s a growing city with a strong student market. What’s more? Many young people, professionals and families are looking to relocate in this city. Thanks to its great quality of living and excellent job and educational opportunities. Thus, there’s always a lot of demand for properties.

On top of that, it provides an affordable cost of living. Aside from daily expenses, the housing market presents different options in various price ranges. Currently, the average property price in Edmonton is $397,811. This allows investors to make an affordable initial investment and potentially higher profit potential.

Splendid living conditions

When seeking to target a particular market, the quality of life in the local area is a key factor to consider. The great news is that Edmonton is among the top Canadian cities that offer one of the highest quality of life in Northern America.

The city offers a wide variety of services, facilities and recreational activities, as well as a high-quality education and a reliable health care system. In addition, Edmonton features modern and well-developed infrastructure, including an extensive road network, dependable public transportation and an international airport. This facilitates mobility in the city which keeps it well communicated with the rest of the country.

Stable & diverse economy

Edmonton is the capital of Alberta province, which is among the top richest provinces in Canada, so it’s to be expected that this city owns a strong and stable economy. Edmonton is known for its booming oil and gas industry, but it also has a diversified economy that includes sectors like technology, transportation, financial services, tourism healthcare and education.

Thanks to this, the city features a solid job market with a plethora of employment opportunities

Alluring destination

Edmonton is truly an alluring and lively city that doesn’t disappoint with its variety of leisure attractions. In fact, it’s home to many art galleries, theaters, museums and green spaces.

Moreover, the city attracts visitors from around the world with its vibrant cultural festivals and sporting events. And there’s also no shortage of activities for outdoor enthusiasts because Edmonton offers many natural attractions, such as Elk Island National Park and the Rocky Mountains.

Moreover, considering that tourism is an important source of income for Edmonton, investors looking to cater to vocational accommodations can expect high rental yields and revenue potential.

Is Airbnb Profitable in Edmonton, AB?

Airbtics confirms that investing in income property in Edmonton can certainly help investors experience a rewarding investment. Moreover, Edmonton is also one of the top Canadian cities for Airbnb investments!

According to Airbtics’ income calculator, an average Airbnb host can earn up to C$28,563 with a median occupancy rate of 56% for managing a 2-bedroom property in Edmonton.

Edmonton is a profitable city with great investment opportunities. But despite that, real estate investors must consider that the level of profitability depends on other factors such as the property type and location. It’s also important to learn about the Airbnb regulations in Edmonton so that you can run your listing smoothly.

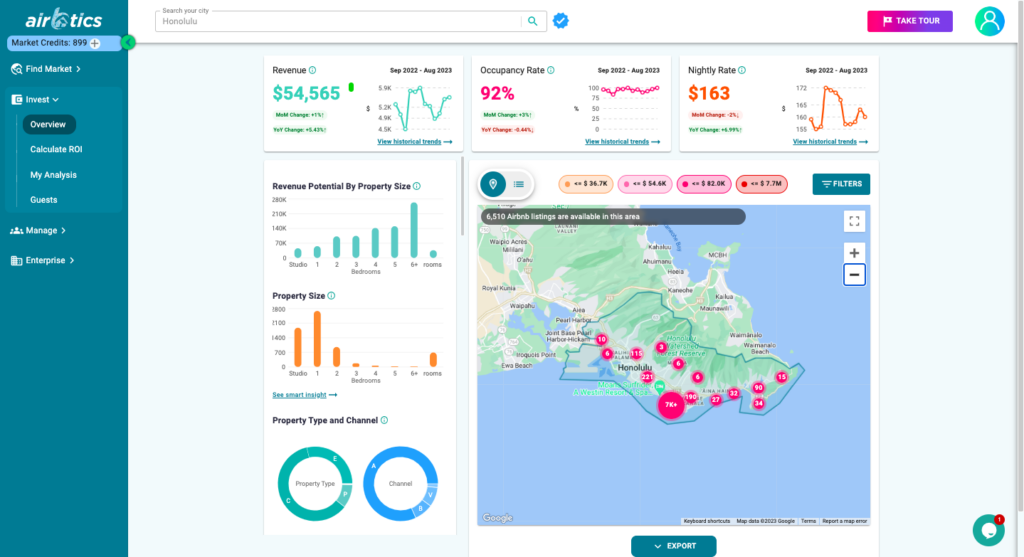

Source: Airbtics Dashboard

10 Prime rental markets in Edmonton for Airbnb properties

While there are many Airbnb host expenses to consider when you plan on owning a rental property, the most important part is to analyze the listing’s location.

But, did you know that Edmonton has around 400 designated neighborhoods? Quite a long list, so it’s understandable if you’re struggling to find the right place to set up your short-term rental property in Edmonton.

Let’s check some of the best neighborhoods in Edmonton, Alberta that are recommended for starting an Airbnb business:

|

|||||

|---|---|---|---|---|---|

| Best Area | Airbnb Listings | Best Number of Bedrooms | Median Property Price | Airbnb Annual Revenue | GRY |

| Chappelle | 151 | 3 bedrooms | C$285,000 (3 BR) | C$31,274 | 10.97% |

| Strathcona | 75 | 2 bedrooms | C$199,999 (2 BR) | C$30,733 | 15.37% |

| Downtown Edmonton | 265 | 1 bedroom | C$107,000 (1 BR) | C$29,485 | 27.56% |

| Jasper Place | 192 | 3 bedrooms | C$298,500 (3 BR) | C$28,251 | 9.46% |

| Oliver | 111 | 1 bedroom | C$96,900 (1 BR) | C$27,955 | 28.85% |

| Garneau | 62 | 2 bedrooms | C$215,000 (2 BR) | C$26,027 | 12.11% |

| Alberta Avenue | 62 | 2 bedrooms | C$210,000 (2 BR) | C$23,456 | 11.17% |

| Windermere | 110 | 2 bedrooms | C$209,000 (2 BR) | C$21,911 | 10.48% |

| Queen Alexandra | 88 | 1 bedroom | C$128,900 (1 BR) | C$21,015 | 16.30% |

| Queen Mary Park | 74 | 1 bedroom | C$149,900 (1 BR) | C$20,418 | 13.62% |

- Total Number of Airbnb Listings: 151

- Best bedroom size: 3 bedrooms

- Median property price (3 bedrooms): C$285,000

- Airbnb Annual revenue: C$31,274

- Gross rental yield: 10.97%

- Total Number of Airbnb Listings: 75

- Best bedroom size: 2 bedrooms

- Median property price (2 bedrooms): C$199,999

- Airbnb Annual revenue: C$30,733

- Gross rental yield: 15.37%

- Total Number of Airbnb Listings: 265

- Best bedroom size: 1 bedroom

- Median property price (1 bedroom): C$107,000

- Airbnb Annual revenue: C$29,485

- Gross rental yield: 27.56%

- Total Number of Airbnb Listings: 192

- Best bedroom size: 3 bedrooms

- Median property price (3 bedrooms): C$298,500

- Airbnb Annual revenue: C$28,251

- Gross rental yield: 9.46%

- Total Number of Airbnb Listings: 111

- Best bedroom size: 1 bedroom

- Median property price (1 bedroom): C$96,900

- Airbnb Annual revenue: C$27,955

- Gross rental yield: 28.85%

- Total Number of Airbnb Listings: 62

- Best bedroom size: 2 bedrooms

- Median property price (2 bedrooms): C$215,000

- Airbnb Annual revenue: C$26,027

- Gross rental yield: 12.11%

- Total Number of Airbnb Listings: 62

- Best bedroom size: 2 bedrooms

- Median property price (2 bedrooms): C$210,000

- Airbnb Annual revenue: C$23,456

- Gross rental yield: 11.17%

- Total Number of Airbnb Listings: 110

- Best bedroom size: 2 bedrooms

- Median property price (2 bedrooms): C$209,000

- Airbnb Annual revenue: C$21,911

- Gross rental yield: 10.48%

- Total Number of Airbnb Listings: 88

- Best bedroom size: 1 bedroom

- Median property price (1 bedroom): C$128,900

- Airbnb Annual revenue: C$21,015

- Gross rental yield: 16.30%

- Total Number of Airbnb Listings: 74

- Best bedroom size: 1 bedroom

- Median property price (1 bedroom): C$149,900

- Airbnb Annual revenue: C$20,418

- Gross rental yield: 13.62%

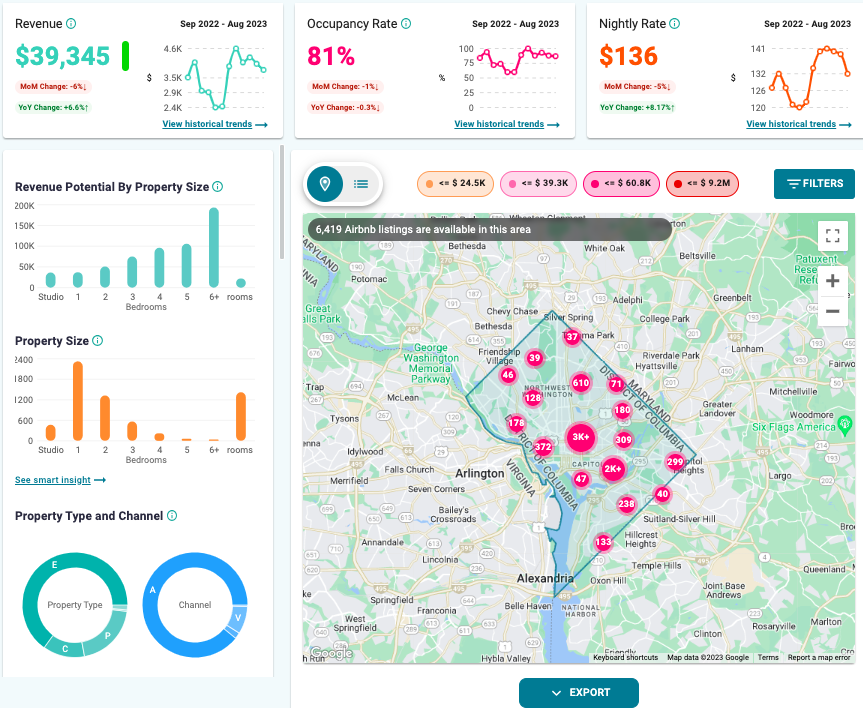

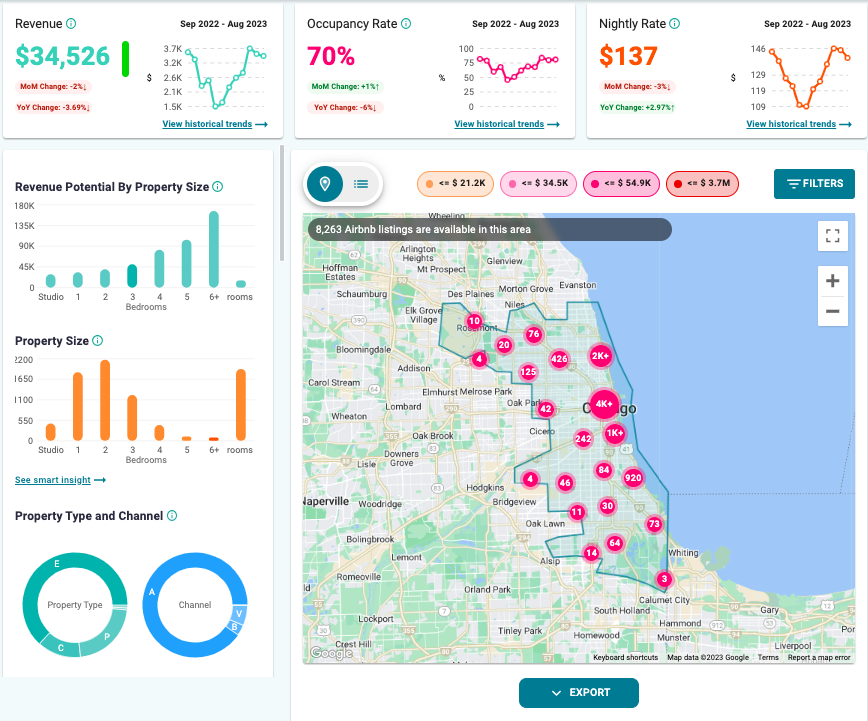

Source: Airbtics Dashboard

How to Find the Most Profitable Airbnb Locations?

It might take a lot of time to identify viable rental markets, and we understand how valuable the investor’s time is. For this reason, it’s a great idea to make use of the advanced resources available to property investors to hasten this process.

On top of that, you should also consider visiting real estate forums or doing a throughout research in search engines to find out which locations are drawing the investors’ attention in specific countries. This will also help you to sort your list and have a clear idea of which cities to focus on. Plus, we encourage investors like you to make use of analytics tools to find profitable markets to invest in Airbnb, particularly those that can provide dynamic data.

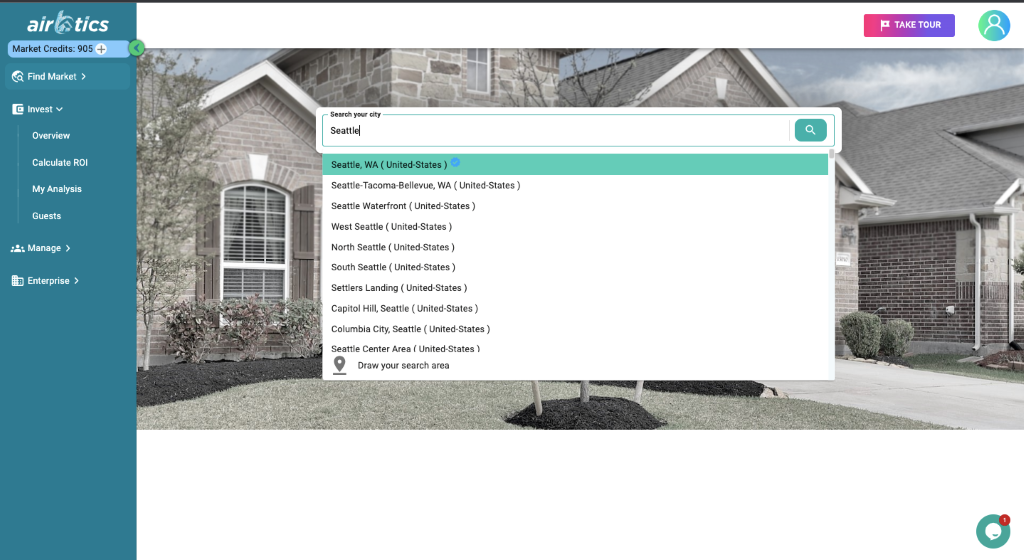

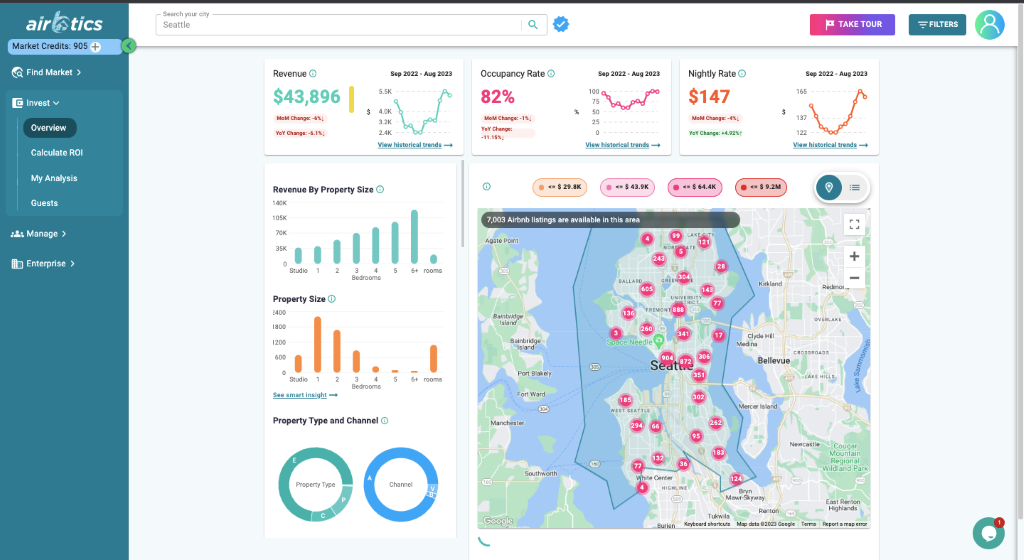

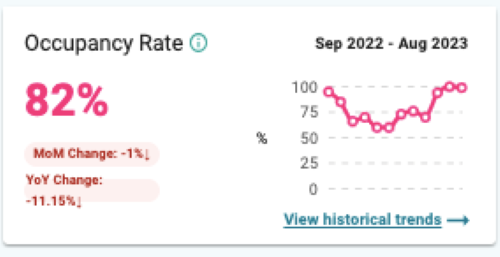

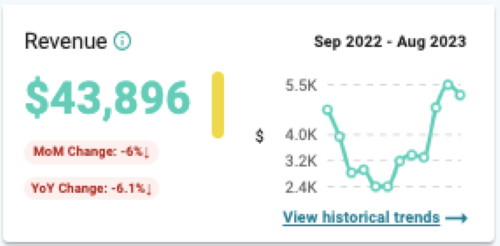

Imagine exploring a city while getting useful info that can make things easier for you, it sounds like a dream come true, right? It’s possible with Airbtics Dashboard since you can get a reliable dataset that will show you metrics like the average revenue, occupancy rates, nightly rates, and seasonality, among others.

But don’t take just our word for it, go ahead and take a look at Simon, an Airbtics customer, who was led to a new Airbnb market that generated more profitability than his previous one!

But, it can happen that your target area is not appearing in the search results, but don’t worry! You can easily create your own custom market.

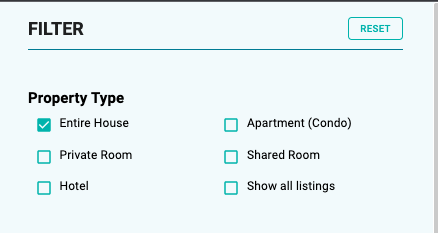

Now, that you have a better view of your target market, go ahead and play around with the filters and find the results that fit your needs. You can use filters to find out what type of property offers the most attractive profit in your preferred area.

The best part of using dynamic data is that by moving and zooming in and out of your map, the data will also change accordingly!

This process can now be repeated until you decide what type of property would be a good investment in your target city or neighborhood. Compare data between different property types and you find out the option that suits you the best!

Take your investment to the next level with Airbtics!

To sum up, property investors in Edmonton can expect to generate a high return on investment for operating Airbnb listings in target neighborhoods thanks to its solid rental demand, affordable housing market and wonderful living conditions.

Knowing the best place to buy a rental property in Edmonton is a great way to start your journey! Still, we encourage you to take things to the next level by making use of the top analytics tools such as our Airbtics’ Airbnb calculator. Move forward and boost your profitability now!

Deeper STR Insights. Broader Investment Opportunities.

Want to go deeper, broader, and faster? Supercharge your Airbnb Investment by accessing the most in-depth Airbnb & real estate insights with our exclusive STR report.

- Vital vacation rental data from 40 Markets – Airbnb Occupancy Rate, ADR, Revenue, and Listings! Access 2-year data from June 2021 to June 2023.

- Uncover 5-year real estate investability metrics for 40 markets including population, property prices, income levels, Google travel interest, crime, and unemployment trends 2017 - 2021)!

- All yours in 3 business days!

Short-Term Rental Data

Short-Term Rental Data

-

Quick Links

Keep Reading

Investing in Property for Sale: How to Buy A Profitable Property for Airbnb in Almeria City Center

airbnb property for sale Almeria City Center The small and welcoming city of Almería offers visitors a rich history and culture, but not only that …

Annual Airbnb Revenue in Tehachapi california, USA

Tehachapi, California| Airbnb Market Data & Overview | USA Tehachapi, California Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Tehachapi, …

Reglas Airbnb en Valencia

Tabla de Contenido Add a header to begin generating the table of contents Es Airbnb legal en Valencia? No te preocupes, Airbnb es legal en …

Annual Airbnb Revenue in Bedford virginia, USA

Bedford, Virginia| Airbnb Market Data & Overview | USA Bedford, Virginia Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Bedford, …

Annual Airbnb Revenue in Carlsbad california, USA

Carlsbad, California| Airbnb Market Data & Overview | USA Carlsbad, California Airbnb Market Data & Overview USA Is it profitable to do Airbnb in Carlsbad, …

Mejores Zonas para Invertir en Airbnb en Guadalajara, México 2023

Métricas claves • Como uno de los principales centros económicos, políticos, culturales y turísticos del país, Guadalajara ofrece muchas oportunidades para inversionistas y anfitriones de …