Are you looking to invest in an Airbnb property in America? If you have chosen Washington in particular, then you’re on the right track. Washington is one of the booming short-term rental areas and it was also recently recognized to be part of the Airbnb cities with the highest occupancy rates.

Moreover, Washington is regarded as an international metropolis that offers plenty of real estate investment opportunities. The city not only has a scenic setting with a wide array of attractions but also owns one of the strongest economies in the US and a thriving job market.

Continue reading to learn more about Airbnb rules in Washington and check out the profitability in this city.

Is Airbnb legal in Washington?

Let’s cut the story short: Yes, Airbnb is certainly legal in Washington! With more than 110 million visitors annually, this city is popular for historical attractions including The Lincoln Memorial, The White House, the National Gallery of Art, and more.

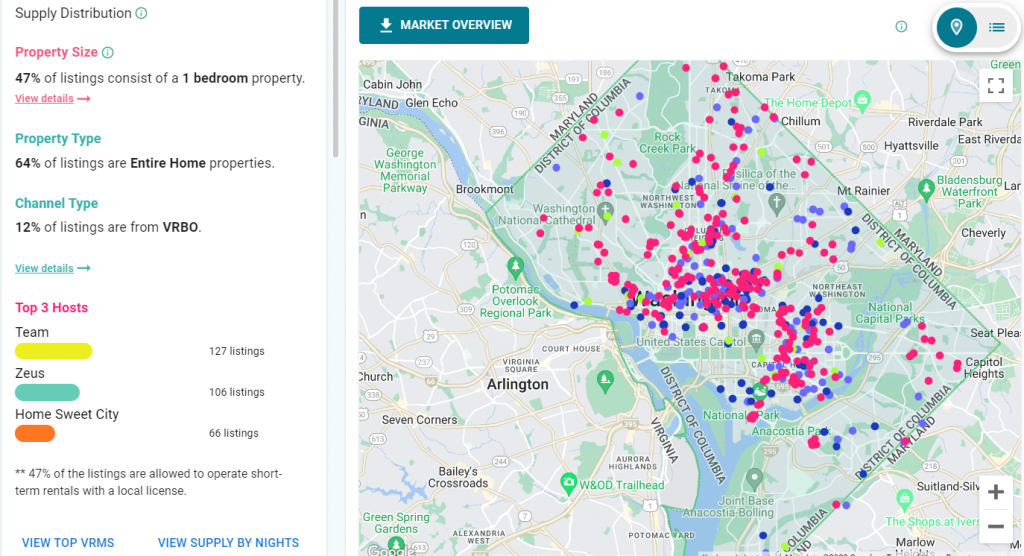

Here is a little proof! As of July 2022, there are 48,976 nights available in Washington from Airbnb alone. Team manages 127 listings, while Zeus and Home Sweet City operate 106 and 66 respectively.

How much can I make by running an Airbnb in Washington?

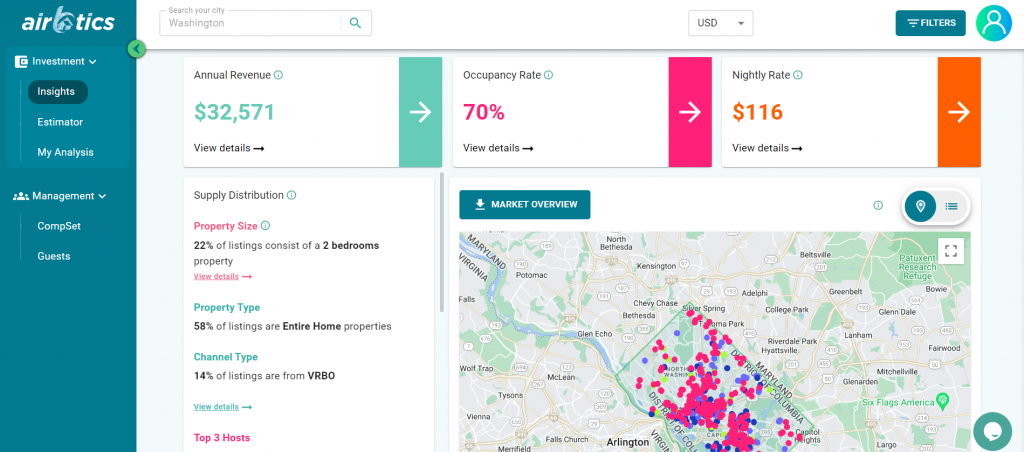

Currently, there are 3,595 Airbnb listings in Washington, with 58% of entire houses earning up to $3,267 a month. The Average Occupancy Rate in Washington is 70% and the average daily rate is $116. According to short-term rental properties data source Airbtics, a 2-bedroom apartment in Washington can make up to $76,646 each year. Check out our Free Airbnb Income Estimator!

What Are The Short-term Rental Accommodation Policies in Washington?

- In order to operate a short-term or vacation rental in the District, the property must be owned by an individual, and serve as a homeowner’s primary residence – with the owner being eligible to receive the Homestead Tax Deduction.

- Short-term rentals are allowed to operate in any neighborhood or zone in the District as long as the host has a valid Short-Term or Vacation Rental License.

- If the rental is a co-op, condo, or if the property is in a community where there is a homeowners’ association, the owner must attest that the bylaws, house rules, or other governing documents of the homeowner/condo/ cooperative governing board or association allow short-term and/or vacation rentals.

- A Certificate of Clean Hands issued within the last 30 days in the property owner’s name must be obtained from the Office of Tax and Revenue.

Is Washington A Profitable Area to Invest In?

If you’re worried about spending thousands of bucks to purchase a property, the good news is you have an option of not owning one. This is because there are many property investors who enjoy doing rental arbitrage in Washington as a passive income!

Airbnb metrics are important in order to expect potential revenue and avoid losing hard-earned money. Before starting an Airbnb business, getting to know your preferred area’s occupancy rates, average daily rates, and annual revenue is important to achieve success.

By using an accurate short-term rental calculator, you’ll be able to confirm if Washington is a good place for investment! In the digital era, it’s easy to discover your estimated annual revenue and high-return investment opportunities in Washington.

Source: Airbtics Dashboard

Washington’s Property Market 2022

Based on a recent report of Washington’s rental market trend in 2022, housing demand continues to rise despite the slow pace of home sales. The majority of properties in Washington remained to be occupied despite the strong housing growth.

Source: Washington’s Housing Market Trend

Profitable Neighborhoods in Washington

Here are some of the most recommended neighborhoods that you can look into & consider purchasing based on Airbtics estimator:

| Suburbs | Average House Price (2bd apartments) | Average Rent Price | Average Airbnb Revenue |

|---|---|---|---|

| Capitol Hill | $350,000 (464 sqft) | $2,800 | $5,194 |

| Bloomingdale | $600,000 (964 sqft) | $2,375 | $5,431 |

| Columbia Heights | $599,000 (1,100 sqft) | $2,300 | $3,702 |

Source for Property Price: Properties in Washington

Conclusion

In general, considering the Airbnb rules & regulations in Washington will help your Airbnb business to run smoothly! Aside from the fact that this is a passive income for various hosts, starting an Airbnb business is also a way to enjoy life and connect with new people from all over the world. Try Airbtics now and make the wisest investment decisions!