Discover profitable Airbnb investment properties for sale in Austin, Texas this 2023 – from studio to property of 1,2,3, and 4+ bedrooms!

Home > Resources > Airbnb Investment >

Discover profitable Airbnb investment properties for sale in Austin, Texas this 2023 – from studio to property of 1,2,3, and 4+ bedrooms!

- Last updated on

- August 7, 2023

Austin is known as the Live Music Capital of the World and it offers plenty of world-class museums. It is also home to unique attractions such as the Zilker Metropolitan Park and Barton Springs Municipal Pool. On top of this, Austin ranks as the best place to invest in Texas real estate in 2022 according to Zillow’s home values in Austin as referenced on this blog. So if you are looking for a sign to invest in a property where you can maximize profitability, then Austin is the right answer!

Airbnb occupancy rates by city state that an average host in Austin can earn up to $41,628 during the peak seasons of October. With over 7,414 Airbnb listings in Austin, it’s certainly a catch for property investors!

Here’s an interesting fact: upon comparing the Airbnb occupancy rates in Texas cities, Austin surprisingly ranked with the highest occupancy rate of 40%.

Aside from looking at a property’s fascinating architectural design, proximity to major tourist areas, and accessibility to the best go-to places, the primary step is to determine profitability. In this article, we’ll discuss the metrics in order to gauge the best property investment.

This includes the best website recommendations for property investment, defining property gross rental yield, cash-on-cash return, and annual revenue, along with some of the most ideal and profitable properties according to their location. Stoked to learn more? Continue reading!

Why Should You Consider Buying An Airbnb in Austin, Texas?

Some of the unique features that Austin has to offer include its perfect weather conditions with 300 sunny days a year, city parks, great restaurants as well as outdoor activities and live music around the town. Not yet convinced? Here are some of the major reasons why you should consider buying a property for Airbnb in Austin:

1. Strong housing market

Although the Austin housing market is somewhat competitive, the good news is that is 23% cheaper than the national average according to Norada Real Estate. The median selling price is around $540K, and while the housing market here is the second most expensive in Texas, it is still cheaper than major cities located in California or New York.

2. Fastest-growing US city

As a technology hub and a city that offers a warm climate and vibrant cultural activities, Austin ranked high in the top 10 fastest-growing cities in the US! Based on a report of the “American Growth Project”, Austin rank as the second fastest-growing city this 2022, this surely is an interesting fact for investors who are wondering if investing here is a good idea or not.

3. Booming job market

It’s widely known that Austin is home to many major companies as well as startups, thanks to this, the city offers many opportunities to those who are looking for jobs. As a matter of fact, based on The Wall Street Journal report, Austin, TX ranks as the number one job market in the country!

4. Enjoy the art and music scene

Who doesn’t enjoy art and music spectacles from time to time? Because Austin has a lot to offer in this field!

Known as the Live Music Capital of the World, Austin hosts art and music festivals almost every weekend and thanks to this, many performers as well as people interested in those festivals arrived in the city to enjoy these spectacles. Investors can surely enjoy listening to great songs while managing their profitable Airbnb investment.

5. Let’s talk about tourist arrivals!

Another point that will certainly catch the attention of investors who want to cater to tourist accommodations is the number of tourist arrivals that Austin possesses. Curious about how many visitors the city welcomes annually? Let me tell you more about this because Austin registers more than 30M visitors per year according to Visit Austin Portal.

Best Neighborhoods for Airbnb in Austin

Let’s take a closer look at the important Airbnb key metrics to discover which is the most profitable neighborhood in Austin. Filtered for a 1-bedroom apartment, here is a brief overview of some of the most recommended and profitable neighborhoods:

1. Zilker

- Annual Revenue: $50,396

- Occupancy Rate: 79%

- Average Daily Rate: $160

2. West Oak Hill

- Annual Revenue: $36,643

- Occupancy Rate: 79%

- Average Daily Rate: $131

3. North Austin

- Annual Revenue: $24,846

- Occupancy Rate: 49%

- Average Daily Rate: $129

Is Property Investment Profitable in Austin City Centre?

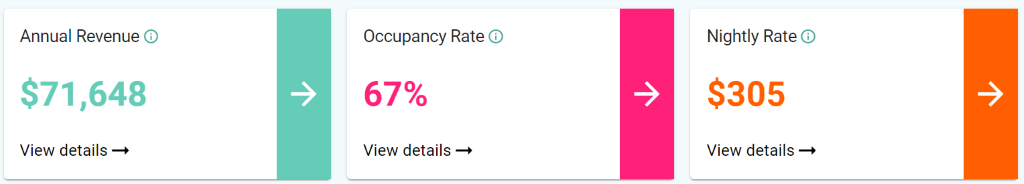

Austin is one of the fastest-growing cities in America. Using an Airbnb calculator, it was discovered that a 2-bedroom apartment in Austin City Centre can generate an annual revenue of $71,648 with a steady occupancy rate of 67% and a nightly rate of $305.

Austin Properties for Sale

Finding the best properties such as Austin houses for sale that have the potential to produce high yields and capital growth is important. It’s always best to ask for assistance from real estate agents to access exclusive and unique properties during the development stage.

At the same time, it’s even better when a property investor like you conducts research about predicted growths and market forecasts. Some of the most popular neighborhoods in Austin are Barton creek and hills, West Lake, and Travis Heights. Here are some of the profitable properties and property prices in Austin City Centre along with the calculated gross rental yield, cash-on-cash return, and annual revenue:

1506 Dallas St, Gonzales, TX 78629

1. Studio-type Property for Sale Austin

- 0.4 miles to Gonzales Elementary School

- Asking Price: $105,000

| GROSS RENTAL YIELD | 24.67% |

| ANNUAL REVENUE | $25,900 |

| CASH ON CASH RETURN | 48.23% |

510 Utah St, Killeen, TX 76541

2. 1-Bedroom Property for Sale Austin

- 0.6 miles West Ward Elementary School

- Asking Price: $74,900

| GROSS RENTAL YIELD | 32.85% |

| ANNUAL REVENUE | $24,607 |

| CASH ON CASH RETURN | 72.79% |

4913 S Interstate Highway 35, Georgetown, TX 78626

3. 2-Bedroom Property for Sale Austin

- 2.5 miles to Chandler Oaks Elementary School

- Asking Price: $130,000

| GROSS RENTAL YIELD | 25.99% |

| ANNUAL REVENUE | $33,781 |

| CASH ON CASH RETURN | 52.19% |

13021 Dessau Rd #733, Austin, TX 78754

4. 3-Bedroom Property for Sale Austin

- 0.3 miles to Delco Primary School

- Asking Price: $189,000

| GROSS RENTAL YIELD | 26.05% |

| ANNUAL REVENUE | $46,882 |

| CASH ON CASH RETURN | 52.37% |

3706 Denehoe Cv, Austin, TX 78725

5. 4-Bedroom Property for Sale Austin

- 0.9 miles to Hornsby-Dunlap Elementary School

- Asking Price: $295,000

| GROSS RENTAL YIELD | 23.78% |

| ANNUAL REVENUE | $70,157 |

| CASH ON CASH RETURN | 45.58% |

Conclusion

Since Airbnb is rapidly increasing and constantly changing for each city in the world, it is crucial to make decisions based on wild guesses. The data points mentioned in this article for Austin such as Airbnb occupancy rates, annual revenue, and average daily rate should be the primary basis before investing in a property.

Hence, if the data presented above has given you ideas to boost your strategic pricing plan for your business, then an Airbnb rental arbitrage calculator is certainly what you need for success in the long run. It’s a fact that some of the STR investors are also considering Airbnb Rental Arbitrage, but they still need to have a reliable data tool on to base their conclusions!

As we live in a digital era, an accurate data analytics tool can help your business stand out among your surrounding competitors and benchmark your property by tracking the occupancy rates of competing listings in your preferred city.

Short-Term Rental Data

-

Quick Links

Annual Airbnb Revenue in Anchor point alaska, USA

Anchor Point, Alaska| Airbnb Market Data & Overview | USA Anchor Point, Alaska Airbnb Market Data & Overview USA Is it profitable to do Airbnb …

Annual Airbnb Revenue in Pacific grove california, USA

Pacific Grove, California| Airbnb Market Data & Overview | USA Pacific Grove, California Airbnb Market Data & Overview USA Is it profitable to do Airbnb …

Annual Airbnb Revenue In Jakarta Indonesia

Jakarta| Airbnb Market Data & Overview | Indonesia Jakarta Airbnb Market Data & OverviewIndonesia Is it profitable to do Airbnb in Jakarta, Indonesia? What is …

A Property Investment Guide to Scranton: Airbnb Profitability

airbnb property for sale Scranton Scranton is a mid-sized city situated within the heart of Lackawanna and has an urban feel which can be a …

Best Places in Alabama for Airbnb: Where to invest in rental properties near Birmingham?

Best Places in Alabama for Airbnb: Where to invest in rental properties near Birmingham?: Investing in the best places to Airbnb near Birmingham, Alabama can …

Benalmadena Airbnb Rules

Table of Contents Add a header to begin generating the table of contents Is Airbnb legal in Benalmadena? Don’t worry, Airbnb is legal in Benalmadena! …