Is Airbnb legal in Greece? Be a responsible host and start your Airbnb journey on the right foot by learning the short-term rental regulations in Greece!

Home > Resources > Airbnb Rules >

Is Airbnb legal in Greece? Be a responsible host and start your Airbnb journey on the right foot by learning the short-term rental regulations in Greece!

- Last updated January 10, 2024

STR Regulations for Responsible Hosting: Is Airbnb legal in Greece?

KEY TAKEAWAYS

- Short-term rentals contributed 1.65% to Greece’s GDP in 2022, showcasing the economic significance of the tourism and rental industry.

- Knowing the legal framework, taxation and operational aspects of Airbnb hosting in Greece will help you to run an Airbnb listing smoothly. We also feature the new rules for STR in Greece that will be in effect in 2024.

- With the aid of the Airbtics STR calculator, we provide potential earnings for Airbnb hosts in major Greek cities such as Athens, Santorini, Mykonos, and Crete, along with average occupancy rates.

Airbnb Legality in Greece: Navigating Regulations and Profitability

The Hellenic Republic of Greece is widely known for being a captivating country that has a rich history and well-preserved archeological sites that draw a great influx of tourists yearly! Its charming towns and cities feature impressive architecture that is blended perfectly with breathtaking landscapes and picturesque islands. Besides, the exquisite gastronomy and warmth of Greek hospitality can make anyone love this country.

Thanks to its attractiveness, Greece enjoys a solid tourist market that strongly contributes to the economy. Thus, short-term rentals have gained popularity as a source of income for homeowners and investors, especially amidst rising living costs. In fact, in 2022, this economic activity contributed 1.65% to GDP according to a research report presented at the Prodexpo Real Estate Conference.

But before making major investment decisions and offering your property to guests, it’s important for future Airbnb hosts like you to grasp the regulations and rules relevant to this activity.

You may be wondering “Is Airbnb legal in Greece?” – Don’t worry because, in this article, we will delve into the existing legal framework in Greece concerning short-term rentals. As a bonus, we also mention the level of profitability that a host can generate in specific Greek cities!

Is Airbnb Legal in Greece?

Hosting Airbnb guests in Greece sounds like a profitable business idea that will certainly guarantee you a hefty passive income. However, first and foremost, you must answer this question: “Is Airbnb legal in Greece?” – Let’s keep things short and let us get to the point: Airbnb is legal in Greece! But, before stepping into the short-term rental market in Greece, you should learn more about the ordinances that regulate the holiday lets in the country.

Greek Law: What is a short-term rental of immovable property?

According to Greek law, a short-term rental is when you lease a property via digital platforms for a specific duration that is shorter than a year, mainly providing furnished accommodations with bed linens. This includes apartments, houses, and dwellings of separate structures, as well as rooms within apartments or single-family dwellings.

Here are some of the existing STR laws & regulations in Greece:

Airbnb Regulations in Greece

Under Greek regulations, article 111 of Law 4446/2016 is the fundamental rule which sets out the terms and conditions for short-term rental properties:

- Before listing a dwelling on digital platforms, you must register the property in the “Register of Short-Term Property Lets” kept by the Independent Authority for Public Revenue (IAPR).

- Once the property is registered, you will obtain a registration number (“AMA”) which must be visibly displayed when listing the rental on the digital platforms and in any advertising tool.

- It’s required to submit a Short-Term Rental (STR) Declaration by the 20th of each month following the check-out of the guest in the electronic application. You can submit the declaration here.

- A separate administrative fine of €100 is imposed if the STR Declaration is submitted late.

- In the case of non-submission or inaccurate submission of a STR Declaration, you will be imposed with a fine double the rent, as it appears on the digital platform on the day on which the check is conducted.

- If you entrust the management of the STR to a third party, you must submit a Declaration of Particulars of Tenancies of Immovable Property.

Please note that if you have more than one STRP, you must register each rental property separately in the Register of Short-Term Property Lets.

If any of the conditions mentioned in the STR Greek law aren’t met, property owners or sublessors will be imposed with an administrative fine of €5,000. They will be required to take the necessary measures to comply within 15 calendar days.

Is there a limit on total Airbnb night stays in Greece?

While the STR legal framework doesn’t currently set daily limits or other restrictions on short-term rentals, the law allows the government to introduce limits on total nights for specific geographical areas:

- The letting of each listing should not exceed 90 days per calendar year;

- For islands with less than 10,000 inhabitants, the property may not exceed 60 days per calendar year

However, it’s possible to exceed the limit duration in the case that the total income of the owner or sublessor from all the rental properties doesn’t go beyond €12,000 in the relevant tax year.

Income Taxes & VAT for STR in Greece

Taxes can become quite a complex and tricky topic to talk about, but it’s important for property owners to familiarise themselves with it as well as to keep up to date with their obligations.

The rental income obtained from a STR property of the sharing economy is considered income from real estate and the same is exempt from VAT. Thus, you, as a property manager, must pay a percentage of tax on your rental income in Greece to the tax authority. However, if you supply additional services aside from bed linen, then you will be required to apply VAT and pay it to Greek tax authorities.

The Greek tax year runs from 1st January to 31st December and the portal to declare income taxes can be found here.

TAXATION:

|

|

|---|---|

| Income from STR | Tax rate (%) |

| €0 - €12,000 | 15% |

| €12,001 - €35,000 | 35% |

| Above €35,001 | 45% |

Are non-residents liable to tax income from leasing a property?

Non-resident individuals are obligated to tax on income derived from short-term rentals located in Greece. If you’re a non-resident, you will be required to file an income tax return where you shall declare the income obtained, and pay the liability just as Greek tax resident individuals.

Stay updated: New short-term rental rules in Greece 2024

The Greek government will be implementing some changes in their short-term rental ordinances, so it’s better to keep an eye on these updates!

- Starting in 2024, homeowners that rent out one to two properties for short-term stays in Greece will need to pay a €1.50 accommodation fee per booking.

- On the other hand, individuals who rent more than two properties will be subject to 13% VAT and must comply with all fees and taxes that apply to hoteliers and rooms for rent.

- Additionally, stays lasting longer than 60 days cannot be reserved through online platforms such as Airbnb or VRBO, as they will be considered long-term rentals.

Still, government intervention in Airbnb remains limited and the changes are labeled as “soft solutions” to avoid burdening those who rely on rental income.

Are Property Investments Lucrative in Greece?

If you’re looking to run a profitable Airbnb business that can help you achieve financial freedom, then Greece may be an ideal place for you to target. Airbnb has been playing an important role in supporting economic lifeline for families and individuals in Greece. As of 2022, an average Airbnb host earned up to $4,000 (€3,746) according to Airbnb! And islands such as Mykonos and Santorini ranked as trending summer destinations in 2023.

There are different Airbnb KPIs that investors must consider when targeting specific markets, but let us provide you with an overview of major STR destinations in Greece: Athens, Santorini, Mykonos, and Crete.

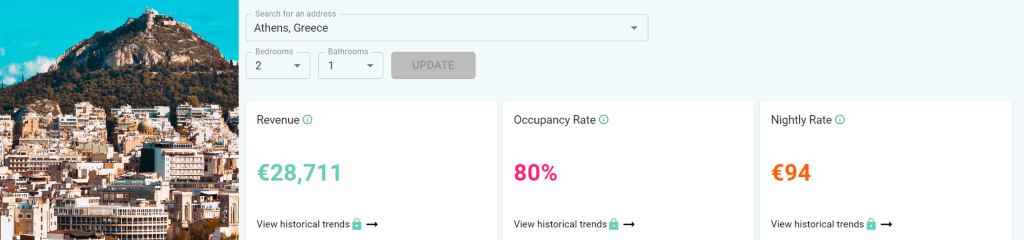

According to Airbtics’ free Airbnb calculator, an average host in Athens can expect to earn €28,711 per year with an occupancy rate of 80% for operating a 2-bedroom property.

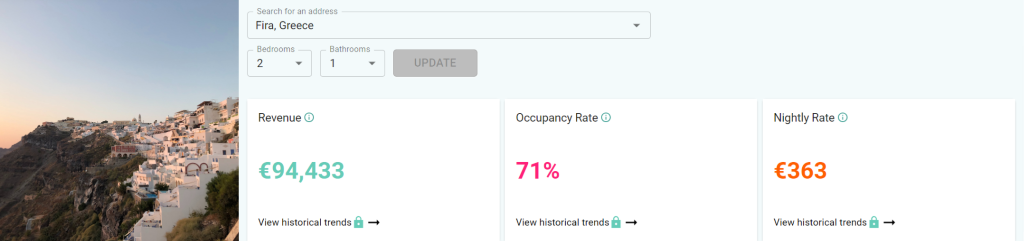

On the other hand, if you’re planning to host guests in Santorini, you can generate up to €94,433 annually with a median occupancy rate of 71% for a 2-bedroom property in the capital city of Fira.

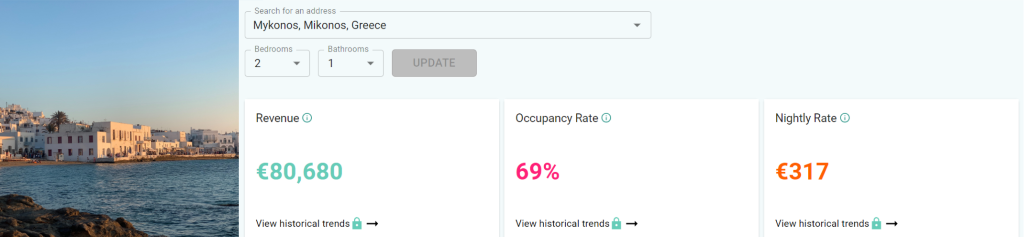

If you want to invest in Mykonos’s Airbnb market, you can make up to €80,680 yearly with an average occupancy rate of 69% for operating a 2-bedroom property!

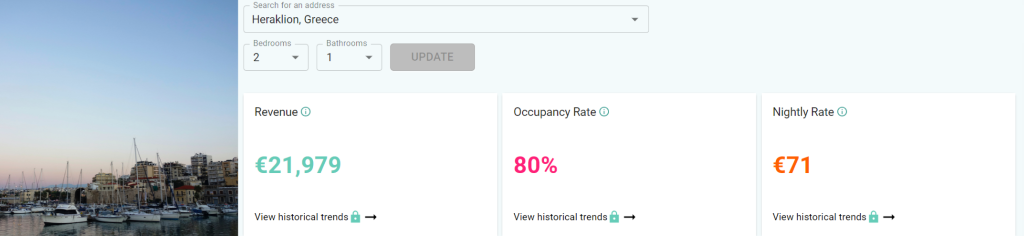

And if you’re targeting Crete’s Airbnb market, you can make up to €21,979 yearly with an average occupancy rate of 80% for operating a 2-bedroom property in the capital city of Heraklion!

Airbnb Market in Greece: The evolving landscape in the Greek rental industry

In summary, hosts like you can ensure the efficient operation of their short-term lease business as long as they stay well-informed about the latest Airbnb regulations in Greece and follow the conditions accordingly. And don’t forget that you can walk on a profitable path by strategically selecting the best property locations for optimal returns!

While the government intervention in Airbnb remains limited, they are working together on improving the short-term rental laws so that the future for holiday lettings will be even brighter than it is. Airbnb and the IAPR have a valuable long-standing collaboration to make it easier for hosts to list their homes on their platform and they remain committed to supporting the growth of sustainable tourism. Thanks to this, old and new Airbnb hosts will be able to run their listings smoothly while reaping the rewards of their STRs while enjoying the atmosphere of this beautiful country.

As Greece’s Airbnb market continues to grow steadily and stronger, property managers across the country should consider leveraging modern analytics tools to set and achieve their business goals based on real-time metrics. Explore your potential earnings in your desired Greek location using our Airbtics Dashboard!

Short-Term Rental Data

Short-Term Rental Data

-

Quick Links

Reglas Airbnb en Cordoba

Si es que deseas comprar inversiones inmobiliarias en España, el primer paso que debes realizar es conocer más a fondo las reglas de Airbnb! En …

Annual Airbnb Revenue in Oxfordshire, UK

Annual Airbnb Revenue in Oxfordshire, UK How Much Can I Make With Airbnb In Oxfordshire , UK? Is it profitable to do Airbnb in Oxfordshire, …

Best Places to Airbnb in Idaho: A Guide to Property Investment 2023

best places to Airbnb in idaho Key Takeaways • Idaho has a thriving economy with an affordable living cost and real estate market as well …

Annual Airbnb Revenue in Junction city kansas, USA

Junction City, Kansas| Airbnb Market Data & Overview | USA Junction City, Kansas Airbnb Market Data & Overview USA Is it profitable to do Airbnb …

Airbnb Rental Arbitrage Market Research 101

Here’s the objective of this blog: To build a property search filter to accurately identify high-return rental arbitrage properties repeatedly. Being able to identify the …

Top Property Management Companies Berkeley united states

Top 7 Property Managers in Berkeley, United states Top 7 Property Managers in Berkeley, United states Last updated on: 5th July, 2024 This list aims …